European Central Bank facts for kids

|

|

The ECB's main building in Frankfurt

|

|

| Headquarters | Ostend district, Frankfurt, Germany |

|---|---|

| Coordinates | 50°06′32″N 8°42′12″E / 50.1089°N 8.7034°E |

| Established | 1 June 1998 |

| Governing body |

|

| President | Lua error in Module:Wikidata at line 70: attempt to index field 'wikibase' (a nil value). |

| Key people |

|

| Currency | Euro (€) EUR (ISO 4217) |

| Reserves |

€526 billion

|

| Bank rate | 2.15% (main refinancing operations) 2.40% (marginal lending facility) |

| Interest on reserves | 2.00% (deposit facility) |

| Preceded by |

20 central banks

Oesterreichische Nationalbank

National Bank of Belgium Croatian National Bank Central Bank of Cyprus Bank of Estonia Bank of Finland Banque de France Deutsche Bundesbank Bank of Greece Central Bank of Ireland Banca d'Italia Latvijas Banka Bank of Lithuania Central Bank of Luxembourg Central Bank of Malta De Nederlandsche Bank Banco de Portugal Banka Slovenije Národná banka Slovenska Banco de España |

The European Central Bank (ECB) is a very important bank for all countries that use the Euro currency. It's like the main bank for the entire Euro area. Its job is to keep prices stable, meaning it tries to stop things from getting too expensive too quickly. The ECB is one of the main organizations of the European Union.

The ECB works with the national central banks of all EU countries that use the euro. Together, they form the Eurosystem. The ECB's main goal is to keep prices stable. This means making sure that the cost of goods and services doesn't go up or down too much.

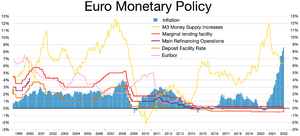

The ECB also manages the money supply in the Eurozone. It sets key interest rates, which affect how much it costs to borrow money. It also manages the foreign money reserves of EU countries. The ECB is the only one that can allow new euro banknotes to be printed.

The ECB was created in June 1998. Its main purpose was to ensure stable prices. In December 2009, it officially became an EU institution. When it started, eleven countries used the euro. Now, 20 countries are part of the Eurozone, with Croatia joining in January 2023. The current President of the ECB is Christine Lagarde. The bank is located in Frankfurt, Germany.

The ECB gets its money from the central banks of all 27 EU member states. These central banks own shares in the ECB. The amount each country contributes depends on its population and how strong its economy is.

Contents

- A Brief History of the ECB

- What the ECB Does

- How the ECB is Organized

- Where the ECB is Located

- Debates About the Digital Euro

- See also

- Images for kids

A Brief History of the ECB

How the ECB Started (1998–2007)

The European Central Bank took over from an older organization called the European Monetary Institute (EMI). The EMI helped countries get ready to use the euro. It also prepared for the creation of the ECB.

The ECB officially started on June 1, 1998. However, it began its full work when the euro currency was introduced on January 1, 1999. The first President of the ECB was Wim Duisenberg. He was the former head of the Dutch central bank.

There was some discussion about who should be the first president. France wanted Jean-Claude Trichet, but Germany and other countries preferred Duisenberg. They reached an agreement that Duisenberg would step down early. Then, Trichet would take over.

Trichet became president in November 2003. During these early years, the ECB successfully kept prices stable. It aimed for inflation to be close to, but below, 2%.

Dealing with Economic Challenges (2015–2019)

In November 2014, the ECB moved into its new main building in Frankfurt. Its old building, the Eurotower, then became home to its new banking supervision activities.

Around 2014, the Eurozone faced a new problem: prices were not rising enough. This could lead to a situation called deflation, where prices fall. To prevent this, the ECB started buying bonds. This was a way to put more money into the economy.

Buying Bonds to Boost the Economy

On January 22, 2015, the ECB announced a large program to buy bonds. This program was called "quantitative easing". It involved buying 60 billion euros worth of bonds each month. The goal was to make it easier for banks to lend money. This would encourage spending and help prices rise.

The ECB also started a program to lend money to banks for longer periods. These were called Long Term Refinancing Operations (LTROs). The idea was to help banks lend more to businesses and households. This would help the economy grow.

Christine Lagarde's Time as President (2019 – Present)

In July 2019, Christine Lagarde was chosen to be the new President of the ECB. She took office on November 1, 2019. She was the first woman to hold this important position.

