COVID-19 recession facts for kids

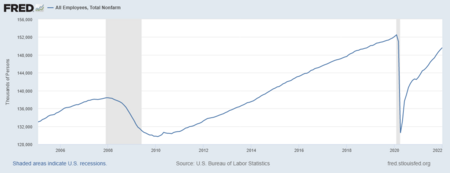

Map showing how much economies grew or shrank in 2020. Brown areas show countries that faced a recession.

|

|

| Date | 20 February 2020–January 2022 |

|---|---|

| Type | Global recession |

| Cause | |

| Outcome |

|

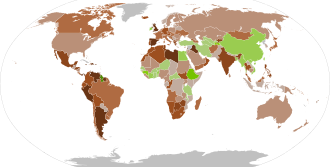

The COVID-19 recession, also known as the Great Lockdown, was a worldwide economic slowdown. It was caused by the COVID-19 pandemic. This recession started in most countries in February 2020.

For a year, the global economy had been slowing down. People were spending less. Then, in early 2020, COVID-19 lockdowns and other safety steps pushed the world economy into a big crisis. Within seven months, almost every rich country was in a recession.

The first big sign of this recession was the 2020 stock market crash. Major stock markets dropped by 20% to 30% in late February and March. But things started to get better in April 2020. By April 2022, most big economies were back to or even better than their pre-pandemic levels. Many stock markets also recovered or set new records by late 2020.

This recession caused a very fast and large increase in unemployment in many countries. By October 2020, over 10 million people in the United States had applied for unemployment help. The United Nations (UN) said in April 2020 that the world would lose 6.7% of working hours in the middle of 2020. This was like 195 million full-time jobs. In some countries, unemployment was expected to reach about 10%. Countries hit harder by the pandemic had even higher rates. Poorer countries also suffered as money sent home by workers abroad dropped. This made food shortages worse.

The recession, along with the 2020 Russia–Saudi Arabia oil price war, led to lower oil prices. It also caused the collapse of tourism, the hospitality industry, and the energy industry. People also spent much less money than in the past ten years. Later, a global energy crisis happened from 2021 to 2023. This was because the world started using more energy as it recovered from the pandemic. The Russian invasion of Ukraine in 2022 made this energy crisis even worse.

Contents

What Led to the Recession?

Companies in Debt

Before the pandemic, many companies had borrowed a lot of money. Since the 2007–2008 financial crisis (a big money problem in 2007-2008), company debt grew a lot. It went from 84% of the world's total economic output in 2009 to 92% in 2019. This was about $72 trillion.

If the economy gets worse, companies with a lot of debt might not be able to pay back their loans. This could force them to change how they run their business or even close down. Experts warned that if there was another economic downturn, many companies would struggle to pay their debts. This was especially true for companies in growing markets like China, India, and Brazil.

Global Economic Slowdown in 2019

In 2019, the International Monetary Fund (IMF) said the world economy was slowing down. It was the slowest pace since the 2007-2008 financial crisis. There were "cracks" in how much people were buying. Factories around the world were also making much less.

The IMF said that "trade and political tensions" were the main reasons for this slowdown. They pointed to Brexit and the China–United States trade war. Other experts thought problems with available money were to blame.

In April 2019, a financial signal called the U.S. yield curve inverted. This often means a recession is coming. This signal and fears about the China-U.S. trade war caused stock markets to drop in March 2019. This made people even more worried about a coming recession.

High debt levels in Europe and the United States were also a concern for economists. By 2019, global debt was 50% higher than during the 2007-2008 financial crisis. Economists believe this high debt led to many businesses failing during the recession.

Trade War Between China and the U.S.

The China–United States trade war happened from 2018 to early 2020. It caused big problems for economies worldwide. In 2018, U.S. President Donald Trump put special taxes (called tariffs) on goods from China. He wanted China to change what the U.S. called "unfair trade practices." These included a growing trade imbalance and the theft of ideas and technology.

