Macroeconomics facts for kids

Macroeconomics is a part of economics that studies how an entire economy works. It looks at big things like countries or even the whole world. Think of it as studying the whole forest, not just one tree.

Macroeconomists explore topics such as how much a country produces (its GDP), how many people have jobs (unemployment), and how prices change (inflation). They also look at how people spend and save money, how businesses invest, and how countries trade with each other.

There are two main types of economics: macroeconomics and microeconomics. Microeconomics focuses on smaller parts, like how one company or one market works. Macroeconomics, on the other hand, looks at the overall health and behavior of the economy. It helps us understand big trends that affect everyone.

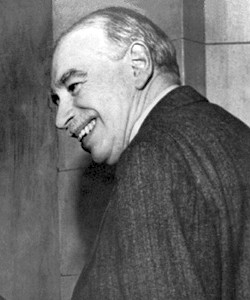

This field also studies how government actions, like taxes or interest rates, can help keep the economy stable. It also looks at what makes economies grow over many years. Many people consider John Maynard Keynes as the person who really started macroeconomics as a separate field in 1936.

Contents

- Understanding Key Economic Ideas

- How Macroeconomics Developed

- Government Actions for the Economy (Macroeconomic Policy)

- Economic Models: Tools for Understanding

- Macroeconomics in the Real World

- See also

Understanding Key Economic Ideas

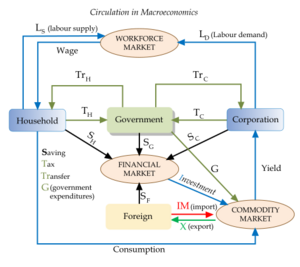

Macroeconomics uses several important ideas to understand how economies work. The three main ones are how much is produced, how many people have jobs, and how prices are changing. Economists also look at different time periods when studying the economy. They also consider if an economy is "open" (trading with other countries) or "closed" (not trading much).

Looking at Different Time Periods

When studying the economy, economists often think about three different time periods:

- The short run (a few years): This looks at quick changes in the economy, like ups and downs in the business cycle. Governments might use policies to help stabilize things during these times.

- The medium run (about a decade): Here, the economy usually settles at a certain level based on things like available workers, technology, and factories. Policies can slowly change these basic parts of the economy.

- The long run (many decades): This focuses on what makes an economy grow over a very long time. This includes things like better education, new technologies, and how many people are in the country.

How Much a Country Produces (Output and Income)

The total amount of goods and services a country makes in a certain time is called its output. When things are produced and sold, they create income for people. The most common way to measure a country's total output is with its Gross Domestic Product (GDP). GDP tells us the total value of everything made within a country's borders. Sometimes, economists also look at gross national income (GNI), which includes income from abroad.

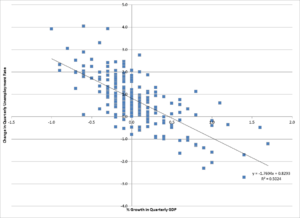

When a country's output grows over time, it's called economic growth. Things like new technology, more factories, and better education help an economy grow. However, economies don't always grow smoothly. Sometimes, output can drop for a short time; these periods are called recessions. Economists try to find ways to keep the economy stable, avoiding big drops or growing too fast (which can cause other problems).

Understanding Unemployment

Unemployment means people who want to work and are looking for a job, but can't find one. The unemployment rate is the percentage of these people in the total group of people who can work (the labor force). People who are retired or not looking for work are not counted as unemployed.

There are different types of unemployment. Sometimes, unemployment goes up when the economy slows down; this is called cyclical unemployment. Other times, there's a more constant level of unemployment, even when the economy is doing well. This is called structural unemployment or the natural rate of unemployment. It can happen because it takes time for people to find new jobs, or because their skills don't match the available jobs.

Inflation and Deflation (Price Changes)

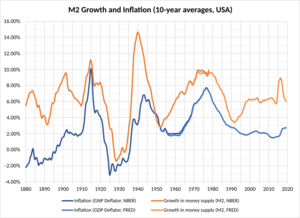

Inflation means that prices for most goods and services are going up across the economy. This means your money buys less than it used to. When prices generally go down, it's called deflation. Economists use special tools called price indexes to measure these changes.

If an economy grows too fast, prices might rise quickly (inflation). If an economy slows down a lot, prices might even fall (deflation). Both very high inflation and deflation can be bad for an economy. Because of this, central banks (like a country's main bank) try to keep prices stable. They often do this by changing interest rates.