Lagarde immediately started a big review of the ECB's strategy. This was the first time in 17 years such a review had happened. She also said the ECB would look at how it could help fight climate change. She wanted the ECB to be more open and talk more with people.

Helping Countries with Borrowing Costs

On July 21, 2022, the ECB introduced a new tool called the Transmission Protection Instrument (TPI). This tool helps ensure that the ECB's decisions affect all euro area countries fairly. Sometimes, some countries might have much higher borrowing costs than others. The TPI allows the ECB to buy government bonds from these countries. This helps to keep borrowing costs similar across the Eurozone.

The TPI helps prevent sudden market problems that are not based on a country's real economic situation. To get this help, countries must follow certain rules. For example, they must manage their government spending well. The TPI has not been used yet.

New Goals for the ECB (2020-2021)

In July 2021, the ECB announced new goals after its strategy review.

- It set a new inflation target of 2%. Before, it aimed for "below but close to 2%". Now, it's a clear 2%.

- The ECB also said it would include housing costs in how it measures inflation.

- It created a plan to help address climate change.

The ECB plans to review its strategy again in 2025.

Rising Prices in 2021

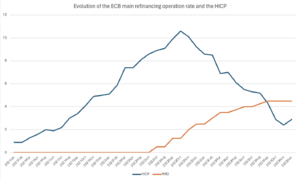

In 2021, the Eurozone saw a big increase in prices, known as inflation. This was the highest inflation rate since the 1970s. It reached 4.9% in November 2021.

The ECB had to change its approach. For a long time, its main focus was only on keeping prices stable. But after the 2008 financial crisis, it started to also support economic growth. It did this by keeping interest rates very low and buying many bonds.

With prices rising quickly in 2021, some wondered if the ECB would go back to focusing only on inflation. The ECB decided to raise interest rates. This was a way to slow down the price increases.

How Raising Interest Rates Helps

Raising interest rates is a way for the ECB to slow down the economy. When interest rates go up, borrowing money becomes more expensive. This means people and businesses borrow and spend less. Less spending helps to bring prices down.

Higher interest rates also make the euro stronger compared to other currencies. A stronger euro means that imported goods, like oil, become cheaper. This also helps to lower prices in the Eurozone.

However, raising interest rates can also slow down economic growth. It can make it harder for factories to produce goods. It can also lead to a small increase in unemployment. But studies showed that the manufacturing sector usually recovers quickly.

The Digital Euro Project (2025)

In May 2025, the ECB started testing a "digital euro". This project involves banks, tech companies, and shops. They are testing how a digital euro could work for payments.

The ECB wants to create a digital euro to offer a new way to pay. It also wants to protect the Eurozone from the risks of other digital currencies, especially those linked to the US dollar. The ECB's president, Christine Lagarde, has asked lawmakers to quickly create laws for the digital euro.

What the ECB Does

The ECB has one main goal: to keep prices stable. But it also has other important jobs.

Main Goal: Price Stability

The ECB's most important job is to keep prices stable in the Eurozone. This means making sure that the cost of everyday items doesn't change too much, too quickly. The ECB aims for inflation to be 2% over the medium term. This target helps everyone know what to expect.

Other Important Goals

While price stability is key, the ECB also supports other goals of the European Union. These include helping with economic growth and protecting the environment. The ECB tries to balance these goals with its main job of keeping prices stable.

Key Tasks of the ECB

To do its job, the ECB has several tasks:

- Setting Money Rules: It decides how much money is available and how much it costs to borrow.

- Managing Foreign Money: It handles the foreign money reserves of EU countries.

- Keeping Payments Smooth: It makes sure that money transfers between banks work well.

- Giving Advice: It gives its opinion on new laws that affect its work.

- Collecting Data: It gathers and publishes important economic information.

- Working with Others: It cooperates with other international organizations.

- Issuing Banknotes: It has the only right to allow new euro banknotes to be printed. Countries can make euro coins, but the ECB must approve the amount.

- Watching Banks: Since 2013, the ECB has been in charge of supervising important banks. This helps keep the financial system safe.

How the ECB Manages Money

The ECB's main way to manage money is by lending to banks. Banks borrow money from the ECB, and they have to offer something valuable as a guarantee, like government bonds. The ECB sets the interest rate for these loans.

If the ECB wants to put more money into the economy, it offers more loans. If it wants to slow things down, it offers fewer loans or raises the interest rate. This helps control how much money is flowing in the economy.