In the U.S., the trade war made things hard for farmers and factories. It also made prices higher for shoppers. This led to the U.S. manufacturing industry having a "mild recession" in 2019. In other countries, it also caused economic damage. The downturn in shopping and manufacturing from this trade war made the COVID-19 economic crisis even worse.

Brexit's Impact

In Europe, economies struggled because of the uncertainty around the United Kingdom leaving the European Union, known as Brexit. Growth in Britain and the EU slowed down in 2019 before Brexit happened. Many businesses left the UK to move into the EU. This caused less trade and economic problems for both EU countries and the UK.

Other Problems That Made Things Worse

China's Property Debt in 2021

In August 2021, it was reported that Evergrande Group, a huge property developer in China, had about $300 billion in debt. When the company missed payments in September 2021, it looked like it might fail without government help. This was a big worry because China has the world's second-largest economy. Problems in its property market could make the COVID-19 recession even worse.

Global Energy Crisis and Sanctions on Russia

The world faced an energy shortage from 2021 to 2023. This was the latest in a series of energy shortages over the past 50 years. Russia's military actions near Ukraine and its later invasion also threatened Europe's energy supply. This made oil prices go up. European countries then looked for energy from other places.

The economic problems from the 2021–2023 global energy crisis and the 2022 Russian invasion of Ukraine affected oil prices worldwide. Countries put strict rules and sanctions on Russia. This caused the value of the Russian currency (the ruble) to drop very low. Oil prices also hit a 14-year high. Russia's ability to pay its debts was questioned, and it eventually defaulted on its foreign debt in June 2022.

Why the Recession Happened

The COVID-19 pandemic is the most disruptive pandemic since the Spanish flu in 1918. When the pandemic started in late 2019 and spread in 2020, the world economy was already slowing down. People were spending less. Most experts thought a recession was coming, but not a very bad one.

Because the pandemic spread so fast, countries around the world started locking down their populations. This was to stop the virus from spreading. These lockdowns caused many different industries and shopping to stop all at once. This put huge pressure on banks and jobs. It led to a stock market crash and then the recession. With new social distancing rules, lockdowns happened across much of the world.

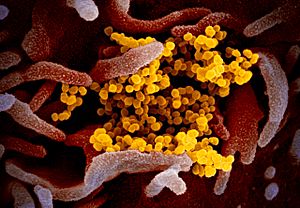

The COVID-19 Pandemic Itself

The COVID-19 pandemic is an ongoing global health crisis. It is caused by the SARS-CoV-2 virus. The outbreak started in Wuhan, China, in December 2019. The World Health Organization declared it a pandemic on March 11, 2020.

The pandemic caused huge global economic problems. Many events were canceled, and there were widespread shortages of supplies. Schools and universities closed in many countries. Governments limited travel. The virus spread quickly, even to people who didn't know how they got infected.

The COVID-19 pandemic had effects far beyond just the illness. As it spread, worries changed from problems with factories making goods to problems with service businesses. Everyone agrees the pandemic was a major reason for the recession. It hurt almost every major industry. It was also a main cause of the stock market crash.

During the first wave of the pandemic, businesses lost 25% of their income and 11% of their workers. Businesses that needed close contact with people, like restaurants and small businesses, were hit especially hard. However, governments gave a lot of help. This stopped many businesses from going bankrupt.

Governments helped people and businesses with job support, money, tax breaks, and loan programs. This aid was about 9% of the total economic output (GDP) in many countries. This help protected businesses and people during the pandemic.

Lockdowns and Their Effects

Stay-at-home orders clearly affected many businesses, especially those that offer in-person services. These include stores, restaurants, hotels, and entertainment places. But government orders were not the only reason these businesses struggled. In the United States, people started changing their spending habits even before their local governments ordered lockdowns. Most of the drop in economic activity was because people chose to avoid going out and spending money.

Oil Price War Between Russia and Saudi Arabia

The drop in travel and factory activity because of the COVID-19 pandemic greatly reduced the demand for oil. This caused oil prices to fall. The oil price war between Russia and Saudi Arabia made the recession even worse by crashing oil prices further.

