Bank of England facts for kids

Seal of the Bank of England  The Bank of England building |

|

| Headquarters | Threadneedle Street, London, England, United Kingdom |

|---|---|

| Coordinates | 51°30′51″N 0°05′19″W / 51.5142°N 0.0885°W |

| Established | 27 July 1694 |

| Governor | Andrew Bailey (since 2020) |

| Central bank of | United Kingdom |

| Currency | Pound sterling GBP (ISO 4217) |

| Reserves | US$101.59 billion |

| Bank rate | 5.25% |

The Bank of England is the central bank of the United Kingdom. It's like the UK's main bank, and many other central banks around the world have copied its ideas. It started way back in 1694 to help the English Government with its money and debts. Today, it still helps the UK Government and is one of the oldest banks in the world.

The bank was owned by private investors until 1946, when the government took it over. In 1998, it became an independent public organisation. This means it works for the government but can make its own decisions about keeping prices stable. In recent years, the Bank of England has also become more responsible for keeping the UK's financial system safe and sound.

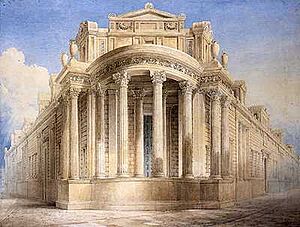

The bank's main office has been in London's financial heart, the City of London, since 1694. Since 1734, it has been on Threadneedle Street. People sometimes call it "The Old Lady of Threadneedle Street." This nickname came from a funny cartoon made in 1797.

The bank also looks after the UK's official gold reserves. It holds gold for about 30 other countries too. In 2016, the bank had about 5,134 tonnes of gold, worth a huge £141 billion. This amount might be as much as 3% of all the gold ever mined in human history!

Contents

What the Bank of England Does

The main goal of the Bank of England is to help the people of the UK. It does this by keeping money and the financial system stable. Here's how:

Keeping Prices Stable

Stable prices mean that things don't get too expensive too quickly. This is called controlling inflation.

Controlling Inflation

The bank tries to keep prices stable by making sure that price increases meet the government's target. The target for inflation is usually 2%. The bank does this by changing the main interest rate, called the bank rate. A special group at the bank, the Monetary Policy Committee (MPC), decides this rate. If inflation goes too high or too low, the Governor of the bank has to explain why to the government.

Making Payments Safe

The Bank of England is the only bank that can print banknotes in England and Wales. It also checks how other banks in Scotland and Northern Ireland print their own notes. These notes must be backed by money held at the Bank of England.

The bank also oversees how payments are made between banks. It helps banks settle large payments quickly and safely. In 2024, the bank helped settle about £500 billion in payments every day!

Keeping the Financial System Safe

The bank also works to protect people's savings and investments. It tries to stop big problems in the financial system.

Checking on Banks

After the big financial crisis in 2008, the bank got new powers. In 2011, it set up the Prudential Regulation Authority (PRA). This group checks on all major banks, building societies, and insurance companies in the UK. They make sure these companies are strong and well-run.

Managing Risks

Another group, the Financial Policy Committee (FPC), looks for big risks in the financial system. They try to find problems before they become too big. The FPC shares its findings twice a year in a report.

Banking Services for the Government

The bank provides special banking services to the UK Government. It also helps over a hundred other central banks around the world. It manages the UK's foreign money reserves and looks after the country's gold.

The bank also helps other banks. Commercial banks often keep a lot of their money at the Bank of England. This money is used to make payments between banks. That's why the Bank of England is sometimes called 'the bankers' bank'. If a bank is in serious trouble, the Bank of England can step in to lend it money as a "lender of last resort".

The Bank of England doesn't offer banking services to regular people anymore. But it still helps by exchanging old banknotes for new ones.

Dealing with Bank Failures

If a very large bank is in danger of failing, the Bank of England has special powers. It can step in to manage the situation. This is to protect important financial services and keep the financial system stable.

Past Responsibilities

For a long time, the Bank of England managed the government's debts. This meant issuing special bonds and paying interest to investors. But in 1998, a new office took over this job.

The bank also used to offer banking services to the public, including individuals and small businesses. But after the First World War, it decided to focus more on its role as a central bank. It stopped offering these services many years ago.

History of the Bank

How it Started

England faced a big problem in the late 1600s. After losing a major naval battle to France in 1690, the government needed to build a stronger navy. But they didn't have enough money and couldn't borrow it easily.

