Foreign exchange reserves facts for kids

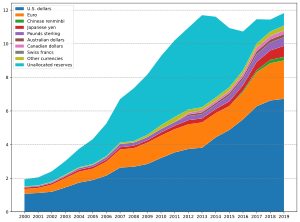

Foreign exchange reserves (also called forex reserves or FX reserves) are like a country's savings account, held by its central bank. These savings are mostly in cash from other countries (like the United States dollar or euro) and sometimes gold. They help a country pay its international bills, keep its own money's value stable, and make sure people trust its financial system.

These reserves can include foreign banknotes, money in foreign bank accounts, and government securities (like bonds) from other countries. Some countries also keep gold as part of their reserves. Sometimes, these foreign currencies or securities don't physically move; they are just marked as belonging to another country in the central bank's records.

Central banks usually earn interest on the government securities they hold, but not on cash or gold. However, the value of these reserves can go up or down if the foreign currency changes its value.

Contents

What Are Foreign Exchange Reserves?

Foreign exchange reserves are also known as reserve assets. They include:

- Foreign banknotes and bank deposits.

- Foreign government bonds (short and long-term).

- Gold.

- Special Drawing Rights (SDRs), which are like an international currency created by the International Monetary Fund (IMF).

- A country's position with the IMF, which shows how much it can borrow from the fund.

In a central bank's financial records, these reserves are listed as assets. They are important for a country's balance of payments, which tracks all money coming in and going out of a country.

Why Do Countries Hold Reserves?

One of the main jobs of a country's central bank is to manage these reserves. They do this to make sure the country has enough foreign money for several important reasons:

- Supporting the Economy: Reserves help keep people confident in a country's money and its economic policies.

- Handling Crises: They act as a safety net during tough times, like financial crises or natural disasters, when it's hard to borrow money from other countries. This helps:

- Show that the country's own money is strong.

- Help the government pay its international bills and debts.

- Provide funds for unexpected emergencies.

Reserves also allow a central bank to buy its own currency. This can help control the value of the country's money in the global market. For example, if a country's money is losing value too quickly, the central bank can use its foreign reserves to buy its own currency, making it stronger.

How Do Countries Build Up Reserves?

After the early 1970s, many countries started letting their money's value change more freely in the market. Even though some thought this would mean fewer reserves were needed, the opposite happened! Countries started building up more and more foreign reserves. Here are some reasons why:

Showing Strength to Others

Financial experts and international groups often look at a country's reserves to see how strong its economy is. For example, they might compare reserves to a country's total external debt (money owed to other countries) or how many months of imports the reserves can cover. Countries want to have enough reserves to look good to investors and avoid being seen as risky.

Being Prepared for Emergencies

Countries keep reserves as a kind of savings for bad times, especially when they might have trouble paying their international bills. The International Monetary Fund (IMF) was created to help countries in such situations. However, getting money from the IMF can take time, which might be too slow during a fast-moving crisis. So, countries prefer to have their own reserves ready.

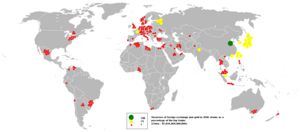

After the 1997 Asian financial crisis, many Asian countries greatly increased their reserves because they didn't want to rely only on the IMF. Also, during the 2008 global financial crisis, the US central bank helped other countries by exchanging currencies, which reduced the need for them to use their own reserves.

Supporting International Trade

Countries that trade a lot with others need reserves to make sure their trade doesn't stop. A common rule is for central banks to hold enough reserves to cover at least three months of imports. As global trade has grown, so have reserves, often covering many months of imports.

Dealing with Global Money Flows

In recent years, money moving freely between countries (like direct investment and portfolio investment) has become very important. These money flows can be unpredictable, making it even more necessary for countries to hold higher reserves. One idea, called the Guidotti–Greenspan rule, suggests a country should have enough liquid reserves to cover any foreign money it owes within a year.

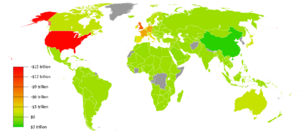

Influencing Exchange Rates

Sometimes, countries use their reserves to influence the value of their own money compared to other currencies. For example, if a country wants its goods to be cheaper for other countries to buy (to boost exports), it might sell its own currency and buy foreign currency, which makes its own currency weaker. This can be a way to help local businesses that sell goods abroad.

Saving for the Future

Building up reserves can also be seen as a way for a government to save money for the future. By holding foreign assets, the government can coordinate savings for the country. Sovereign wealth funds are an example of this, where governments save money from booming exports to use later when those exports might slow down.

Are There Downsides to Holding Lots of Reserves?

Yes, keeping very large amounts of foreign currency reserves can have costs:

- Value Changes: The value of reserves can go up or down due to changes in exchange rates.

- Inflation: The buying power of money can decrease over time due to inflation. This means a central bank needs to keep increasing its reserves just to maintain the same value.

- Low Returns: Foreign currency reserves usually earn very little interest. This return might even be less than the loss in buying power due to inflation, meaning the central bank effectively loses money.

- Missed Opportunities: Large reserves could have been invested in other things that might have earned a higher profit for the country.

Economists try to measure these costs. While holding reserves can be expensive, it's often seen as a type of insurance against a financial crisis, which could cost a country much more.

A good example is the Swiss National Bank, Switzerland's central bank. The Swiss franc is seen as a "safe" currency, so its value often goes up during times of global financial stress. After the 2008 crisis, the Swiss central bank bought a lot of foreign currency to stop the Swiss franc from getting too strong. This helped Swiss businesses, but it also led to big losses for the central bank when the value of those foreign currencies went down.

A Brief History of Reserves

Gold Standard Era

Before the 1970s, international payments were often tied to gold. Countries held gold as their main reserve. Later, under the Bretton Woods system (from 1944-1973), the United States dollar also became a key reserve currency because it could be exchanged for gold. However, after 1973, major currencies were no longer directly linked to gold. Even so, the US dollar and other major currencies still serve as important international reserves.

Central banks have sometimes worked together to buy and sell reserves to influence exchange rates and prevent financial crises. For example, in the 1890s, the Bank of England borrowed money from the Bank of France to help its economy.

After the Gold Standard

After the 1997 Asian financial crisis, many countries in Asia started building up huge amounts of foreign exchange reserves. They felt their previous reserve levels were too low and made them vulnerable to sudden money movements. This build-up of reserves, especially in US and European debt, has had a big impact on the global economy.

In 2007, another financial crisis hit, and the US central bank again worked with other central banks to help. Some developing countries saw their currencies get stronger, and to prevent losing their ability to compete in trade, they tried to stop money from flowing in and continued to build up reserves. This led to some countries calling it a "currency war".

How Many Reserves Are Enough?

The IMF suggests ways to figure out how many reserves a country needs. They look at how much money might flow out of a country during a crisis. The more reserves a country has compared to this amount, the lower the risk of a crisis and the less its economy might suffer.

Reserves that are more than what's considered "enough" can be used in other ways. For example, they can be put into sovereign wealth funds, which invest in more profitable assets for the long term, or into stabilization funds, which are used to smooth out economic ups and downs. Countries like Norway, Singapore, and the Persian Gulf States have large sovereign wealth funds in addition to their foreign exchange reserves.

See also

In Spanish: Reserva internacional para niños

In Spanish: Reserva internacional para niños

- Balance of payments

- Foreign exchange market

- Foreign-exchange reserves of China

- Foreign-exchange reserves of India

- International Reserves of the Russian Federation

| DeHart Hubbard |

| Wilma Rudolph |

| Jesse Owens |

| Jackie Joyner-Kersee |

| Major Taylor |