Gold standard facts for kids

A gold standard is a way a country manages its money. It means that the value of a country's money is directly linked to a fixed amount of gold. For example, if a dollar was on a gold standard, it might be worth a certain tiny amount of gold. This system was used by many countries around the world from the 1870s until the early 1920s, and then again from the late 1920s to 1932. It was also part of the international money system after World War II until 1971. Even today, many countries still keep large amounts of gold as a backup.

Historically, systems based on silver or a mix of gold and silver (called bimetallism) were more common. Great Britain accidentally started using a gold standard in 1717. This happened because Isaac Newton, who was in charge of the Royal Mint (where coins are made), set the value of silver too low compared to gold. This made silver coins disappear from circulation. As Britain became a major financial power, other countries started to copy its money system.

The gold standard was mostly stopped during the Great Depression because it made economic problems worse. It limited what governments could do to help their economies. For instance, it made it hard for them to print more money to create jobs during tough times. Most economists today agree that going back to the gold standard would not make prices more stable or help with jobs. In fact, many believe it made the Great Depression longer and deeper.

However, some people, especially those who believe in free markets, still support the gold standard. They think it helps keep prices stable and prevents governments from spending too much money.

Contents

- How the Gold Standard Works

- Early History of Money and Gold

- The International Gold Standard (1873–1914)

- The Gold Standard in the United States

- Why the Gold Standard Was Abandoned

- Modern Gold Production

- Reintroducing the Gold Standard

- Why Gold Was Used as Money

- Impact of the Gold Standard

- Who Supports the Gold Standard?

- Images for kids

- See also

How the Gold Standard Works

There are different ways a gold standard can be set up:

Gold Coin Standard

The United Kingdom started using a gold coin standard in 1717. In this system, gold coins are the main money that people use every day. However, it was tricky because silver coins were still around but were worth less.

Gold Bullion Standard

Later, in the 19th century, the gold bullion standard became more common. In this system, gold coins don't circulate much. Instead, big banks (like central banks) promise to exchange paper money for large bars of gold (called bullion) at a set price. This was a way to manage money between countries.

Limping Standard

Some countries used a "limping standard." This meant they had switched to gold, but still had a lot of old silver coins that were accepted at their original value, even if the silver in them was worth less. This made the value of their money a bit uncertain. Examples include old French, German, Dutch, Indian, and U.S. silver coins.

Gold Exchange Standard

Finally, a gold exchange standard means a government promises to keep its money's value fixed, not directly to gold, but to the money of another country that is on a gold standard. This was the main international system after World War II, where many countries linked their money to the U.S. dollar, and the U.S. dollar was linked to gold.

Early History of Money and Gold

People started using gold as money around 600 BCE in Asia Minor. Over time, gold and other valuable items became accepted forms of money because they kept their value well. For a long time, silver was the main money used for daily life, like paying wages or buying food. Gold was mostly used for international trade or very large payments.

Why Silver Was More Common

Before the 19th century, gold wasn't practical for everyday use for a few reasons:

- Small Size: Gold coins were very small and rare. A tiny gold coin could be worth a week's pay for a skilled worker, making it hard to use for small purchases. Silver coins were better for daily needs.

- No Small Change: There weren't many small copper or low-value silver coins that could be easily exchanged for gold or silver. Small coins were often made of valuable metal themselves, or people didn't trust them.

- No Banknotes: Paper money (banknotes) wasn't widely trusted until the 19th century. People worried about them losing value or being fake.

So, early money systems in Europe were mostly based on silver. Gold was used for big international deals, but its value often changed compared to silver.

Britain's Shift to Gold

The English pound sterling started as a silver-based currency around 800 CE. However, there were always problems with silver coins being worn down or underweight. In 1717, the value of the gold guinea coin was set too high compared to silver. This made gold cheaper and more reliable than silver in Britain, leading to a shift towards gold.

Several things helped Britain move to a gold standard:

- A lot of gold came from the Brazilian Gold Rush in the 18th century.

- Trade with China often meant silver left Europe, making gold more important.

- People started trusting banknotes from the Bank of England more.

- Small, low-value silver coins (called "token coins") became accepted as substitutes for gold.

After the Napoleonic Wars, Britain officially moved to the gold standard. They stopped using the old guinea coin and introduced the gold sovereign, worth 20 shillings. They also started issuing permanent low-value silver coins and made Bank of England banknotes convertible into gold. This system was then spread to British colonies like Australia, New Zealand, and Canada.