In mid-February, experts thought oil demand growth in 2020 would be the smallest since 2011. A drop in demand from China led to a meeting of oil-producing countries (OPEC) to discuss cutting oil production.

After OPEC and Russia could not agree on oil cuts on March 6, Saudi Arabia and Russia both said they would increase oil production on March 7. Oil prices then fell by 25%. On March 8, Saudi Arabia surprisingly announced it would produce more oil and sell it at a discount. This was after talks failed because Russia didn't want to cut production.

Before this announcement, oil prices had already dropped over 30% since the start of the year. After Saudi Arabia's announcement, they dropped another 30%. Brent Crude, a key oil price, had its biggest drop since the 1991 Gulf War on March 8. The price of American oil (West Texas Intermediate) fell to its lowest since February 2016. Experts said this was the first time a huge drop in demand happened at the same time as a huge increase in supply. Fears about this oil price war caused U.S. stocks to fall sharply.

In early April 2020, Saudi Arabia and Russia agreed to cut their oil production. On April 20, 2020, the price of oil even briefly went negative. This meant sellers had to pay buyers to take the oil because there was nowhere left to store it.

Financial Crisis

The 2020 stock market crash began on February 20, 2020. But the economic problems of the COVID-19 recession actually started to appear in late 2019. Because of the COVID-19 pandemic, global markets, banks, and businesses faced problems not seen since the Great Depression in 1929.

From February 24 to 28, stock markets dropped the most in a week since the 2007–2008 financial crisis. This meant they entered a "correction" phase. Global markets became very unstable in early March, with big ups and downs. On March 9, most global markets saw big drops. This was mainly due to the COVID-19 pandemic and the oil price war. This day became known as Black Monday I. It was the worst drop since the Great Recession in 2008.

Three days after Black Monday I, there was another big drop called Black Thursday. Stocks across Europe and North America fell more than 9%. Wall Street had its largest single-day percentage drop since Black Monday in 1987. Italy's stock market (FTSE MIB) fell almost 17%, the worst hit during Black Thursday. Even after a short recovery on March 13, all three Wall Street indexes fell over 12% when markets reopened on March 16. During this time, many major stock markets around the world were in "bear markets," meaning they had fallen more than 20% from their highest points.

Black Monday I (March 9)

Before the market opened, the Dow Jones Industrial Average futures market dropped 1,300 points. This was due to the pandemic and falling oil prices. This triggered a "circuit breaker," which stopped trading for 15 minutes. This predicted drop was one of the biggest point drops ever for the Dow Jones. When the market opened on March 9, the Dow Jones Industrial Average fell 1800 points right away.

The U.S. Dow Jones Industrial Average lost over 2000 points. Oil companies like Chevron and ExxonMobil fell about 15%. The S&P 500 fell by 7.6%. Oil prices dropped 22%. Canada's stock market (S&P/TSX Composite Index) ended the day down over 10%. Brazil's IBOVESPA lost 12%. Australia's ASX 200 lost 7.3%. London's FTSE 100 lost 7.7%, its worst drop since the 2008 financial crisis.

In Asia, shares in Japan, Singapore, the Philippines, and Indonesia dropped over 20% from their recent highs. Japan's Nikkei 225 fell 5.1%. Hong Kong's Hang Seng Index sank 4.2%. Pakistan's stock market had its largest ever drop in one day, losing 6.0%.

Experts suggested that the pandemic's problems could cause the "corporate debt bubble" to burst. This would make the recession worse. Central banks in Russia and Brazil took steps to help their economies. Japan and Indonesia also announced plans to spend more government money.

Black Thursday (March 12)

Black Thursday was another global stock market crash on March 12, 2020. It was part of the larger 2020 stock market crash. U.S. stock markets had their biggest single-day percentage fall since the 1987 stock market crash. Black Thursday happened three days after Black Monday. It was blamed on the COVID-19 pandemic and a lack of trust in U.S. President Donald Trump after he announced a 30-day travel ban from Europe. Also, the European Central Bank decided not to cut interest rates, which surprised markets and caused more drops.

