Bank Charter Act 1844 facts for kids

| Act of Parliament | |

|

|

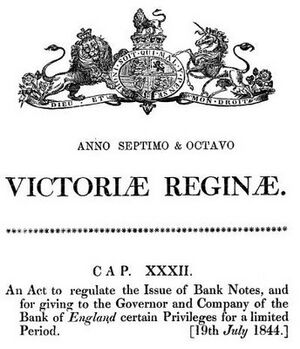

| Long title | An Act to regulate the Issue of Bank Notes, and for giving to the Bank of England certain Privileges for a limited Period. |

|---|---|

| Citation | 7 & 8 Vict. c. 32 |

| Territorial extent | United Kingdom of Great Britain and Ireland |

| Dates | |

| Royal assent | 19 July 1844 |

| Other legislation | |

| Repealed by |

|

|

Status: Current legislation

|

|

| Text of statute as originally enacted | |

| Revised text of statute as amended | |

The Bank Charter Act 1844 was an important law passed in the United Kingdom. It was created by the government of Robert Peel. This Act changed how banks worked in Britain. It gave the central Bank of England the only power to print and issue banknotes. Before this, many different banks could print their own money.

Why Was This Act Needed?

Before the mid-1800s, many banks in Britain and Ireland printed their own banknotes. These notes were used like regular money. But this system could cause problems.

The 1844 Act made a new rule: the Bank of England had to keep enough gold to back up the banknotes it printed. This meant that for every banknote issued, there was gold to match its value. The Act also limited how many notes the Bank of England could print without gold backing. This limit was set at £14 million.

This law also stopped other banks in the United Kingdom from printing new banknotes. This was the start of making the Bank of England the only place that could issue money.

Some people, called the British Currency School, believed that printing too many banknotes caused prices to go up (this is called price inflation). They thought this new law would help keep prices stable.

Even though the Act said notes had to be backed by gold, the government could pause the law during a financial crisis. This happened a few times, like in 1847, 1857, and during the 1866 Overend Gurney crisis.

The Act focused on banknotes, but it didn't control "bank deposits." These are sums of money that banks hold for customers or lend out. These deposits continued to grow throughout the 1800s.

Because of this Act, smaller banks that joined together to form bigger banks lost their right to print money. Eventually, private banks in England and Wales stopped issuing their own banknotes. The last one was Fox, Fowler and Company in 1921. This gave the Bank of England a complete monopoly on printing money in England and Wales.

The rules were a bit different for Scotland. The Bank Notes (Scotland) Act 1845 allowed Scottish banks to print more notes than they did in 1845. But any extra notes had to be fully backed by gold. Today, three banks in Scotland and four in Northern Ireland still print their own banknotes. The Bank of England regulates them.

What Happened Later?

The Banking Act 2009 made a small change to the 1844 Act. It stopped the Bank of England from having to publish a weekly report of how many banknotes it had issued.

Impact of the Act

Some historians have looked at the effects of the Bank Charter Act. For example, Charles Read has suggested that this law made it harder for the British government to provide help during the Great Famine in Ireland (1845–1852). He also argued that it made financial problems in 1847, 1857, and 1866 worse than they might have been.

See also

- Henry Meulen – a person who thought the Act caused economic problems.

- Banknotes of the pound sterling – a list of banks that print money.

- Fractional reserve banking

- Central bank

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |