Ben Bernanke facts for kids

Quick facts for kids

Ben Bernanke

|

|

|---|---|

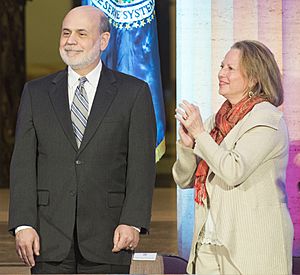

Official portrait, 2008

|

|

| 14th Chairman of the Federal Reserve | |

| In office February 1, 2006 – January 31, 2014 |

|

| President | George W. Bush Barack Obama |

| Deputy | Roger Ferguson Donald Kohn Janet Yellen |

| Preceded by | Alan Greenspan |

| Succeeded by | Janet Yellen |

| Member of the Federal Reserve Board of Governors | |

| In office February 1, 2006 – January 31, 2014 |

|

| President | George W. Bush Barack Obama |

| Preceded by | Alan Greenspan |

| Succeeded by | Stanley Fischer |

| In office July 31, 2002 – June 21, 2005 |

|

| President | George W. Bush |

| Preceded by | Edward W. Kelley Jr. |

| Succeeded by | Kevin Warsh |

| 23rd Chairman of the Council of Economic Advisers | |

| In office June 21, 2005 – January 31, 2006 |

|

| President | George W. Bush |

| Preceded by | Harvey Rosen |

| Succeeded by | Edward Lazear |

| Personal details | |

| Born |

Ben Shalom Bernanke

December 13, 1953 Augusta, Georgia, U.S. |

| Political party | Republican (before 2015) Independent (2015–present) |

| Spouse | Anna Friedmann |

| Children | 2 |

| Education | Harvard University (BA, MA) Massachusetts Institute of Technology (PhD) |

| Awards | Nobel Memorial Prize in Economic Sciences (2022) |

| Signature |  |

| Scientific career | |

| Thesis | Long Term Commitments, Dynamic Optimization, and the Business Cycle (1979) |

| Doctoral advisor | Stanley Fischer |

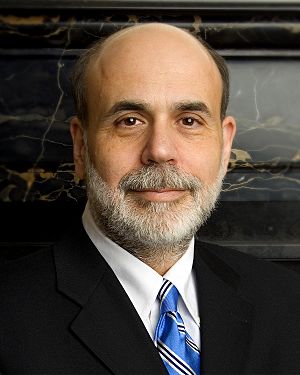

Ben Shalom Bernanke (pronounced bər-NANG-kee; born December 13, 1953) is an American economist. He was the 14th chairman of the Federal Reserve from 2006 to 2014. The Federal Reserve is like the central bank of the United States.

After leaving the Federal Reserve, he became a special expert at the Brookings Institution. While he was chairman, Bernanke helped guide the Federal Reserve through the 2008 financial crisis. This was a very difficult time for the world's economy. Because of his work, he was named the 2009 Time Person of the Year.

Before leading the Federal Reserve, Bernanke was a professor at Princeton University. He even led the economics department there. In 2022, Bernanke won the Nobel Memorial Prize in Economic Sciences. He shared it with Douglas Diamond and Philip H. Dybvig. They won for their important research on banks and financial crises. His work especially helped us understand the Great Depression.

From 2002 to 2005, he was a member of the Board of Governors of the Federal Reserve System. He talked about the "Great Moderation" during this time. This idea suggests that big ups and downs in the economy have become less extreme. This is due to changes in the global economy.

Later, Bernanke led President George W. Bush's Council of Economic Advisers. President Bush then chose him to become the chairman of the Federal Reserve. His first term began on February 1, 2006. President Barack Obama nominated him for a second term. Obama called him "the epitome of calm." His second term ended on January 31, 2014. Janet Yellen took over as chairman after him.

In his 2015 book, The Courage to Act, Bernanke wrote about his time at the Federal Reserve. He said the world's economy almost collapsed in 2007 and 2008. He believes the Federal Reserve's new actions helped stop an economic disaster. This disaster could have been even worse than the Great Depression.

Contents

Early Life and Education

Ben Bernanke was born in Augusta, Georgia. He grew up in Dillon, South Carolina. His father was a pharmacist, and his mother was a teacher. The Bernankes were one of the few Jewish families in Dillon. Ben learned Hebrew from his grandfather.

As a teenager, Bernanke worked different jobs. He worked construction and waited tables at a roadside attraction. He continued to work there during summers to help pay for college.

School Days

Bernanke went to East Elementary, J.V. Martin Junior High, and Dillon High School. He was the best student in his class. He also played saxophone in the marching band. Since his high school did not teach calculus, he taught it to himself. He scored very high on the SAT test. He was also a contestant in the 1965 National Spelling Bee.

Bernanke started at Harvard College in 1971. He earned a bachelor's degree in economics in 1975. He then received his PhD in economics from the Massachusetts Institute of Technology (MIT) in 1979. His PhD paper was about how long-term plans affect the economy.

