London Stock Exchange facts for kids

| London Stock Exchange | |

|---|---|

Quick facts for kids

|

|

| Paternoster Square.jpg | |

| Type | Stock exchange |

| Location | London, England, UK |

| Founded | 30 December 1801 |

| Owner | London Stock Exchange Group |

| Key people |

|

| Currency | Sterling (most primary listings; stock prices are quoted in pence rather than pounds) |

| No. of listings | 1,918 issuers |

| MarketCap | US$3.42 trillion (as of July 2024[update]) |

| Indexes |

|

| Website | |

The London Stock Exchange (LSE) is a famous place in London, England. It is where companies buy and sell parts of their business, called shares. It's like a big marketplace for money. As of July 2024, all the companies trading on the LSE were worth a huge amount – about US$3.42 trillion!

The LSE is located in Paternoster Square, which is close to St Paul's Cathedral. Since 2007, the LSE has been part of a bigger company called the London Stock Exchange Group (LSEG). Even after some companies moved away because of Brexit, the LSE was still the most valuable stock exchange in Europe in 2023. Many people in the UK, about 12-15%, have invested in stocks and shares.

Contents

- History of the LSE

- What the LSE Does

- How Trading Works

- Mergers and Acquisitions

- Opening Times

- Arms

- See also

History of the LSE

Early Trading in Coffee Houses

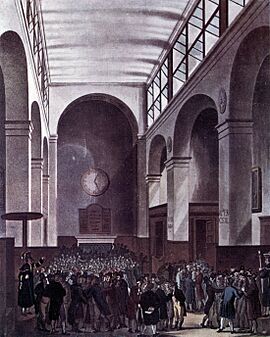

Long ago, in the 1600s, people who wanted to buy and sell shares weren't allowed in the main trading place called the Royal Exchange. So, they met in coffee houses instead, like Jonathan's Coffee-House.

In 1698, a broker named John Castaing started writing down the prices of things like salt, coal, and how much different currencies were worth. This was one of the first organized lists of prices. Later, this activity moved to Garraway's coffee house. Sometimes, auctions were held by seeing how long a candle could burn. This was a very early way of trading in London.

The Royal Exchange and New Rules

After the first Royal Exchange building was destroyed in the Great Fire of London, it was rebuilt in 1669. This was a step away from trading in coffee houses and towards a more modern stock exchange.

The Royal Exchange was a busy place for both brokers and merchants. But there were problems with people trading without a license. In 1697, a law was passed to stop this, setting a limit on how many brokers could trade. This limit caused some traders to leave the Royal Exchange and start dealing on the streets, especially in a place called 'Exchange Alley'.

Over time, traders became worried about companies that grew very quickly and then failed. So, they asked Parliament to make rules to prevent these "bubbles."

A New Stock Exchange Building

After a war (the Seven Years' War), trading at Jonathan's Coffee House became very busy again. In 1773, Jonathan and 150 other brokers formed a club. They opened a new, more formal "Stock Exchange" in Sweeting's Alley. People had to pay a fee to enter and trade.

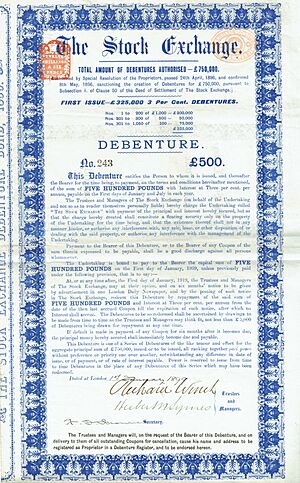

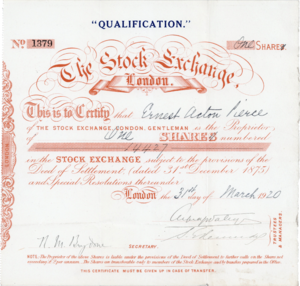

However, there was still a lot of cheating. To stop this, it was suggested that people pay a higher fee. This led to the idea of annual fees and turning the Exchange into a "Subscription room" in 1801. This was the first truly regulated exchange in London. A new, bigger building was planned at Capel Court. The first stone for this new building was laid on May 18, 1801, and it was finished on December 30, with "The Stock Exchange" written on its entrance.

