Asian Development Bank facts for kids

|

|

Headquarters in 2011

|

|

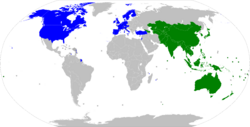

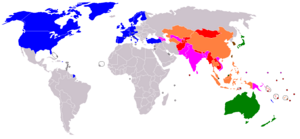

Nonregional members Regional members

|

|

| Abbreviation | ADB |

|---|---|

| Formation | 19 December 1966 |

| Type | Multilateral development bank |

| Legal status | Treaty |

| Purpose | Social and Economic Development |

| Headquarters | 6 ADB Avenue, Mandaluyong, Metro Manila 1550, Philippines |

|

Region served

|

Indo-Pacific |

|

Membership

|

69 countries |

|

President

|

Masato Kanda |

|

Main organ

|

Board of Governors |

| Affiliations | International Monetary Fund (International) |

|

Staff

|

3,769 |

The Asian Development Bank (ADB) is a special bank that helps countries in Asia grow and improve. It works to make life better for people by supporting social and economic development. The main office of the bank is in Metro Manila, Philippines. It also has 31 smaller offices around the world.

The ADB started on December 19, 1966. It welcomes countries from Asia and the Pacific, as well as other developed countries. When it first began, it had 31 members. By 2019, the ADB had grown to include 69 member countries.

The ADB is similar to the World Bank. It uses a voting system where countries with more money invested in the bank get more votes. Every year, the ADB publishes a report. This report shares information about its work and how it uses its money. The ADB also has a scholarship program with Japan. This program helps about 300 students each year. These students study in different countries in the region. After they finish their studies, they are expected to help their home countries develop. The ADB is also an official observer at the United Nations.

As of December 31, 2020, Japan and the United States owned the largest parts of the bank, each with 15.571% of the shares. China owned 6.429%, India owned 6.317%, and Australia owned 5.773%.

Contents

How the ADB Works

The most important group that makes decisions for the ADB is the Board of Governors. This board has one representative from each member country. The Board of Governors chooses 12 people to be on the board of directors. They also choose their helpers. Eight of these 12 directors come from countries in Asia and the Pacific. The other directors come from countries outside this region.

The Board of Governors also chooses the bank's president. The president leads the board of directors and manages the ADB. A president serves for five years and can be chosen again. Because Japan is one of the biggest investors in the bank, the president has always been Japanese.

The current president is Masato Kanda. He took over from Masatsugu Asakawa on February 24, 2025. Mr. Asakawa had announced his resignation in 2024. Before Mr. Asakawa, Takehiko Nakao was president, and before him, Haruhiko Kuroda.

The main office of the bank is at 6 ADB Avenue, Mandaluyong, Metro Manila, Philippines. It has 42 field offices in Asia and the Pacific. It also has offices in Washington, Frankfurt, Tokyo, and Sydney. About 3,000 people work for the bank. These workers come from 60 of its 68 member countries.

Leaders of the ADB

| Name | Dates | Nationality |

|---|---|---|

| Takeshi Watanabe | 1966–1972 | |

| Shiro Inoue | 1972–1976 | |

| Taroichi Yoshida | 1976–1981 | |

| Masao Fujioka | 1981–1989 | |

| Kimimasa Tarumizu | 1989–1993 | |

| Mitsuo Sato | 1993–1999 | |

| Tadao Chino | 1999–2005 | |

| Haruhiko Kuroda | 2005–2013 | |

| Takehiko Nakao | 2013–2020 | |

| Masatsugu Asakawa | 2020–February 23, 2025 | |

| Masato Kanda | February 24, 2025– |

ADB's History

Starting in the 1960s

The idea for a bank like the ADB first came up in 1956. Japan's Finance Minister, Hisato Ichimada, suggested it to the United States. He thought a new bank could help with development projects in Southeast Asia. A year later, Japanese Prime Minister Nobusuke Kishi said Japan wanted to help create a regional development fund. This fund would get money mostly from Japan and other industrial countries. But the U.S. was not interested at that time, so the idea was put on hold.

The idea came up again in late 1962. An economist named Kaoru Ohashi suggested forming a study group. This group would look into creating a development bank for Asia. The group met often in 1963. They looked at different ways to set up a new organization. They used the experiences of Takeshi Watanabe with the World Bank. However, the World Bank itself was not very supportive, and the group became discouraged.

At the same time, the idea was officially suggested at a trade meeting in 1963. A young Thai economist, Paul Sithi-Amnuai, proposed it. Even though people had mixed feelings at first, support for a new bank quickly grew.

An expert group was formed to study the idea. Japan was asked to join this group. When Watanabe was recommended, the two ideas for a new bank came together. At first, the U.S. was unsure. They did not oppose the idea, but they were not ready to offer money. However, a new bank for Asia soon fit into a bigger plan. This plan was for the U.S. to help Asia more, especially as the U.S. was increasing its military support in South Vietnam.

Japan was a key player in creating the ADB. It hoped the ADB offices would be in Tokyo. But eight other cities also wanted to host the bank. These included Bangkok, Colombo, Kabul, Kuala Lumpur, Manila, Phnom Penh, Singapore, and Tehran. To decide, the 18 possible member countries voted at a meeting in Manila in November/December 1965. Tokyo did not win enough votes in the first two rounds. In the final vote, Tokyo got eight votes, and Manila got nine. One country did not vote. So, Manila was chosen to host the new development bank. The Japanese were surprised and very disappointed. Watanabe later wrote that he felt like his carefully raised child had been taken far away.

On December 3, 1965, Philippine President Diosdado Macapagal laid the first stone for the Asian Development Bank building.

In 1966, a lot of work was done to get the new bank ready to open in Manila. A big decision was choosing the president. Japanese Prime Minister Eisaku Satō asked Watanabe to be a candidate. He first said no, but other countries pressured him, and he agreed. Since there were no other candidates, Watanabe was chosen as the first President of the Asian Development Bank. This happened at its first meeting on November 24, 1966.

By the end of 1972, Japan had given $173.7 million to the bank's main funds. This was 22.6% of the total. It also gave $122.6 million to special funds, which was 59.6% of that total. In comparison, the United States only gave $1.25 million to the special fund.

After it was created in the 1960s, the ADB mostly helped with food production and rural development. At that time, Asia was one of the poorest regions in the world.

Early loans mostly went to Indonesia, Thailand, Malaysia, South Korea, and the Philippines. These countries received 78.48% of all ADB loans between 1967 and 1972. Japan also benefited a lot. It received 41.67% of all purchases made by the bank between 1967 and 1976. Japan linked its special fund contributions to its preferred areas and regions. It also linked them to purchases of its goods and services. For example, it gave $100 million for the Agricultural Special Fund in April 1968.

Watanabe served as the first ADB president until 1972.

1970s–1980s: Growing Support

In the 1970s, the ADB started helping developing countries in Asia with education and health. Then, it expanded to help with infrastructure and industry. As Asian economies grew later in the decade, there was a need for better infrastructure. This was to support economic growth. The ADB focused on improving roads and providing electricity. When the world faced its first oil price shock, the ADB gave more help to energy projects. These projects especially supported countries in developing their own energy sources.

In the 1980s, the ADB began working with private companies. This was after a lot of pressure from the Reagan Administration. The goal was to increase the impact of its help to poor countries in Asia and the Pacific. After the second oil crisis, the ADB gave more help to energy projects. In 1982, the ADB opened its first field office in Bangladesh. Later in the decade, it worked more with non-government organizations (NGOs).

Japanese presidents Inoue Shiro (1972–76) and Yoshida Taroichi (1976–81) were important in the 1970s. Fujioka Masao, the fourth president (1981–90), was a strong leader. He started a big plan to make the ADB a high-impact development agency.