Career in Economics and Government

Bernanke taught at the Stanford Graduate School of Business from 1979 to 1985. He then became a professor at Princeton University. He led Princeton's economics department from 1996 until 2002. He left Princeton in 2005.

From 2002 to 2005, Bernanke was a member of the Board of Governors of the Federal Reserve System. In one of his first speeches, he talked about preventing deflation. Deflation is when prices for goods and services go down, which can hurt the economy.

In 2005, President George W. Bush chose Bernanke to lead his Council of Economic Advisers. This was seen as a way to see if Bernanke would be a good choice to lead the Federal Reserve. He held this job until January 2006.

Leading the Federal Reserve

On February 1, 2006, Bernanke became the chairman of the Federal Reserve. This was a very important role. He also led the Federal Open Market Committee. This group makes key decisions about the country's money supply.

Early in his time as chairman, he tried to make the Federal Reserve's plans clearer. He wanted to be more open than previous leaders. However, some of his early comments caused confusion in the stock market. He later said this was a "lapse in judgment."

The 2008 Financial Crisis

As the Great Recession got worse, Bernanke led the Federal Reserve in taking unusual steps. They lowered interest rates to almost zero. When this wasn't enough, the Fed started "quantitative easing." This meant they created new money to buy financial assets from banks and the government. This helped to keep money flowing in the economy.

Second Term as Chairman

On August 25, 2009, President Obama announced he would nominate Bernanke for a second term. Obama said Bernanke's calm nature and courage helped prevent another Great Depression. Some senators were unsure about his nomination.

However, Bernanke was confirmed for his second term on January 28, 2010. The Senate voted 70-30 in favor. He was replaced by Janet Yellen on February 3, 2014. She was the first woman to hold the position.

Economic Ideas and Views

Bernanke has taught about money and economics at the London School of Economics. He has also written several textbooks. He was a director at the National Bureau of Economic Research. He is known as one of the most published economists.

Bernanke is very interested in what caused the Great Depression. He has written many articles about it. Before his work, many believed the Federal Reserve caused the Depression by reducing the money supply. Bernanke has said that raising interest rates too early was a big mistake during that time.

In 2002, Bernanke gave a speech about deflation. He said that a government with its own money system can always avoid deflation. It can simply print more money. He famously said the U.S. government has a "printing press" to make as many dollars as it wants. Some critics jokingly called him "Helicopter Ben" because of this idea.

Bernanke believes that reducing the U.S. budget deficit is important. He thinks this can be done by changing programs like Social Security and Medicare. He said that without a plan, the country might not have financial stability or healthy economic growth.

Life After the Federal Reserve

In January 2014, Bernanke spoke about his time as chairman. He hoped the economy was growing stronger. He was confident the central bank could slowly reduce its support.

Since February 2014, Bernanke has been a special expert at the Brookings Institution. In 2015, he also became a senior advisor for Citadel, a large investment fund, and for PIMCO.

In his 2015 book, The Courage to Act, Bernanke shared that he no longer considers himself a Republican. He now sees himself as a "moderate independent."

In 2022, Bernanke published a new book called 21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19. This book looks at the successes and failures of the Federal Reserve. The New York Times gave it a good review.

Nobel Prize in Economics

In 2022, Ben Bernanke won the Nobel Memorial Prize in Economic Sciences. He shared it with Philip H. Dybvig and Douglas Diamond. Their research helped explain why the Great Depression happened. They found that problems in the credit market and a failing gold standard were key reasons.

When banks and borrowers were worried about money, they became very careful. Banks lent less, and people took their money out of banks. This made the economy worse. Also, after World War I, many countries had their money tied to gold. But this system failed in the late 1920s. This caused prices, money supply, and economic output to drop. Their research showed that these two problems together led to a huge economic downturn.

Personal Life

Bernanke met his wife, Anna, who is a schoolteacher, on a blind date. They have two children, Joel and Alyssa. He is a big fan of the Washington Nationals baseball team. He often goes to their games.

When Bernanke moved to Princeton, his family moved to Montgomery Township, New Jersey. His children went to local public schools there. Bernanke also served on the school board for six years.

Awards and Honors

- Fellow of the Econometric Society (1997)

- Fellow of the American Academy of Arts and Sciences (2001)

- Order of the Palmetto (2006)

- Member of the American Philosophical Society (2006)

- Distinguished Leadership in Government Award, Columbia Business School (2008)

- In 2009, a highway exit in Dillon County, South Carolina, was named the Ben Bernanke Interchange.

- In 2009, he was named Time magazine's Person of the Year.

- In 2020, he received the BBVA Foundation Frontiers of Knowledge Award for Economics, Finance, and Management.

- Member of the National Academy of Sciences (2021)

- Awarded the 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (Nobel Prize in Economics).

See also

In Spanish: Ben Bernanke para niños

In Spanish: Ben Bernanke para niños

- Causes of the Great Depression

- Great Contraction

- Greenspan put

- 2008–2009 Keynesian resurgence

- List of Jewish Nobel laureates

| Audre Lorde |

| John Berry Meachum |

| Ferdinand Lee Barnett |