Nasdaq facts for kids

| Nasdaq Stock Market | |

|---|---|

Quick facts for kids  |

|

| NASDAQ Composite Index.webp | |

| Type | Stock exchange |

| Location | [[New York City]], U.S. |

| Founded | February 8, 1971 |

| Owner | Nasdaq, Inc. |

| Currency | United States dollar |

| No. of listings | 3,890 (February 2025) |

| MarketCap | $30.13 trillion (November 2024) |

| Indexes |

|

The Nasdaq Stock Market (pronounced "NAZ-dak") is a major American stock exchange located in New York City. It is known for being the busiest place in the U.S. for trading stocks. Nasdaq is the second largest stock exchange in the world based on the total value of all the companies listed there. It is owned by a company called Nasdaq, Inc.. Nasdaq is especially famous for listing many technology companies, but it also includes businesses from healthcare, finance, media, and more. Many companies from other countries, especially China and Israel, also list their stocks on Nasdaq.

Contents

History of Nasdaq

How Nasdaq Started

Nasdaq was created in 1971 by the National Association of Securities Dealers (NASD). The name "Nasdaq" originally stood for "National Association of Securities Dealers Automated Quotations."

On February 8, 1971, the Nasdaq Stock Market officially began. It was the first stock market in the world to be fully electronic. This meant that instead of people shouting orders on a trading floor, everything was done using computers. At first, Nasdaq mainly showed stock prices. Later, it became a full trading platform. Early companies listed on Nasdaq included Intel Corporation, Comcast, and Applied Materials.

Nasdaq Grows Bigger

After Nasdaq launched, many companies that traded "over-the-counter" (meaning not on a big exchange) moved to Nasdaq. Over time, Nasdaq added ways to report trades and automated trading systems. This made it a true stock market.

By 1991, Nasdaq handled 46% of all stock trades in the U.S. In 1992, Nasdaq teamed up with the London Stock Exchange. This was the first time two major stock markets on different continents connected.

In 1998, Nasdaq became the first U.S. stock market to allow online trading. It attracted many new technology companies during the "dot-com bubble" in the late 1990s.

Nasdaq in the 2000s

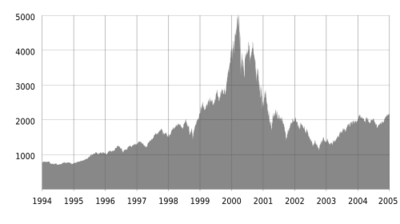

In March 2000, the NASDAQ Composite index reached a high point. However, it then dropped sharply as the dot-com bubble burst.

Becoming a Public Company

In 2002, Nasdaq, Inc. became a public company. This meant its own shares could be bought and sold on the stock market. In 2006, the Nasdaq Stock Market officially became a licensed national securities exchange.

In 2007, Nasdaq merged with OMX, a big exchange company in Nordic countries. This helped Nasdaq grow its reach around the world. The company then changed its name to NASDAQ OMX Group.

To have its shares listed on Nasdaq, a company must meet certain rules. It needs to be registered with the United States Securities and Exchange Commission (SEC). It also needs enough "market makers" (firms that help buy and sell stocks). Plus, it must meet minimum requirements for its assets, money, and number of shareholders.

Buying Other Exchanges

Nasdaq has bought other exchanges over the years. In 2005, it bought Instinet. In 2007, Nasdaq acquired the Philadelphia Stock Exchange. This is the oldest stock exchange in the U.S.

Important Milestones

In 2012, NASDAQ OMX became a founding member of the United Nations Sustainable Stock Exchanges Initiative. This group works to make stock markets more environmentally friendly and fair.

In 2016, Adena Friedman became the chief executive officer of Nasdaq. She was the first woman to lead a major stock exchange in the U.S.

In 2018, the SEC stopped the New York Stock Exchange (NYSE) and Nasdaq from raising certain prices for market data. This was the first time the SEC rejected such price increases.

In December 2020, Nasdaq removed shares of four Chinese companies from its indexes. This was done to follow a U.S. government order.

Nasdaq Today

In September 2024, the European Commission inspected Nasdaq's offices. They were looking into possible unfair business practices.