Central banks in Indonesia, Europe, and the U.S. announced actions to help. Australia's Prime Minister announced a large economic support package. India, Australia, and Brazil also took steps to support their economies.

Asia-Pacific stock markets closed down. European stock markets closed down 11%. The Dow Jones Industrial Average closed down another 10%. The NASDAQ Composite was down 9.4%, and the S&P 500 was down 9.5%. These drops activated the "trading curb" at the New York Stock Exchange for the second time that week. Oil prices dropped by 8%.

The U.S. Dow Jones Industrial Average and S&P 500 Index had their biggest single-day percentage falls since the 1987 stock market crash. The UK's FTSE 100 Index fell 10.87%. Canada's stock market dropped 12%. Italy's stock index (FTSE MIB) closed with a 16.92% loss, its worst ever. Germany's DAX fell 12.24%, and France's CAC 12.28%. In Brazil, the IBOVESPA fell 14.78%. In India, the NIFTY 50 fell 7.89%.

Black Monday II (March 16)

Over the weekend, Saudi Arabia and South Africa announced economic support plans. The U.S. Federal Reserve cut its main interest rate to almost zero. It also started a $700 billion program to buy assets.

Stock futures for the Dow and S&P 500 fell sharply, triggering a circuit breaker again. On Monday, March 16, stock markets in Asia-Pacific and Europe closed down. Australia's S&P/ASX 200 had a record one-day fall of 9.7%. The Dow Jones Industrial Average, NASDAQ Composite, and S&P 500 all fell by 12-13%. The Dow's drop was even bigger than the one on March 12. This activated the trading curb for the third time. Oil prices fell by 10%.

The Cboe Volatility Index (VIX), which measures market fear, reached its highest closing level ever on March 16. The Federal Reserve Bank of New York announced it would provide $500 billion in short-term loans. Indonesia's Finance Minister announced more tax-related economic help. Central banks in Turkey, Japan, Russia, South Korea, Chile, New Zealand, and the Czech Republic also took steps to support their economies.

How Different Places Were Affected

The COVID-19 recession affected countries and regions in different ways.

Africa

In April 2020, Sub-Saharan Africa was expected to enter its first recession in 25 years. The World Bank predicted that Africa's economy would shrink by 2.1% to 5.1% in 2020. Many African countries owe a lot of money to China. China considered giving them more time to pay back their loans.

Egypt

Egypt's economy suffered. Tourism, which employs one in ten Egyptians, almost stopped. Money sent home by workers abroad was also expected to fall. Lower fuel prices and less demand also meant fewer ships used the Suez Canal, reducing fees for the government.

Ethiopia

Ethiopia relies heavily on its national airline, Ethiopian Airlines, for income. The airline canceled many flights. Exports of flowers and other farm products also dropped sharply.

Americas

Argentina

Argentina went into its ninth sovereign default (meaning it couldn't pay its debts) because of the recession.

Brazil

The Brazilian government thought its economy would have its biggest crash since 1900. Its gross domestic product (GDP) was expected to shrink by 4.7%. In the first three months of 2020, Brazil's GDP was 1.5% smaller than the year before. By April 2020, at least 600,000 businesses went bankrupt, and 9 million people lost their jobs.

Canada

Between February and April 2020, 3 million jobs were lost in Canada. The total hours worked fell by 30%. Canadian factory sales in March dropped to their lowest level since mid-2016.

In response, the Canadian government started several programs to help people. These included the Canada Emergency Response Benefit and the Canada Emergency Wage Subsidy. By June 2020, Canada's unemployment rate was 12.5%.

Mexico

Mexico's economy was already struggling before the pandemic. Its president's economic plans relied on money from the state oil company, Pemex. But the oil price crash raised doubts about these plans. Mexico's economy also depends on tourism, trade with the U.S., and money sent home by workers abroad. All of these were affected. This could lead to Mexico's worst recession in a century.

United States

Experts say the United States recession began in February 2020 and ended about two months later, in April 2020. This makes it the shortest recession on record since 1854.