On November 18, 1972, the bank opened its headquarters on Roxas Boulevard in Pasay City, Philippines. On May 31, 1991, the ADB moved its offices to Ortigas Center in Pasig City. The Department of Foreign Affairs (Philippines) then took over its old Pasay building.

1990s: Expanding and Responding to Crises

In the 1990s, the ADB started to encourage countries in the Mekong River area to work and trade together. This decade also saw more countries join the ADB. Several Central Asian countries became members after the Cold War ended.

In mid-1997, a financial crisis hit the region. The ADB responded with projects to make financial systems stronger. It also created safety nets for poor people. During this crisis, the ADB approved its largest single loan. It was a $4 billion emergency loan to South Korea. In 1999, the ADB made reducing poverty its main goal.

2000s: New Challenges and Growth

The early 2000s saw a big increase in money given to private businesses. The ADB had done this since the 1980s, but it was not very successful then. However, starting in 2002, the ADB greatly increased its private sector lending. Over the next six years, the Private Sector Operations Department (PSOD) grew a lot. Its new loans and earnings became 41 times higher than in 2001. In March 2008, the board officially recognized these achievements. They adopted a plan called the Long Term Strategic Framework (LTSF). This plan stated that helping private sector development was the ADB's top priority. It also said that private sector lending should make up 50% of the bank's loans by 2020.

In 2003, the severe acute respiratory syndrome (SARS) epidemic affected the region. The ADB responded with programs to help countries work together. These programs addressed infectious diseases like avian influenza and HIV/AIDS. The ADB also helped after many natural disasters in the region. It gave more than $850 million for recovery in parts of India, Indonesia, Maldives, and Sri Lanka. These areas were hit by the 2004 Indian Ocean earthquake and tsunami. Also, $1 billion in loans and grants was given to people affected by the October 2005 earthquake in Pakistan.

In December 2005, China gave $20 million to the ADB. This money was for a regional fund to help reduce poverty. It was China's first such fund set up at an international organization.

In 2009, the ADB's Board of Governors agreed to make the bank's capital three times larger. It went from $55 billion to $165 billion. This gave the bank much-needed money to respond to the 2008 financial crisis. This 200% increase was the largest in the ADB's history. It was also the first increase since 1994.

2010s: Moving Forward

Asia recovered from the economic crisis. By 2010, it had become a new engine for global economic growth. However, it was still home to two-thirds of the world's poor. Also, the growing wealth of many people in the region created a bigger income gap. This left many people behind. The ADB responded by giving loans and grants that encouraged economic growth.

In early 2012, the ADB started working with Myanmar again. This was because of reforms the government had started. In April 2014, the ADB opened an office in Myanmar. It also started giving loans and grants to the country again.

In 2017, the ADB combined its Asian Development Fund (ADF) lending with its ordinary capital resources (OCR). This made the OCR balance sheet larger. It allowed the bank to increase its yearly loans and grants to $20 billion by 2020. This was 50% more than before.

In 2020, the ADB gave a $2 million grant from the Asia Pacific Disaster Response Fund. This helped the Armenian government fight the spread of the COVID-19 pandemic. In the same year, the ADB promised a $20 million loan to Electric Networks of Armenia. This loan would ensure electricity for citizens during the pandemic. It also approved $500,000 in regional technical help. This was to buy personal protective equipment and other medical supplies.

What the ADB Aims to Do

Goals

The ADB sees itself as an organization that helps with social development. Its main goal is to reduce poverty in Asia and the Pacific. It does this by promoting economic growth that includes everyone. It also supports growth that is good for the environment and helps countries work together. The ADB achieves this through investments. These investments are loans, grants, and sharing information. They go into areas like infrastructure, health care, and financial systems. The ADB also helps countries get ready for climate change or better manage their natural resources.

Main Areas of Focus

Most of the ADB's loans (80%) go to public projects in five main areas:

- Education – Many developing countries in Asia have greatly increased the number of children in primary school. But big challenges remain that could stop economic and social growth.

