Global minimum corporate tax rate facts for kids

The global minimum tax is a special agreement between many countries. It sets a lowest possible tax rate for big companies that operate all over the world. This tax is called a "corporate tax" because it's paid by corporations (large businesses).

The main goal of this agreement is to stop countries from competing too much by offering very low tax rates. When countries offer super low taxes, big companies might move their profits there to avoid paying higher taxes in other places. This is called "profit shifting." The global minimum tax helps make sure these large companies pay a fair share of taxes, no matter where they do business.

Contents

Why a Global Minimum Tax?

Stopping the Race to the Bottom

For a long time, countries have tried to attract big companies by lowering their corporate tax rates. This created a "race to the bottom," where countries kept cutting taxes to be more appealing. While this might seem good for companies, it meant governments had less money for public services like schools, hospitals, and roads.

The idea of a global minimum tax is to stop this race. If all countries agree on a lowest tax rate, companies can't just move their profits to a country with almost no tax. This helps create a more fair playing field for everyone.

Early Ideas for a Minimum Tax

The idea of a minimum corporate tax isn't new. Back in 1992, a group of experts suggested a 30% minimum tax for countries in the European Union. However, this idea was not put into action at that time.

The OECD/G20 Agreement

How the Plan Started

In 2019, the OECD (Organisation for Economic Co-operation and Development) started working on a new plan. The OECD is a group of mostly rich countries that work together on economic issues. They noticed that many big companies, especially those in digital services, were moving their profits to countries with very low taxes.

To fix this, the OECD formed a group called the OECD/G20 Inclusive Framework. This group includes many countries, not just the richest ones. Their goal was to find a way to update tax rules for the modern global economy.

Key Countries Join In

In May 2019, Germany and France suggested a plan called "Pillar Two." This plan aimed to stop companies from avoiding taxes by moving profits. Olaf Scholz, who was Germany's finance minister then, said that fair taxes for companies were very important. Both the International Monetary Fund (IMF) and the OECD leaders supported this idea.

In 2020, the United States joined the discussions. In April 2021, Janet Yellen, the US Treasury Secretary, also agreed with the Franco-German plan.

The 15% Agreement

In June 2021, the finance ministers from the Group of Seven (G7) major economies met. They agreed on a global minimum corporate tax rate of at least 15%. This rate would apply to the 100 largest multinational companies. The goal was to discourage countries from lowering their taxes too much to attract these companies.

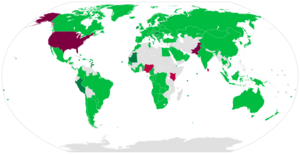

French Finance Minister Bruno Le Maire said that 15% was a starting point and could be raised later. Janet Yellen saw this agreement as a positive step for the world economy. On July 1, 2021, 130 countries officially supported the OECD's plan for a 15% global minimum corporate tax rate.

By October 8, 2021, even countries like Republic of Ireland, Hungary, and Estonia, which had lower tax rates, agreed to the plan. They agreed as long as the 15% rate would not be increased. In total, 137 countries approved this agreement. For it to become law, each country's parliament needs to approve it.

Putting the Tax into Action

Countries Start Implementing

By July 2022, countries like the UK and Japan had started writing their own rules to put the agreement into practice. Many other countries were also working on it.

On February 2, 2023, the OECD released detailed guides to help countries actually set up the global minimum tax. These guides explain how to handle different parts of the tax rules, including how to count a country's own minimum taxes. This helps countries put the rules into their own laws in a smooth way.

In July 2023, 138 countries agreed to move forward with the tax reform. They planned to sign a special agreement later that year. This agreement officially entered into force in 2025.

Switzerland's Approach

Switzerland decided to put the OECD minimum tax into action by changing its constitution. People in Switzerland voted on this change on June 18, 2023, and approved it. This vote gave the Swiss government the power to start the minimum tax.

Most companies in Switzerland (about 99%) are not directly affected by this new tax. They continue to pay taxes as before. The new tax mainly affects a small number of very large companies. It is estimated that this new tax could bring in about 1 to 2.5 billion Swiss francs each year. About 75% of this money goes to the regions (cantons) where these big companies are located, and the rest goes to the national government.

Switzerland started applying the Global minimum tax on January 1, 2024.

The United States and the Tax Deal

In January 2025, after starting his second term, President Donald Trump issued an order stating that the United States would not continue to apply the global tax deal. This decision put the agreement at risk because the US is home to many of the world's largest companies. Without the US, it is harder for the agreement to work as planned.

Countries and Their Implementation Dates

This table shows when different countries started (or planned to start) putting the global minimum tax (Pillar 2) into action.

| Implementation | |||

|---|---|---|---|

| Pillar 1 | Pillar 2 | ||

| Country | Date | Date | Note |

| 1 January 2024 | |||

| 1 January 2024 | |||

| 31 December 2023 | |||

| 1 January 2024 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 1 January 2024 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 1 April 2024 | |||

| 1 January 2024 | |||

| 31 December 2023 | |||

| 1 January 2025 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 31 December 2023 | |||

| 1 January 2025 | |||

| 31 December 2023 (partial) |

|||

| 31 December 2023 | |||

| 1 January 2024 | |||

| 31 December 2023 | |||

| 31 December 2023 (partial) |

|||

| 1 January 2025 | |||

| 31 December 2023 | |||

Other Tax Ideas

UN Tax Convention

Some countries, especially in Africa, felt that the OECD-led minimum tax was mainly decided by rich countries. They argued that global tax rules should be agreed upon at the United Nations (UN) level, just like climate goals. The G77, a group of over 130 developing countries, agreed with this idea. Because of this, in 2023, a UN committee voted to start working on a "UN Framework Convention on International Tax Cooperation." This means the UN might create its own global tax rules in the future.

Digital Services Taxes

Another idea related to global taxes is called "Pillar One" under the OECD/G20 Inclusive Framework. This plan aims to tax the very largest multinational companies (those earning over €20 billion) in the countries where they have many customers.

This plan is an alternative to "digital services taxes" (DSTs). DSTs were created to tax big companies that operate in a country but don't have a physical office there. Unlike a regular corporate tax, which is on a company's profits, a DST is a tax on its revenue (total money earned).

Many countries, including those in the European Union, the UK, India, and Canada, have introduced DSTs. However, the US has been against DSTs, saying they might unfairly target American companies and lead to companies being taxed twice. As part of the global minimum tax agreement, countries would eventually remove their DSTs.

See also

- Tax competition, which is when countries try to attract businesses by lowering taxes

- Base erosion and profit shifting, how companies move profits to avoid taxes

- List of countries by tax rates for a comparison of corporate tax rates around the world

- Corporate haven, a country with very low taxes for companies

- International taxation, how taxes work across different countries

- OECD/G20 Inclusive Framework, the group working on these tax rules

| Isaac Myers |

| D. Hamilton Jackson |

| A. Philip Randolph |