Job losses were very fast starting in March 2020. About 16 million jobs were lost in three weeks. Unemployment claims reached a record high. By May 13, new claims were over 35 million. In May, the official unemployment rate was 14.7%, the highest since 1941.

Restaurant visits fell sharply. Major airlines greatly reduced their flights. Big car makers stopped production. In April, building new homes dropped by 30%. About 5.4 million Americans lost their health insurance after losing their jobs.

The U.S. government passed the CARES Act, a $2 trillion package, on March 27, 2020. This was the largest economic support law in American history.

The COVID recession made wealth and racial inequality worse. One study showed that the pandemic pushed 8 million Americans into poverty between May and September 2020. In July 2020, it was reported that the U.S. economy shrank by 33% in the second quarter of the year.

Latin America

The recession caused by COVID-19 was expected to be the worst in Latin America's history. Latin American countries were expected to fall into a "lost decade," with their GDP returning to 2010 levels. The region's GDP was predicted to fall by 9.1%.

Asia-Pacific

Australia

Australia was already struggling before the recession due to severe bushfires. Its economic growth had slowed down. Experts expected a deep recession with at least 10% unemployment and a 6.7% drop in GDP.

The government introduced the JobSeeker Payment unemployment benefit with extra money. By April 2020, up to a million people had lost their jobs. Over 280,000 people applied for unemployment help on one peak day.

In July 2020, the government announced a $289 billion economic support package. This led to the largest budget deficit since WWII. By December 2020, Australia had pulled out of recession. Its GDP grew by 3.3% in the third quarter.

China

As a result of the recession, China's economy shrank for the first time in almost 50 years. Its national GDP dropped 6.8% in the first three months of 2020.

In May 2020, China's Premier said the government would not set an economic growth target for 2020. This was the first time ever. However, the government aimed to create 9 million new urban jobs.

By October 2020, China's economy was recovering steadily. It grew by 4.9% in the third quarter. China used strict virus control measures and helped businesses. It was the only major economy expected to grow in 2020. China's economy grew by 2.3% in 2020. In the first three months of 2021, China's economy grew by a record 18.3%.

India

The International Monetary Fund (IMF) first thought India's economy would grow by 1.9% in 2020-21. But later, in June 2020, the IMF changed its prediction to -4.5%, a historic low.

In August 2020, data showed that India's GDP shrank by 23.9% in the first three months of the financial year. This happened after a strict lockdown to stop the pandemic. About 140 million jobs were lost. This was the worst fall in India's history.

Japan

Japan's economy was already shrinking in late 2019. This was due to a sales tax increase and a strong typhoon. The Japan–South Korea trade dispute also hurt exports. All these factors added to the pandemic's effect on Japan's economy. The prime minister announced a huge economic support plan.

New Zealand

In April 2020, New Zealand's Treasury thought unemployment could reach 13.5% if the country stayed in lockdown for four weeks. Before the lockdown, unemployment was 4.2%. The Finance Minister promised to keep unemployment below 10%.

New Zealand's GDP shrank 1.6% in the first three months of 2020. The country officially entered a recession after its GDP shrank by 12.2% in the second three months of 2020.

Philippines

The Philippines' economy shrank by 0.2% in the first three months of 2020. This was the first time it shrank since 1998. The economy officially went into a recession after a 16.5% drop in the second three months.

The government expected the GDP to shrink by 5.5% in 2020. This decline was mainly due to less household spending. In 2020, the Philippines' GDP shrank by 9.5%, its worst contraction since World War II.

Singapore

Property investment sales in Singapore fell 37% in the first three months of 2020. This was because the pandemic hurt investor confidence.

In April, the Monetary Authority of Singapore (MAS) said Singapore would enter a recession in 2020. This would lead to job losses and lower wages. The MAS said there was "significant uncertainty" about how long and bad the downturn would be.

How Different Industries Were Affected

Many service industries were hit very hard by the COVID-19 recession.