- Environment, Climate Change, and Disaster Risk Management – Taking care of the environment is necessary for economic growth and reducing poverty in Asia.

- Finance Sector Development – A strong financial system is vital for a country's economy. It helps create wealth that can be shared and benefit everyone, especially the poorest. Developing financial systems, including small loans and business support, is key to reducing poverty. The Private Sector Operations Department (PSOD) has focused on this since 2002. They also help a lot with trade finance, supporting billions of dollars in trade each year.

- Infrastructure – This includes transport and communications, energy, water supply, sanitation, and city development.

- Regional Cooperation and Integration – This means helping countries in a region become more connected. It helps speed up economic growth, reduce poverty, and create more jobs.

- Private Sector Lending – The ADB also lends money directly to private companies. This started because the Reagan Administration wanted it. This type of lending grew very fast and is now a major part of the ADB's work.

How the ADB Gets and Gives Money

The ADB offers two main types of loans. "Hard" loans are like regular commercial loans. They are mostly for middle-income countries in Asia. "Soft" loans have lower interest rates. These are for poorer countries in the region. Since January 2017, both types of loans come from the bank's main fund, called ordinary capital resources (OCR).

The ADB's Private Sector Department (PSOD) offers more than just commercial loans. They can also provide guarantees, equity (owning a part of a company), and mezzanine finance (a mix of debt and equity).

In 2017, the ADB lent $19.1 billion. Of this, $3.2 billion went to private businesses. The ADB's total operations in 2017, including grants and money from partners, reached $28.9 billion.

The ADB gets its money by selling bonds in the world's financial markets. As of April 2025, Moody's Investors Service gave its debt a very high credit rating of AAA. The bank also gets money from member countries' contributions, profits from its lending, and money repaid from loans.

| Country | 2018 | 2017 | 2016 | 2015 | ||||

|---|---|---|---|---|---|---|---|---|

| $ million | % | $ million | % | $ million | % | $ million | % | |

| 17,015 | 16.6 | 16,284 | 16.9 | 15,615 | 24.8 | 14,646 | 25.2 | |

| 16,115 | 15.7 | 14,720 | 15.2 | 13,331 | 21.2 | 12,916 | 22.2 | |

| 10,818 | 10.6 | 10,975 | 11.4 | 4,570 | 7.3 | 4,319 | 7.4 | |

| 10,356 | 10.1 | 9,393 | 9.7 | 8,700 | 13.8 | 8,214 | 14.1 | |

| 9,169 | 8.9 | 8,685 | 9.0 | - | - | - | - | |

| - | - | - | - | 5,935 | 9.4 | 5,525 | 9.5 | |

| Others | 38,998 | 38.1 | 36,519 | 37.8 | 14,831 | 23.5 | 12,486 | 21.6 |

| Total | 102,470 | 100.0 | 96,577 | 100.0 | 62,983 | 100.0 | 58,106 | 100.0 |

Working with Other Organizations

The ADB works with other development organizations on some projects. This helps to get more money for projects. In 2014, $9.2 billion of the ADB's $22.9 billion operations were funded by other organizations. This was nearly half of the total. The bank also talks with many other international organizations.

Funds and Resources

More than 50 different funds and resources, totaling billions of dollars each year, are managed by the ADB. These funds are used for projects that help social and economic development in Asia and the Pacific. The ADB has also raised money by issuing bonds linked to the Indian rupee.

On February 26, 2020, the ADB raised $118 million from rupee-linked bonds. This helped develop the India International Exchange in India. It also helped create a clear yield curve for bonds from 2021 through 2030, with $1 billion in outstanding bonds.

2022 Annual Report Highlights

The 2022 Annual Report shows how the ADB helped its developing member countries. It helped them recover from the COVID-19 pandemic and deal with new challenges. These challenges included the Russian invasion of Ukraine and a serious food crisis. The ADB also worked on climate change, giving $6.7 billion for climate projects. It also provided a $14 billion package for food security. The ADB gave a total of $20.5 billion in different types of help, including money for private businesses. It also encouraged countries to work together. The report highlights a focus on gender equality, education, healthcare, and finding more money through new financial methods. The report also mentions changes within the organization to make it work better. It also notes that the headquarters fully reopened and adopted a hybrid work model.

