Dot-com bubble facts for kids

The dot-com bubble, also known as the dot-com boom, was a period in the late 1990s when excitement about the internet was at an all-time high. The World Wide Web was new and growing fast, and people were eager to invest in online companies, often called "dot-coms" because of their website addresses.

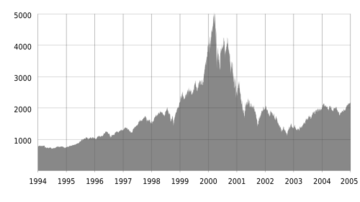

This excitement created a stock market bubble. Imagine a balloon being blown up bigger and bigger. Investors poured money into new internet startups, causing their values on the stock market to soar. Between 1995 and 2000, the value of the tech-focused NASDAQ stock index grew incredibly fast.

However, on March 10, 2000, the bubble popped. Stock prices started to fall just as quickly as they had risen. By 2002, the NASDAQ index had lost almost 78% of its peak value, erasing all the gains it had made during the boom.

During this crash, many famous online companies like Pets.com and Webvan ran out of money and had to shut down. Even big companies like Amazon and Cisco Systems saw their stock values drop dramatically, though they managed to survive and grow strong later on.

Contents

What Led to the Bubble?

The dot-com bubble didn't happen overnight. It was caused by a mix of new technology and economic conditions. Think of it like building with blocks—several blocks had to be in place to build something so big.

The Rise of the Internet

In the early 1990s, the internet was mostly used by scientists and universities. But with the release of web browsers like Mosaic in 1993, anyone with a computer could explore the World Wide Web.

Suddenly, the internet was exciting and easy to use. Between 1990 and 1997, the number of American homes with a computer more than doubled. This created a huge new audience for online businesses.

Easy Money for New Ideas

At the same time, it was easier for new companies to get money to start up. Investors were looking for the "next big thing," and the internet seemed like a sure bet. This money, called venture capital, helped thousands of new dot-com companies get started.

People were so excited that they would invest in almost any company with ".com" in its name, even if the company had no clear plan for how to make money.

The Internet Gold Rush

The late 1990s felt like a gold rush. Everyone wanted to get rich from the internet. New companies were being created every day, and many became worth millions of dollars overnight.

Going Public and Getting Rich

Many dot-com companies decided to "go public" by having an initial public offering (IPO). This is when a private company starts selling shares of itself on the stock market for anyone to buy.

During the bubble, a dot-com company could have an IPO even if it had never made a profit. Stock prices would often double or triple on the very first day of trading. This made many company founders and early employees incredibly wealthy—at least on paper.

Spending Big to Grow Fast

Most dot-coms followed the motto "get big fast." They believed that if they could attract millions of users quickly, they could worry about making a profit later.

Because of this, they spent huge amounts of money on advertising. For example, in 2000, seventeen dot-com companies bought expensive commercials during the Super Bowl. They also spent money on fancy offices and big parties to celebrate their launches. Many offered their products or services for free just to get more customers.

When the Bubble Popped

Like a real bubble, the dot-com bubble couldn't keep growing forever. In early 2000, investors started to worry that these companies were not worth as much as their stock prices suggested.

On Friday, March 10, 2000, the NASDAQ stock index reached its highest point ever. But just a few days later, a major sell-off began. Here’s what happened:

- Investor Worries: News from Japan's economy made investors around the world nervous. They started selling their riskiest stocks, which included many dot-com companies.

- Reality Check: Magazines and news reports began to question if these companies would ever make money. One famous article in Barron's warned that many dot-coms were running out of cash.

- A Chain Reaction: As some people started selling, stock prices dropped. This scared other investors, who also sold their stocks to avoid losing more money. This selling frenzy caused prices to crash.

By the end of 2001, most dot-com stocks had lost over 75% of their value. Companies that had been worth billions of dollars were now worthless. The dream was over for many.

What Happened After the Crash?

The end of the dot-com bubble was a difficult time for the technology industry.

Companies Shut Down

Once the investor money dried up, many dot-coms had no way to pay their bills. They had spent all their cash on advertising and growth, but they weren't making any profits. Thousands of companies went out of business, and many people lost their jobs.

A Silver Lining

However, the crash wasn't all bad news. During the boom, telecommunications companies had built a huge amount of internet infrastructure, like laying fiber optic cables across the country. When the bubble burst, there was a lot of extra capacity. This helped make high-speed internet much cheaper and more widely available for everyone.

The Survivors

While many companies failed, some of the strongest ones survived. Companies like Amazon.com and eBay had solid business plans and managed to get through the tough times. They learned from the crash and grew to become some of the biggest and most successful companies in the world. New companies, like Google, also started during this time and came to define the next era of the internet.

The dot-com bubble taught investors and business leaders important lessons about the difference between hype and real value. It showed that even with amazing new technology, a company still needs a good plan to succeed in the long run.

See also

- Stock market crash

- Cryptocurrency bubble

- AI boom

- List of stock market crashes and bear markets

| Jessica Watkins |

| Robert Henry Lawrence Jr. |

| Mae Jemison |

| Sian Proctor |

| Guion Bluford |