In March 2025, Nasdaq announced plans for 24-hour, 5-day-a-week trading. This change is expected in the second half of 2026. It aims to meet the growing global demand for U.S. stocks. The plan still needs approval from the U.S. Securities and Exchange Commission.

Nasdaq Stock Indexes

The main index for Nasdaq is the NASDAQ Composite. This index has been around since Nasdaq started. It is one of the most watched indexes globally. It includes all stocks listed on the Nasdaq exchange. The index uses a point system based on the total value of all listed companies. In June 2020, the Nasdaq Composite went over 10,000 points. By December 2024, it had doubled, crossing 20,000 points.

To be part of the Composite index, stocks must be listed only on Nasdaq. They can be common stocks, American Depositary Receipts (ADRs), or other types of shares.

The QQQ exchange-traded fund tracks the NASDAQ-100 index. This index was created in 1985. It tracks the 100 largest companies on Nasdaq, not including financial companies. The NASDAQ Financial-100 Index tracks the 100 largest financial companies.

How Stock Prices Are Shown

A "quote" is the price of a stock on an exchange. Quotes show two main prices:

- Bid: The highest price buyers are willing to pay.

- Offer (or Ask): The lowest price sellers will accept.

Nasdaq shows quotes at three levels:

- Level 1: Shows the best bid (highest buying price) and the best ask (lowest selling price).

- Level 2: Shows all public quotes from "market makers." These are firms that help trade specific stocks. It also shows information about other dealers wanting to buy or sell.

- Level 3: This level is used by market makers themselves. It allows them to enter their own prices and complete trades.

Trading Hours

Nasdaq trading sessions are based on Eastern Time Zone:

- 4:00 a.m. to 9:30 a.m.: This is the "premarket" session. It's for trading before the main hours.

- 9:30 a.m. to 4:00 p.m.: This is the normal trading session. Most trading happens during these hours.

- 4:00 p.m. to 8:00 p.m.: This is the "postmarket" session. It's for trading after the main hours.

Nasdaq usually has about 253 trading days each year.

Nasdaq Market Tiers

The Nasdaq exchange has three different levels, or "tiers," for companies to be listed on. These tiers are based on the size of the company.

- Capital Market (NASDAQ-CM): This market is for smaller companies. The rules for listing here are not as strict as for larger companies.

- Global Market (NASDAQ-GM): This market includes about 1,450 stocks. These companies meet Nasdaq's strong financial and trading rules. They also follow good company management standards. It's less exclusive than the Global Select Market.

- Global Select Market (NASDAQ-GS): This is the most exclusive market. It includes about 1,200 stocks. These are the largest companies on Nasdaq. They meet the strictest financial, trading, and management rules. Every October, Nasdaq checks if any companies from the Global Market can move up to the Global Select Market.

Nasdaq vs. New York Stock Exchange (NYSE)

Nasdaq is the second largest stock exchange in the U.S. The New York Stock Exchange (NYSE) is the largest. As of 2021, Nasdaq's total market value was about $19 trillion. This was about $5.5 trillion less than the NYSE. Nasdaq is also much younger, having started in 1971.

Here are some other key differences:

- Trading Systems: The NYSE used to have both electronic trading and a physical trading floor with people. Nasdaq has always been an all-electronic exchange.

- Market Types: The NYSE uses an "auction market." Buyers and sellers offer prices at the same time. When prices match, a trade happens. Nasdaq uses a "dealer market." Here, special firms called "dealers" set the buying and selling prices. They update these prices all day.

- Listing Fees: The cost to list a company's shares is different. On Nasdaq, listing fees can range from $55,000 to $80,000 for the smallest companies.

- Types of Companies: Investors often see the NYSE as a place for older, more established companies. Nasdaq tends to be home to newer companies, especially those focused on technology and new ideas.

See also

In Spanish: Nasdaq para niños

In Spanish: Nasdaq para niños

- ACT (NASDAQ)

- Advanced Computerized Execution System

- Directors Desk

- Economy of New York City

- List of stock exchange mergers in the Americas

- List of stock exchanges in the Americas

- NASDAQ futures

- Supermontage (SM) integrated trading system

- United States corporate law

- CCP Global