Car Industry

New car sales in the United States dropped by 40%. The three biggest American car makers all closed their U.S. factories. The German car industry also suffered.

Energy Industry

The drop in demand for oil was so severe that the price of American oil futures contracts became negative. This meant traders were paying buyers to take the oil. This happened because there was too much oil and not enough storage space. This occurred even after a deal by major oil producers to cut world production by 10%.

Tourism Industry

The global tourism industry may shrink up to 50% because of the pandemic.

Restaurants

The COVID-19 pandemic greatly affected the restaurant business. In early March 2020, some major U.S. cities announced that restaurants would close for dine-in customers. They could only offer takeout and delivery. Many restaurant employees lost their jobs.

Retail Stores

Shopping centers and other stores around the world reduced their hours or closed completely. Many were not expected to recover. This sped up the problems already facing retail, sometimes called the "retail apocalypse." Department stores and clothing shops were especially affected.

Transportation

The pandemic had a big impact on the aviation (airline) industry. This was due to travel restrictions and a drop in demand from travelers. Many flights were nearly empty or canceled.

Several airlines went bankrupt or into administration (a type of financial restructuring):

- Compass Airlines

- Flybe

- Trans States Airlines

- Virgin Australia

- Air Mauritius

- Alitalia

- Avianca

- LATAM Airlines Group

- South African Airways

- Montenegro Airlines

The cruise ship industry was also heavily affected. The stock prices of major cruise lines dropped by 70-80%.

Food Shortages

Unlike the Great Recession, the COVID-19 recession was expected to affect most developing nations. In April, the United Nations World Food Programme warned that a famine "of biblical proportions" was expected in several parts of the world because of the pandemic. This was a particular problem in countries affected by war. It also happened after locust infestations in East Africa.

The United Nations predicted that many countries would face serious food shortages in 2020. These included:

Afghanistan

Afghanistan Angola

Angola Burkina Faso

Burkina Faso Cameroon

Cameroon CAR

CAR Chad

Chad DR Congo

DR Congo El Salvador

El Salvador Ethiopia

Ethiopia Haiti

Haiti Honduras

Honduras Iraq

Iraq Kenya

Kenya Lebanon

Lebanon Libya

Libya Madagascar

Madagascar Mali

Mali Mozambique

Mozambique Myanmar

Myanmar Namibia

Namibia Nicaragua

Nicaragua Niger

Niger Nigeria

Nigeria Pakistan

Pakistan Somalia

Somalia South Sudan

South Sudan Sudan

Sudan Syria

Syria Venezuela

Venezuela Yemen

Yemen Zambia

Zambia Zimbabwe

Zimbabwe

In July, Oxfam warned that "12,000 people per day could die from COVID-19 linked hunger" by 2021. They estimated that an additional 125 million people were at risk of starvation due to the pandemic.

Government Help for Economies

Many countries announced stimulus programs to fight the recession. These programs involved governments spending money or guaranteeing loans to help businesses and people. Here is a summary of some of these efforts:

| Country | Direct Spending (billions US$) | Loan Guarantees (billions US$) | Notes |

|---|---|---|---|

| 194 | 125 | ||

| 193 | 220 | ||

| 2600 | 5320 | ||

| 540 | 870 | This does not include actions by individual countries. | |

| 115 | 300 | ||

| 156 | 825 | States in Germany also announced more spending. | |

| 267 | |||

| 80 | 400 | ||

| 117000 | 1600 | ||

| 62.1 | |||

| 16000 | 100000 | ||

| 54.5 | |||

| 280 | |||

| 2,900 | 4000 |

Images for kids

-

Movement of the DJIA between January 2017 and December 2020.

See also

In Spanish: Recesión por la pandemia de COVID-19 para niños

In Spanish: Recesión por la pandemia de COVID-19 para niños

- Economic impact of the COVID-19 pandemic

- Financial market impact of the COVID-19 pandemic

- Green recovery

- Lists of recessions

| James Van Der Zee |

| Alma Thomas |

| Ellis Wilson |

| Margaret Taylor-Burroughs |