Sharing Information

The ADB has a policy about sharing information. It believes that all information it creates should be shared with the public. The only exceptions are if there's a good reason to keep it private. This policy means the ADB is open and responsible in its work. It also means it responds quickly to requests for information. The ADB does not share information that could harm people's privacy or safety. It also keeps some financial and business information private.

Important Projects and Help

The ADB has supported many important projects, including:

- Afghanistan: Hairatan to Mazar-e-Sharif Railway Project

- Armenia: Water Supply and Sanitation Sector Project

- Bhutan: Green Power Development Project

- India: Rural Roads Sector II Investment Program; Agartala Municipal Infrastructure Development Project

- Indonesia: Vocational Education Strengthening Project

- Laos: Northern and Central Regions Water Supply and Sanitation Sector Project

- Mongolia: Food and Nutrition Social Welfare Program and Project

- Philippines: North–South Commuter Railway Extension Project (Malolos–Clark Railway Project and South Commuter Railway Project), funded with Japan International Cooperation Agency; Bataan–Cavite Interlink Bridge, funded by Asian Infrastructure Investment Bank and Export-Import Bank of Korea-Economic Development Cooperation Fund; Laguna Lakeshore Road Network, funded by Asian Infrastructure Investment Bank and Export-Import Bank of Korea-Economic Development Cooperation Fund

- Solomon Islands: Pacific Private Sector Development Initiative

Countries with the Most Investment and Votes

The table below shows the 20 countries with the largest investment and voting power in the Asian Development Bank as of December 2021.

| Rank | Country | Subscribed capital (% of total) |

Voting power (% of total) |

|---|---|---|---|

| World | 100.000 | 100.000 | |

| 1 | 15.571 | 12.751 | |

| 1 | 15.571 | 12.751 | |

| 3 | 6.429 | 5.437 | |

| 4 | 6.317 | 5.347 | |

| 5 | 5.773 | 4.913 | |

| 6 | 5.434 | 4.641 | |

| 7 | 5.219 | 4.469 | |

| 8 | 5.026 | 4.315 | |

| 9 | 4.316 | 3.747 | |

| 10 | 2.717 | 2.468 | |

| 11 | 2.377 | 2.196 | |

| 12 | 2.322 | 2.152 | |

| 13 | 2.174 | 2.033 | |

| 14 | 2.038 | 1.924 | |

| 15 | 1.803 | 1.737 | |

| 16 | 1.532 | 1.520 | |

| 17 | 1.358 | 1.381 | |

| 18 | 1.087 | 1.164 | |

| 19 | 1.023 | 1.113 | |

| 20 | 1.019 | 1.109 | |

| All Remaining Members | 10.894 | 22.832 |

ADB Members

As of September 27, 2024, the ADB has 69 members. Fifty of these members are from the Asian and Pacific Region. The other 18 members are from other parts of the world. The year next to a country's name shows when it became a member. If a country stops being a member, the bank will buy back its shares as part of settling accounts.

|

|

Related Organizations

- African Development Bank

- Asian Clearing Union

- Asian Development Bank Institute (ADBI)

- Asian Infrastructure Investment Bank (AIIB)

- Asia Cooperation Dialogue

- Asia Council

- CAF – Development Bank of Latin America and the Caribbean

- Caribbean Development Bank

- Eurasian Development Bank

- Inter-American Development Bank

- International Monetary Fund

- South Asia Subregional Economic Cooperation

- World Bank

See also

In Spanish: Banco Asiático de Desarrollo para niños

In Spanish: Banco Asiático de Desarrollo para niños

| Laphonza Butler |

| Daisy Bates |

| Elizabeth Piper Ensley |