Gold Rushes Change Things

Until about 1850, only Britain and some of its colonies were on the gold standard. Most other countries used silver or a mix of both. But then, huge amounts of gold were discovered in California in 1849 and Australia in 1851. These "gold rushes" greatly increased the world's gold supply.

This made gold cheaper compared to silver. Countries like France and the United States, which had used both metals, started to use more gold. This meant more countries were using the gold standard, and it gained momentum around the world. By the late 19th century, more and more countries, including Portugal and many British colonies, joined the gold standard.

The International Gold Standard (1873–1914)

The international gold standard really took off in 1873. This happened after the German Empire decided to switch from silver to gold money, partly using the huge amount of gold it received from France after the Franco-Prussian War. This move by a major European country encouraged many others to follow.

Many countries switched to gold around this time:

- The British Empire (1816)

- The German Empire (1873)

- The Latin Monetary Union (France, Belgium, Switzerland, Italy) (1873)

- The United States (1873)

- The Scandinavian Monetary Union (Denmark, Sweden, Norway) (1875)

- The Netherlands (1875)

- The Ottoman Empire (1881)

- Austria-Hungary (1892)

- The Russian Empire (1897)

Adopting the gold standard helped international trade and investment because it made exchange rates between countries stable. This meant businesses knew what their money would be worth in other countries.

Central Banks and Gold Exchange

As more countries switched to gold, there wasn't always enough gold to go around, and many still had lots of old silver coins. To solve this, national central banks stepped in. They started replacing silver coins with national banknotes and token coins (coins worth less than their metal content). These banks held the country's gold supply and promised to exchange banknotes for gold bullion (large bars) or for the money of other gold-standard countries, especially for international payments. This system was called the gold bullion standard or gold exchange standard.

Economist John Maynard Keynes explained that this system was the main way the international gold standard worked before World War I. He believed it was even better than Britain's old system where gold coins circulated everywhere. He said that as long as gold was available for international payments at a steady rate, it didn't really matter if gold coins were used for everyday transactions inside a country.

So, the classical gold standard wasn't just about gold coins circulating. It was mostly about central banks managing banknotes and other money, with their value backed by gold reserves. This was a step towards modern money systems where central banks manage the value of money without a direct link to gold.

Gold Standard Spreads to Asia

The gold exchange standard also spread to many Asian countries before 1914. For example, the Netherlands East Indies (now Indonesia) linked its money to the gold Dutch guilder in 1875. Japan, the Philippines, and Mexico also adopted gold standards around the turn of the century. Japan, for instance, needed gold reserves to join Western financial markets.

How the System Was Supposed to Work

Economists talked about the "rules of the game" for how central banks should manage the gold standard. The idea was that if a country exported more goods, it would get more gold. This extra gold would make prices go up in that country. If a country imported more, it would lose gold, and prices would go down. These price changes were supposed to balance trade between countries.

However, in reality, this "self-correcting" system didn't always work perfectly. Central banks often found it more effective to change interest rates to influence prices and gold flows. Sometimes, central banks didn't follow the "rules" because they had other goals, like keeping domestic prices low.

The Gold Standard in the United States

The United States started with a money system based on both silver and gold in 1792. The value of the U.S. dollar was linked to both a certain amount of silver and a certain amount of gold. For many years, Spanish silver dollars were more common than U.S. coins.

Before the Civil War

In 1834, the U.S. changed the value of gold to make it more attractive. This meant gold coins became more common. When gold was discovered in California in 1848, even more gold entered the economy. This made silver coins less valuable, and they started to disappear from circulation. By 1857, foreign money was no longer accepted as legal tender.

After the Civil War

During the U.S. Civil War, the government printed a lot of paper money (called "greenbacks") that wasn't backed by gold or silver. This caused prices to rise. After the war, the government wanted to go back to a metallic standard. By 1879, the value of greenbacks matched the price of gold, and the U.S. was effectively back on the gold standard.

In 1873, a law was passed that stopped the minting of silver dollars. This caused a lot of debate, especially from silver miners who wanted to sell their silver. Laws were later passed to force the government to mint large amounts of silver dollars again. However, people didn't fully trust the silver money, which led to problems for U.S. gold reserves in 1893.

By 1900, the gold dollar was officially declared the main unit of money, and a gold reserve was set up for paper money. All paper money and silver coins could be exchanged for gold.