The Idea

In 1691, a man named William Paterson suggested creating a national bank. He thought it would help the government raise money. His idea was that people could lend money to the government, and in return, they would get interest. This idea became the basis for the Bank of England.

Two other important people were Charles Montagu, who helped pass the laws for the bank, and Michael Godfrey, who convinced rich people in London to support it.

The Law

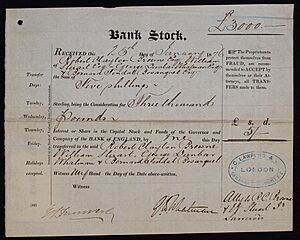

To get the money for the navy, Parliament passed a law in 1694. This law said that people who lent money to the government would become part of a new company called the Governor and Company of the Bank of England. The government promised to pay 8% interest on the loan, which was a very high rate at the time.

Becoming Official

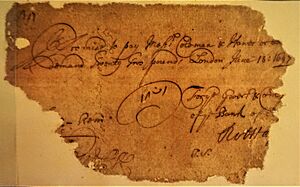

The Bank of England officially received its royal charter on July 27, 1694. People quickly lent the £1.2 million needed in just 12 days! About 1,268 people invested, mostly middle-class merchants. Even King William and Queen Mary invested £10,000.

This money helped build a strong navy. This effort also boosted England's economy, helping the new Kingdom of Great Britain become a powerful nation.

How it was Run

The first Governor of the bank was John Houblon. The bank was run by the Governor, a Deputy Governor, and 24 Directors. These Directors were often experienced bankers. The bank's symbol, Britannia, a female figure representing Britain, has been used since 1694.

The bank started with just 17 clerks and two doorkeepers.

Where it Started

The bank first opened in a smaller building in London in August 1694. But it quickly moved to Grocers' Hall in December 1694, where it stayed for almost 40 years.

How it Worked

The law said the bank couldn't trade in goods. But it could deal in gold and silver. Soon, the bank started making money by printing banknotes, taking deposits, and lending money.

The 1700s

Around this time, the idea of a "national debt" began, and the bank largely managed it. The bank helped the government raise money by selling special investments.

In 1734, the bank had 96 staff members. Its right to print banknotes was renewed several times. By 1742, it was the only company allowed to print banknotes in London.

Moving to Threadneedle Street

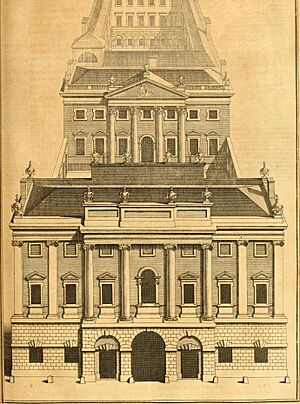

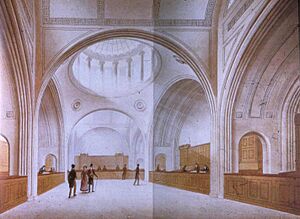

The Bank of England moved to its current home on Threadneedle Street in 1734. The new building was designed by George Sampson. It had a large hall where banknotes were issued and exchanged. It also had strong vaults underground to keep the money safe.

Growing Bigger

In the second half of the 1700s, the bank bought more land and added new buildings. The church next door was taken down in 1782 to make more space. This allowed the bank to expand even further.

The Bank's Guard

In 1780, during some riots, soldiers were sent to protect the bank. After that, a military guard protected the bank every night until 1973.

New Designs

John Soane became the bank's architect in 1788. He expanded and rebuilt parts of the bank. He made sure the whole building looked like one complete design.

Trading at the Bank

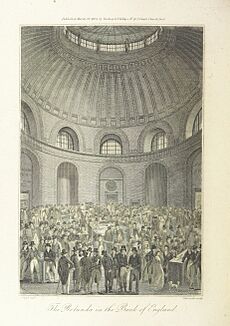

Before the London Stock Exchange was set up, the Rotunda inside the Bank of England was a busy place. Stockbrokers met there to buy and sell government investments.

Tough Times

In 1797, during a war with France, the bank's gold reserves became very low. The government had to stop the bank from paying out gold for its banknotes. This lasted until 1821.

The 1800s

In the early 1800s, the bank continued to grow. New steam-powered machines were brought in to print banknotes.