First Rule Book and Growth

For many years, the Capel Court trading had no clear rules. In 1812, the Exchange created its first official rule book. This book covered important topics like how trades should be completed and what happens if someone doesn't pay.

With its new rules and more trading, the Exchange became an important part of London's financial life. Even though newspapers and the public sometimes criticized it, the government used the Exchange to raise money for wars.

Trading Around the World

After the wars, countries like Brazil, Peru, and Chile started borrowing money from London. The Exchange allowed merchants to trade with foreign countries. As international business grew, trading in foreign shares was allowed everywhere in the Exchange.

Other cities in Great Britain, like Liverpool and Manchester, also grew. In 1836, both the Manchester and Liverpool stock exchanges opened. Trading shares became a serious business, attracting many people. But just like there were times of fast growth, there were also times when markets fell quickly.

New Technologies and World Wars

By 1853, the Exchange was too crowded, so a new, larger building was built. It was finished in 1854 and had twice the space. Later in the 1800s, new inventions like the telephone, ticker tape, and the telegraph changed how the Exchange worked.

First World War Impact

When World War I started in 1914, the London Stock Exchange was hit hard. People worried that banks would ask for their money back, so prices went up quickly. The Exchange was closed from the end of July until the New Year to prevent problems. When it reopened in January 1915, there were strict rules, like only trading with cash. Many members left the Exchange during the war. In 1923, the Exchange got its own coat of arms with the motto Dictum Meum Pactum, which means "My Word is My Bond."

Second World War Impact

In 1937, the Exchange planned for a new war, thinking about moving to a safer place. But this never happened. On September 1, 1939, the Exchange closed, and two days later, World War II was declared. Unlike the first war, the Exchange reopened just six days later.

During the war, there were concerns about air raids. On December 29, 1940, a big fire happened in London. The Exchange's trading floor was hit by bombs, but the fires were put out quickly. Most trading was done over the phone to keep people safe. The Exchange only closed for one more day during the war, in 1945, due to damage from a rocket. Trading continued in the basement.

After the Wars

After the wars, the stock market became very busy in the late 1950s. This led to building a new, taller building called the Stock Exchange Tower. It was 321 feet (98 meters) high with 26 floors. Queen Elizabeth II opened it on November 8, 1972. It became a new landmark in London.

In 1973, big changes happened. Women and people born in other countries were allowed to become members. Also, the London Stock Exchange joined with eleven other British and Irish exchanges. This led to a new role, the chief executive officer. In 1991, the way the Exchange was run changed again, and its trading name became "The London Stock Exchange."

The FTSE 100 Index (pronounced "Footsie 100") was started on January 3, 1984. This index tracks the movements of the 100 biggest companies listed on the Exchange.

Modern Era Changes

On July 20, 1990, a bomb exploded in the building. Luckily, the area had been cleared, so no one was hurt. This event, along with the rise of electronic trading, led to the visitors' gallery closing permanently in 1992.

"Big Bang" and Electronic Trading

A huge change happened in 1986, known as the "Big Bang". This involved removing old rules, like fixed fees for trading. It also changed trading from people shouting orders to using computers and screens.

In 1995, the Exchange launched the Alternative Investment Market (AIM) for smaller, growing companies. Two years later, the Electronic Trading Service (SETS) was introduced, making trading faster and more efficient.

The 21st Century LSE

In 2000, the LSE became a public company, London Stock Exchange plc. It also handed over its job of listing companies to the Financial Services Authority.

With the "Big Bang" and new computer systems, the old Stock Exchange Tower was no longer needed for face-to-face trading. In 2004, the LSE moved to a new headquarters in Paternoster Square.

In 2007, the LSE joined with Borsa Italiana, which is the Italian stock exchange. This created the London Stock Exchange Group (LSEG). The LSEG's main office is also in Paternoster Square.