Inflation can be caused by many things. If people want to buy too many things and there aren't enough goods, prices can go up. Big events, like a sudden change in oil prices, can also affect inflation.

Economies Open to the World

Open economy macroeconomics looks at how countries interact through international trade. This includes buying goods from other countries (imports) and selling goods to them (exports). It also studies how money and investments move between countries. An important part of this is understanding exchange rates, which tell you how much one country's money is worth compared to another's. These interactions affect a country's economy in many ways.

Calculating GDP: The Spending Way

One common way to figure out a country's GDP is by adding up all the spending. Think of it as measuring how much money everyone in the country spends on new things. The bigger the GDP, the bigger the economy. This method looks at four main types of spending:

- Consumer Spending (CS): This is what families and individuals spend on things like food, clothes, movies, and even new homes.

- Government Spending (GS): This is what the government spends on services like roads, schools, defense, and salaries for public workers. It doesn't include payments like welfare, which are just moving money around.

- Investment Spending (IS): This is when businesses buy new equipment, build factories, or add to their inventory. It's about spending to help produce more in the future.

- Net Exports (EXP-IMP): This is the value of what a country sells to other countries (exports) minus what it buys from them (imports).

So, the formula for GDP using this method is: GDP = Consumer Spending + Government Spending + Investment Spending + Net Exports

GDP Deflator: Seeing Real Growth

Sometimes, a country's GDP might look like it's growing, but it could just be because prices went up (inflation). To see if the economy is truly producing more, we use the GDP Deflator. This tool helps us adjust GDP for inflation, showing the real change in production.

The formula is: GDP Deflator = (Nominal GDP / Real GDP) x 100

- Nominal GDP is the GDP measured with current prices, including any inflation.

- Real GDP is the GDP adjusted to remove the effects of inflation, using prices from a "base year."

If the GDP Deflator is 100, it means there's no inflation or deflation compared to the base year. If it's more than 100, there's inflation. If it's less than 100, there's deflation.

Money in the Economy: Supply and Multiplier

The money supply is the total amount of money available in an economy. Economists measure it in different ways, like M1 and M2.

- M1 includes money that is easy to use right away, like cash, coins, and money in checking accounts. This is called "liquid" money.

- M2 includes M1 plus other types of money that are not as easy to access quickly, like savings accounts and time deposits.

The amount of money in circulation affects things like interest rates and how central banks manage the economy.

How Banks Create More Money

Banks play a big role in increasing the money supply through something called the money multiplier. When you deposit money into a bank, the bank doesn't keep all of it. It keeps a small part, called the reserve requirement, and lends out the rest.

The formula for the money multiplier is: Money Multiplier = 1 / Reserve Requirement Ratio

For example, if a bank must keep 20% (or 0.20) of deposits, the money multiplier is 1 / 0.20 = 5. This means that an initial deposit can lead to a much larger increase in the total money supply. This happens as the money lent out by one bank is deposited into another, and that bank lends out a portion, and so on.

How Macroeconomics Developed

The formal study of macroeconomics began in 1936 with a book by John Maynard Keynes. Before Keynes, economists had some ideas about big economic issues. But Keynes offered new ways to understand why economies sometimes struggled.

Keynes and His Ideas

During the Great Depression in the 1930s, many people lost jobs and businesses closed. Keynes suggested that the total demand for goods and services was key to a healthy economy. He believed governments could help by spending money or changing taxes. His ideas led to a school of thought called Keynesian economics.

Different Economic Ideas

After Keynes, other economists developed different views. Some, like the Monetarists, thought that the amount of money in circulation was most important. They believed steady growth in the money supply was the best way to manage the economy. These different ideas helped shape how we understand macroeconomics today.

The 2008 Financial Crisis

The 2008 financial crisis caused a major economic downturn. This event made economists rethink how financial systems affect the whole economy. Since then, researchers have focused more on banks and financial markets. They also study how economic changes affect different groups of people.

What Makes Economies Grow?

Economists also study what helps countries become richer over time. Early models, like the Solow–Swan model, showed that growth comes from more workers, more tools (capital), and new technologies. Later theories looked at how things like research and development (R&D) also drive long-term growth.

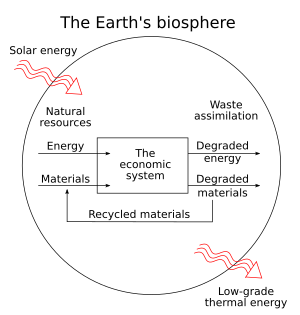

Caring for Our Planet and Economy

Since the 1970s, environmental issues have become part of macroeconomic studies. Economists now look at how using natural resources affects our future. They study topics like climate change and sustainable development. This helps us understand how the economy depends on a healthy environment.