A financial crisis in 1825 showed some problems with the bank's role. Many smaller banks failed. Because of this, the Bank of England was allowed to open branches in other cities. This helped spread its banknotes around the country.

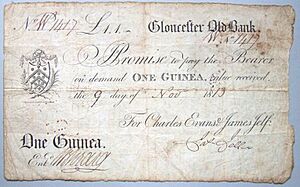

The Bank Charter Act 1844 was a very important law. It linked the amount of banknotes the bank could issue to its gold reserves. It also gave the Bank of England the only right to issue banknotes in England and Wales. Other private banks slowly stopped issuing their own notes.

The bank also acted as a "lender of last resort" for the first time in 1866. This means it lent money to other banks when no one else would.

The 1900s

Until 1931, Britain used the gold standard. This meant the value of the pound was directly linked to gold. But during the Great Depression, the UK had to stop using the gold standard.

Attempted Bombing in 1913

In 1913, a bomb was found outside the Bank of England. It was planted by suffragettes, who were campaigning for women's right to vote. Luckily, the bomb was defused, preventing many injuries. The remains of the bomb are now in a museum.

Changes and Rebuilding

From 1920 to 1944, the bank's Governor, Montagu Norman, worked to make the bank a true central bank. It moved away from regular banking services. The bank also started hiring more economists and statisticians.

Between 1925 and 1939, the bank's main building on Threadneedle Street was completely rebuilt. Most of the old buildings were taken down and replaced with a new, larger structure. This new building is seven stories tall, with three more underground levels for vaults.

During World War II, some of the bank's operations and staff moved out of London for safety. The gold and silver were kept safe in the vaults.

Becoming Government-Owned

In 1946, the Labour government officially took over the Bank of England. This meant it became owned by the public.

After the war, the bank continued to grow. It even built a large new office building near St Paul's Cathedral in 1957. However, with computers, fewer staff were needed, and this building was later sold and demolished.

In 1997, a new government gave the Bank of England more independence. This meant the bank's Monetary Policy Committee (MPC) was given the job of setting interest rates to control inflation. If inflation goes off target, the Governor has to explain why to the government.

In 1998, the job of regulating banks and insurance companies was moved away from the Bank of England. But after the 2008 financial crisis, these responsibilities were given back to the bank.

The 2000s

In 2002, the bank sold its banknote printing operations to a private company.

Mervyn King became Governor in 2003. In 2009, some people asked about unnamed shareholders who owned a small part of the bank's old stock. The government explained that this was old stock from when the bank was private, and interest was still paid on it.

In 2010, the government decided to bring bank regulation back to the Bank of England. A new committee, the Financial Policy Committee (FPC), was set up to focus on keeping the financial system stable.

Mark Carney became Governor in 2013, the first non-UK citizen to hold the role. Andrew Bailey became Governor in 2020.

Asset Purchase Facility

Since 2009, the bank has used something called the Asset Purchase Facility (APF). This is a way for the bank to buy government bonds to help the economy. It's part of a policy called quantitative easing (QE). The idea is to lower long-term interest rates and encourage spending.

QE was used several times between 2009 and 2020. At its highest point, the bank held £895 billion in bonds. In 2022, the bank started to reduce these holdings.

Banknotes

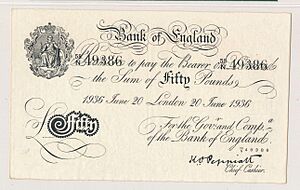

The Bank of England has been printing banknotes since 1694. At first, notes were handwritten. From 1855, they were fully printed. Until 1928, all notes were "White Notes," printed in black.

The bank started working with a company called Henry Portal in 1724 to make special paper for banknotes. The printing was done by private companies at first, but the bank took over the printing itself in 1808.

For a long time, other banks could also print their own banknotes. But the Bank Charter Act 1844 stopped this for new banks. Over time, the Bank of England became the only bank to issue notes in England and Wales. The last private bank to do so stopped in 1921. However, some commercial banks in Scotland and Northern Ireland still print their own notes today, but the Bank of England regulates them.

During World War I, the government started issuing its own £1 and 10-shilling notes. These notes showed King George V. In 1928, the Bank of England took over printing these notes.

During World War II, Germany tried to make fake British banknotes to harm the UK economy. They made huge numbers of fake notes. After the war, many of these fakes appeared, leading the bank to remove larger banknotes from circulation.

In 2006, over £53 million in banknotes were stolen from a bank depot.