How the ECB is Organized

The ECB has four main groups that make decisions. These groups help the ECB do its job.

Decision-Making Groups

The Executive Board

The Executive Board runs the day-to-day operations of the ECB. It makes sure that the money policies decided by the Governing Council are put into action. The board meets every Tuesday.

It has six members: the President (currently Christine Lagarde), the Vice-President (currently Luis de Guindos), and four other members. They are chosen by European leaders for eight-year terms.

The Governing Council

The Governing Council is the main decision-making group for the Eurozone's money policy. It includes the six members of the Executive Board. It also includes the heads of the national central banks from all 20 euro area countries.

This council decides on the key interest rates and other important money policies. A representative from the European Commission can attend meetings but does not vote.

The General Council

The General Council helps countries that are getting ready to adopt the euro. It deals with issues like setting exchange rates for currencies that are being replaced by the euro. This council will continue until all EU countries use the euro. It includes the President and Vice-President of the ECB, plus the heads of all EU national central banks.

The Supervisory Board

The Supervisory Board oversees the ECB's job of supervising banks. It meets twice a month to plan and carry out these tasks. It suggests decisions to the Governing Council.

The board has a Chair, a Vice-Chair, four ECB representatives, and representatives from national bank supervisors.

Who Owns the ECB?

The ECB is owned by the central banks of all 27 EU member states. These national central banks are like shareholders. The ECB's capital is about €11 billion.

Each national central bank contributes money based on its country's population and economic size. These shares are adjusted every five years. The national central banks are the only ones who own parts of the ECB.

Money Reserves

Besides their capital contributions, the national central banks of euro area countries also gave the ECB foreign money reserves. This was about €40 billion. Part of this was in gold, and the rest was in US dollars and UK pounds.

Languages Used

The main working language at the ECB is English. Press conferences are also held in English. For official documents, the ECB uses the official languages of the EU, usually English, German, and French.

How Independent is the ECB?

The European Central Bank is known for being very independent. This means it can make decisions about money policy without being told what to do by governments or other groups. This independence helps the ECB keep prices stable.

There are four main ways the ECB is independent:

- Freedom to Act: The ECB can make its own decisions and rules to achieve its goal of price stability.

- Long Terms for Leaders: The leaders of the ECB have long terms (8 years). This helps them make decisions without worrying about short-term political changes.

- Own Money: The ECB has its own money and income. It doesn't rely on governments for funding. This helps it stay free from political pressure.

- Political Freedom: Governments and other EU groups are not allowed to try and influence the ECB's decisions.

Being Accountable

Even though the ECB is independent, it is still accountable to the European Parliament. This means it has to explain its actions and decisions.

Here are some ways the ECB is accountable:

- Annual Report: The ECB publishes a yearly report about its activities. It presents this report to the European Parliament.

- Regular Meetings: The ECB President meets with a special committee of the European Parliament every three months. Members of Parliament can ask questions and discuss the ECB's work.

- Written Questions: Members of the European Parliament can send written questions to the ECB President, who must provide a written answer.

- Approving Leaders: The European Parliament is consulted when new members of the Executive Board are chosen.

How Transparent is the ECB?

The ECB is less transparent than some other EU organizations or central banks. For example, it doesn't usually publish how individual members of its Governing Council voted on decisions. This means it's not always clear who voted for what.

Also, the ECB has rules that allow it to keep some documents secret for longer periods than other EU bodies.

Where the ECB is Located

The ECB is located in the Ostend district of Frankfurt am Main, Germany. Frankfurt is the biggest financial center in the Eurozone. The ECB moved into its new, specially built headquarters in 2014. The building is about 180 meters (590 feet) tall. It was designed to hold twice as many staff as the old building. The old building, the Eurotower, is still used by the ECB for its banking supervision work.

Debates About the Digital Euro

In November 2025, some large European banks publicly said they were against the ECB's plan for a digital euro. They argued that it would just copy existing ways to pay and cost too much money.

See also

In Spanish: Banco Central Europeo para niños

In Spanish: Banco Central Europeo para niños

- European Banking Authority

- European Systemic Risk Board

- Open market operation

- Economic and Monetary Union

- Capital Markets Union

- European banking union

- List of central banks

- List of banks in Germany

- List of financial supervisory authorities by country

Images for kids

| Chris Smalls |

| Fred Hampton |

| Ralph Abernathy |