Why the Gold Standard Was Abandoned

World War I's Impact

The gold standard faced its biggest challenge during World War I. Many countries had to stop using it to pay for the war. For example, the United Kingdom and its empire stopped exchanging paper money for gold coins. This was because governments needed to print more money to fund the war, which caused prices to rise sharply.

The system couldn't handle the huge trade imbalances caused by the war. Prices didn't balance out quickly enough. By the time the Great Depression hit, the gold standard was already struggling, and the Depression finished it off. Germany, for example, had to print a lot of money to pay for war damages, leading to extreme inflation in the early 1920s. The U.S. was one of the few countries that kept the gold standard during the war.

Between the World Wars

After World War I, Britain officially ended the gold coin standard in 1925 and switched to a gold bullion standard. This meant gold coins no longer circulated, but the government still sold large gold bars at a fixed price. Some, like John Maynard Keynes, warned that returning to the gold standard would cause economic problems. In 1931, Britain abruptly left the gold standard again. This decision actually helped Britain's economy because it allowed the government to use its money policies to boost the economy. Australia, New Zealand, and Canada quickly followed.

The Great Depression's Role

The Great Depression (1929–1939) forced many countries to abandon the gold standard. Countries that produced raw materials were the first to leave. In 1931, a banking crisis in Europe caused Germany and Austria to stop exchanging their money for gold. This spread fear, and people started withdrawing their money from banks, leading to a loss of confidence in the British pound.

On September 19, 1931, Britain officially left the gold standard. This move, though meant to be temporary, had surprisingly good effects on the economy. It showed that leaving the gold standard could be helpful.

When Franklin D. Roosevelt became U.S. President in March 1933, he also took the U.S. off the gold standard. By the end of 1932, the gold standard was no longer a global money system.

Economists like Barry Eichengreen believe the gold standard made the Great Depression worse and longer. Here's why:

- Conflicting Goals: Governments faced pressure to reduce unemployment, but the gold standard made it hard to do so while keeping money stable.

- Capital Flight: People lost trust in governments to keep their money stable, leading to money quickly leaving countries during crises.

- U.S. Leadership: The U.S. became the main financial center, but it wasn't as good as Britain at managing the international money system.

The gold standard limited central banks' ability to print more money to help the economy during the Depression. Once countries left the gold standard, they could use money policies to stimulate their economies. Studies show that countries that left the gold standard earlier recovered faster from the Great Depression.

In 1934, the U.S. government took control of all gold held by banks and changed the value of the dollar from $20.67 to $35 per troy ounce of gold. This was a big devaluation. Other factors like trade wars and high taxes also contributed to the Depression.

Bretton Woods System

After World War II, a new international money system called the Bretton Woods system was set up in 1944. It was like a gold standard, but with some big differences. Other countries' money was fixed to the U.S. dollar, and only central banks could exchange dollars for gold at a fixed rate of $35 per ounce. Regular people or businesses couldn't do this. This meant all currencies linked to the dollar also had a fixed value in gold.

However, this system eventually faced problems. Countries like France started exchanging their dollars for gold, reducing U.S. gold reserves. Also, the U.S. was spending a lot on the Vietnam War. Because of these issues, U.S. President Richard Nixon stopped the international exchange of U.S. dollars for gold on August 15, 1971. This event is known as the "Nixon Shock."

This was supposed to be a temporary fix, but gold convertibility never resumed. The dollar's value was later changed, but it was eventually allowed to "float," meaning its value was determined by the market, not a fixed amount of gold. By 1976, all links to gold were removed from U.S. laws. From then on, the international money system used fiat money, which is money whose value comes from government decree, not from being backed by a physical commodity like gold.

Modern Gold Production

It's estimated that about 174,100 tonnes of gold have been mined throughout human history. This amount would fit into a cube about 21 meters (69 feet) on each side. Today, the world produces about 2,700 tonnes of gold each year. Gold production has kept pace with population growth since the 1950s, but it hasn't grown as fast as the world economy.

Reintroducing the Gold Standard

In 2024, Zimbabwe became the first country in the 21st century to try using a gold standard for its money. They did this to fight high inflation and build trust in their economy. Their new currency, the Zimbabwe Gold (ZiG), is backed by gold and U.S. dollars. This happened after their previous currency lost almost all its value.

Why Gold Was Used as Money

Gold was a popular form of money because it's rare, lasts a long time, can be divided into smaller pieces, and is easy to identify. It was often used with silver. Money made of a commodity like gold is anonymous; you can't tell who owned it before. It also keeps its value no matter what happens to the government. For example, after the fall of South Vietnam, many refugees took their wealth in gold because their national currency became worthless.