Today, modern banknotes are printed by a company called De La Rue Currency.

Branch Offices

For most of the 1800s and 1900s, the Bank of England had branches in London and other English cities.

The first branches opened in 1826. The bank wanted these branches to help spread its banknotes and control the money supply. Each branch had an "Agent" who knew a lot about local business. By 1829, there were eleven branches. Some closed due to losses, but others stayed open until the 1990s.

In 1997, the last five branches closed. However, the bank still has "Regional Agencies" across the UK, with Agents who keep an eye on local economies.

Examples of Past Bank of England Branches

| Branch | Opened | Closed | Notes | Photo |

|---|---|---|---|---|

| Birmingham | 1827 | 1997 | Moved to new buildings over the years, including one built in 1970. |  |

| Bristol | 1827 | 1997 | Moved into a purpose-built building in 1847. |  |

| Hull | 1829 | 1939 | Moved into a new building in 1856. |  |

| Leeds | 1827 | 1997 | Moved into a new building in 1847, and again in 1971. |  |

| Liverpool | 1827 | 1986 | Moved into a purpose-built building in 1849. |  |

| Manchester | 1826 | 1997 | Moved into new buildings in 1847 and 1971. |  |

| Newcastle-upon-Tyne | 1828 | 1997 | Moved into its first purpose-built branch in 1838. |  |

Who Runs the Bank of England

Governors

Here are the Governors of the Bank of England since the 1900s:

| Name | Period |

|---|---|

| Samuel Gladstone | 1899–1901 |

| Augustus Prevost | 1901–1903 |

| Samuel Morley | 1903–1905 |

| Alexander Wallace | 1905–1907 |

| William Campbell | 1907–1909 |

| Reginald Eden Johnston | 1909–1911 |

| Alfred Cole | 1911–1913 |

| Walter Cunliffe | 1913–1918 |

| Brien Cokayne | 1918–1920 |

| Montagu Norman | 1920–1944 |

| Thomas Catto | 1944–1949 |

| Cameron Cobbold | 1949–1961 |

| Rowland Baring (3rd Earl of Cromer) | 1961–1966 |

| Leslie O'Brien | 1966–1973 |

| Gordon Richardson | 1973–1983 |

| Robert Leigh-Pemberton | 1983–1993 |

| Edward George | 1993–2003 |

| Mervyn King | 2003–2013 |

| Mark Carney | 2013–2020 |

| Andrew Bailey | 2020–present |

Court of Directors

The Court of Directors is like the bank's main board. It decides the bank's plans and budget. It has five full-time members (the Governor and four Deputy Governors) and up to nine other members. The government chooses all these members. The Governor serves for eight years, and Deputy Governors for five years.

| Name | Job |

|---|---|

| David Roberts | Chair, Court of Directors |

| Andrew Bailey | Governor, Bank of England |

| Benjamin Broadbent | Deputy Governor, Monetary Policy (money decisions) |

| Sarah Breeden | Deputy Governor, Financial Stability (keeping the financial system safe) |

| Sam Woods | Deputy Governor, Prudential Regulation (checking on banks) |

| Sir Dave Ramsden | Deputy Governor, Markets and Banking (managing markets and banking services) |

| Jonathan Bewes | Non-Executive Director |

| Sabine Chalmers | Non-Executive Director |

| Jitesh Gadhia | Non-Executive Director |

| Anne Glover | Non-Executive Director |

| Sir Ron Kalifa | Non-Executive Director and Senior Independent Director |

| Diana Noble | Non-Executive Director and Deputy Chair |

| Frances O'Grady | Non-Executive Director |

| Tom Shropshire | Non-Executive Director |

Other Staff

The Secretary of the Bank of England makes sure the bank is run well and ethically. The bank also has a Chief Operating Officer (COO) who handles daily tasks like HR, IT, and security. Many other Executive Directors work with the Governors to manage different parts of the bank. This includes the bank's chief economist and chief cashier.

See also

In Spanish: Banco de Inglaterra para niños

In Spanish: Banco de Inglaterra para niños

- List of British currencies

- Bank of England Act

- Coins of the pound sterling

- Financial Sanctions Unit

- Commonwealth banknote-issuing institutions

- Bank of England Museum

- Deputy Governor of the Bank of England

- List of directors of the Bank of England

- List of central banks

| Janet Taylor Pickett |

| Synthia Saint James |

| Howardena Pindell |

| Faith Ringgold |