Government Actions for the Economy (Macroeconomic Policy)

Governments and central banks use different tools to guide the economy. These actions are called macroeconomic policies. They aim to keep the economy stable, help it grow, and ensure people have jobs. Policies can be for the short-term (to fix quick problems) or long-term (to improve the economy's basic structure).

Monetary Policy: The Central Bank's Role

Monetary policy is how a country's central bank manages the money supply and interest rates. Their main goal is usually to keep prices stable (control inflation) and help the economy grow. Central banks change short-term interest rates. When interest rates go down, it's cheaper to borrow money, so people and businesses might spend and invest more. This can boost economic activity. When interest rates go up, borrowing becomes more expensive, which can slow down spending and help control inflation. Big central banks, like the Federal Reserve in the US, often aim for a specific inflation target.

Fiscal Policy: Government Spending and Taxes

Fiscal policy is when the government uses its spending and taxes to influence the economy. If the economy is slow, the government might spend more money on projects like building roads or schools. This creates jobs and encourages more spending. They might also lower taxes, so people have more money to spend. These actions can help boost the economy.

Sometimes, government spending can have a "multiplier effect." This means that every dollar the government spends can lead to more than a dollar of economic activity. However, if the government borrows too much, it might leave less money for private businesses to invest. This is called "crowding out." Some fiscal policies, like unemployment benefits, happen automatically when the economy slows down. These are called "automatic stabilizers."

Comparing Monetary and Fiscal Policies

Both monetary and fiscal policies can help manage the economy in the short term. Economists often prefer monetary policy for smaller adjustments. This is because central banks are usually independent and can act quickly without political delays. However, for very big economic problems, both policies might be needed. Also, if interest rates are already very low, monetary policy might not be as effective. In such cases, fiscal policy becomes a more powerful tool.

Economic Models: Tools for Understanding

Economists use models to help them understand how the economy works. These models are like simplified maps that show how different parts of the economy connect. They help economists make predictions and understand what might happen if policies change.

Popular Economic Models

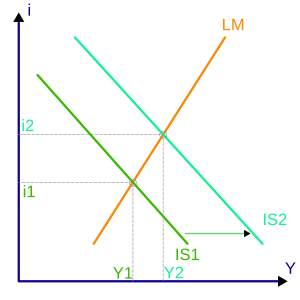

The IS-LM Model

The IS–LM model is a classic tool that links interest rates with the total amount of goods produced. It helps explain how money markets and goods markets interact. This model shows how government actions can affect the economy.

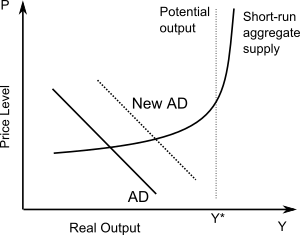

The AD-AS Model

The AD–AS model (Aggregate Demand - Aggregate Supply) is another important model. It shows how the total demand for all goods and services (Aggregate Demand) and the total supply (Aggregate Supply) interact. This helps determine the overall price level and the total output of an economy.

Macroeconomics in the Real World

Macroeconomics helps us understand real-life economic events and data.

Tariff Policy Example (February 2025)

In February 2025, former United States President Donald Trump discussed imposing new tariffs. He proposed a 25% tariff on goods imported from Mexico and Canada, and a 10% tariff on goods from China. A tariff is like a tax added to imported goods. This would have made imported goods more expensive for US consumers. It was expected to reduce US imports by 15% and bring in $100 billion in government money.

These proposed tariffs could have had a big impact on trade. While the US imports a lot from Mexico and Canada, those countries rely even more on selling their goods to the US. For example, the US buys a large share of Mexico's car and petroleum exports. Economists predicted that Mexico's economy could shrink by 16% and Canada's by a similar amount. Such changes in trade would affect the "Net Exports" part of a country's GDP calculation.

Looking at GDP Deflator Data

Data from the Bureau of Economic Analysis shows how the GDP deflator has changed over time. Using 2017 as a base year (a starting point for comparison), the GDP deflator has been increasing. For example, the GDP Deflator rose from 100 in 2017 to 126.22 by the end of 2024. This upward trend indicates that there has been inflation in the economy since 2017.

See also

In Spanish: Macroeconomía para niños

In Spanish: Macroeconomía para niños

| Bessie Coleman |

| Spann Watson |

| Jill E. Brown |

| Sherman W. White |