Under a gold standard, paper money itself has no value, but people accept it because they know it can be exchanged for gold. This system is believed to protect people from very high inflation (hyperinflation) and other problems with money policies. However, it can also lead to deflation, where prices fall, which can hurt the economy.

Countries that left the gold standard earlier during the Great Depression recovered faster. This suggests that the gold standard made the Depression worse for many nations.

Different Types of Gold Standards

A full gold standard means a country has enough gold to exchange all its paper money for gold. This is hard to do because there isn't enough gold in the world to back all the money at current prices. If it were implemented, the price of gold would have to go up a lot.

In an international gold standard, gold or gold-backed money is used for payments between countries. If exchange rates go too high or low, gold flows in or out of a country until rates return to normal.

Impact of the Gold Standard

Most economists today do not believe that returning to the gold standard would improve the economy. A 2012 survey of 39 leading U.S. economists found that none of them thought it would lead to better price stability or employment. They generally agree that it would not be good for the average American.

Advantages of the Gold Standard

Some people argue that the gold standard has benefits:

- Prevents Government Overspending: It stops governments from printing too much money to pay for things, which can lead to inflation.

- Long-Term Price Stability: Supporters say it keeps prices stable over a long period, though history shows short-term prices can still change a lot.

- Fixed Exchange Rates: It provides stable exchange rates between countries, which can make international trade easier.

- Prevents Hyperinflation: It makes it harder for governments to cause hyperinflation, which is when money loses its value very quickly.

Disadvantages of the Gold Standard

However, there are also many downsides:

- Uneven Gold Distribution: Countries with more gold mines have an advantage.

- Limits Economic Growth: Some economists believe it limits how much an economy can grow because the money supply is tied to the amount of gold.

- No Help in Recessions: It prevents central banks from increasing the money supply during tough economic times, which is a common way to fight recessions.

- Price Volatility: While it might offer long-term stability, gold discoveries can cause big short-term changes in prices.

- Punishes Debtors: Falling prices (deflation) make debts harder to pay back, which can hurt the economy.

- Speculative Attacks: A gold standard can be vulnerable to people betting against a country's money, forcing it off the standard.

- Less Flexible: It makes it harder for central banks to respond to economic crises.

- Not Practical for Daily Use: Gold's high value made it impractical for everyday transactions compared to silver.

Who Supports the Gold Standard?

In 1982, the U.S. considered returning to the gold standard, but it didn't get much support. In 2001, Malaysia's Prime Minister suggested a new gold-backed currency for trade among Muslim nations, but this idea wasn't adopted.

Former U.S. Federal Reserve Chairman Alan Greenspan once supported a "pure" gold standard, believing it protected people's property from government overspending. However, more recently, he has said that central banks now act as if they are on a gold standard by focusing on controlling inflation.

The gold standard is mainly supported by economists from the Austrian School of economics, people who believe in very free markets (libertarians), and some who focus on supply-side economics.

Gold Standard in U.S. Politics

Some politicians, like former congressman Ron Paul, have long supported a gold standard. In 2011, Utah passed a law to accept gold and silver coins for taxes, driven by concerns about government policies. Similar ideas have been discussed in other states. In 2015, some Republican presidential candidates also spoke in favor of a gold standard, though economic historians disagreed with their claims that it would help the U.S. economy.

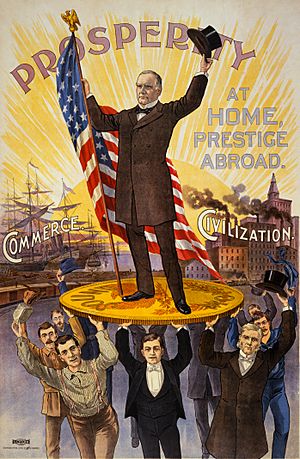

Images for kids

-

Ending the gold standard and economic recovery during the Great Depression

See also

In Spanish: Patrón oro para niños

In Spanish: Patrón oro para niños

- Black Friday (1869)—Also called the Gold Panic of 1869

- Executive Order 6102

- Gold as an investment

- Gold dinar

- Hard money (policy)

- Metal as money

- Metallism

International Institutions

- Bank for International Settlements

- International Monetary Fund

- United Nations Monetary and Financial Conference

- World Bank