In 2011, protesters from Occupy London tried to gather in Paternoster Square, but police stopped them because it is private property. The protesters then moved to St Paul's Cathedral. In 2019, activists from Extinction Rebellion blocked the entrances of the LSE to protest about climate change. They were later arrested.

In March 2022, the LSE stopped trading shares for some Russian companies after the 2022 Russian invasion of Ukraine. In December 2022, Microsoft bought a small part of the London Stock Exchange Group.

What the LSE Does

The LSE has two main markets where companies can trade their shares: the Main Market and the Alternative Investment Market.

Main Market

The Main Market is where over 1,300 large companies from 60 different countries trade. The FTSE 100 Index is a list of the 100 biggest British companies on the Main Market.

Alternative Investment Market (AIM)

The Alternative Investment Market (AIM) is the LSE's market for smaller companies. Many different types of businesses, including new companies and more established ones, join AIM to get money to grow. It's a flexible market with simpler rules for companies that want to be listed publicly.

Types of Securities Traded

Many different types of financial products can be traded on the LSE, including:

- Shares of companies (Common stock)

- Bonds (loans to companies or governments)

- Exchange-traded funds (ETFs)

- Global depositary receipts (GDRs)

How Trading Works

The LSE uses its own computer system called Millennium Exchange for trading. This system helps make trading fast and efficient. Most stocks are traded in British Pounds (GBP), but some are traded in Euros (EUR) or US Dollars (USD).

The LSE also works with many Israeli technology companies. These companies help the LSE grow and build stronger business ties between the UK and Israel.

Mergers and Acquisitions

The London Stock Exchange has been involved in several attempts to merge with other exchanges.

- In 2000, there were talks about merging with the Deutsche Börse (the German stock exchange), but this did not happen.

- In 2007, the LSE agreed to merge with Borsa Italiana, the Italian stock exchange. This created the London Stock Exchange Group (LSEG), making it a leading exchange group in Europe.

- In 2020, the LSE agreed to sell Borsa Italiana to Euronext for a large sum of money. This sale was completed in 2021.

- In 2011, the LSE Group tried to merge with the TMX Group, which owns the Toronto Stock Exchange in Canada. However, this merger did not happen because it did not get enough support from TMX Group's shareholders.

NASDAQ's Attempts to Buy LSE

In 2005 and 2006, NASDAQ, a big stock exchange in the United States, tried to buy the London Stock Exchange.

- In December 2005, the LSE said no to an offer from Macquarie Bank, calling it too low.

- Soon after, NASDAQ made an offer, but the LSE also rejected it.

- NASDAQ then started buying many shares of the LSE from other investors, hoping to force a sale. By November 2006, NASDAQ owned almost 29% of the LSE and made another offer.

- However, the LSE and its shareholders continued to reject NASDAQ's offers, saying they didn't value the company enough.

- In February 2007, NASDAQ's offer failed because not enough shareholders agreed to sell their shares.

- In August 2007, NASDAQ gave up its plan to take over the LSE and later sold most of its shares to Borse Dubai, an exchange based in the United Arab Emirates.

Opening Times

The main trading hours on the LSE are from 8:00 AM to 4:30 PM local time, every day except Saturdays, Sundays, and holidays.

The detailed schedule is:

- Trade reporting: 7:15 AM – 7:50 AM

- Opening auction: 7:50 AM – 8:00 AM

- Continuous trading: 8:00 AM – 4:30 PM

- Closing auction: 4:30 PM – 4:35 PM

- Order maintenance: 4:35 PM – 5:00 PM

- Trade reporting only: 5:00 PM – 5:15 PM

The LSE is closed on holidays like New Year's Day, Good Friday, Easter Monday, and Christmas. If a holiday falls on a weekend, the next working day is observed as a holiday.

Arms

See also

In Spanish: Bolsa de Londres para niños

In Spanish: Bolsa de Londres para niños

- List of stock exchanges

- List of stock exchanges in the Commonwealth of Nations

- List of stock exchanges in the United Kingdom, the British Crown Dependencies and United Kingdom Overseas Territories

| Mary Eliza Mahoney |

| Susie King Taylor |

| Ida Gray |

| Eliza Ann Grier |