Budget Control Act of 2011 facts for kids

|

|

| Long title | An Act to provide for budget control. |

|---|---|

| Enacted by | the 112th United States Congress |

| Effective | August 2, 2011 |

| Citations | |

| Public law | Pub.L. 112-25 |

| Statutes at Large | 125 Stat. 239 |

| Codification | |

| Acts amended | Balanced Budget and Emergency Deficit Control Act of 1985 Congressional Budget and Impoundment Control Act of 1974 Deficit Reduction Act of 2005 |

| Titles amended | 2 U.S.C.: Congress |

| U.S.C. sections amended | 2 U.S.C. ch. 20 § 901 |

| Legislative history | |

|

|

The Budget Control Act of 2011 is a federal law that was passed by the 112th United States Congress and signed by President Barack Obama on August 2, 2011. This law helped end the 2011 US debt-ceiling crisis, which was a time when the government was close to running out of money to pay its bills.

The Act introduced several important ideas. These included creating a special group called the Joint Select Committee on Deficit Reduction, also known as the "super committee." It also looked at ways to make a balanced budget amendment and set up automatic spending cuts called budget sequestration.

Contents

What the Law Did

This law had several key parts to help manage the country's money.

Raising the Debt Ceiling

The debt ceiling is a limit on how much money the U.S. government can borrow.

- The law immediately raised the debt ceiling by $400 billion.

- The President could ask for another $500 billion increase. If Congress disagreed, the President could veto their decision. Then, Congress would need a two-thirds vote to stop the increase. This was sometimes called the 'McConnell mechanism'.

- Finally, the President could ask for a last increase of $1.2 to $1.5 trillion. The exact amount depended on how much the "super committee" cut from the budget.

Reducing Government Spending

The law aimed to cut government spending more than the debt limit was increased. It did not include any new taxes.

- The bill immediately cut $917 billion from spending over 10 years. This was the first set of cuts. About $21 billion of these cuts happened in the 2012 budget year.

- The law also created the Joint Select Committee on Deficit Reduction, or "super committee." This group had to create a plan to cut at least $1.5 trillion over 10 years. They had a deadline of November 23, 2011, to propose their plan.

- There was a strong reason for Congress to act. If the "super committee" failed to agree on cuts, then automatic, across-the-board spending cuts (called "sequestration") would start on January 2, 2013. These cuts would apply to most government spending from 2013 to 2021. Some areas, like Social Security and Medicaid, were protected. Medicare benefits could only be cut by 2%.

- Originally, these cuts would affect both defense and non-defense programs equally. But because the "super committee" didn't agree on a plan, the cuts were reset to affect only defense and non-defense categories. This became a big part of the fiscal cliff.

Balanced Budget Amendment Vote

The law required Congress to vote on a balanced budget amendment between October 1, 2011, and the end of that year. This amendment would make it harder for the government to spend more money than it takes in. Congress did not have to pass it, just vote on it.

Other Important Changes

- Funding for Pell Grants (money for college students) was increased, but other student financial aid was cut. For example, graduate students could no longer get interest-subsidized loans.

- Section 106 of the Act changed the Congressional Budget Act of 1974. It allowed the Senate to create a two-year budget plan, which is usually done differently.

How the Law Was Passed

This bill was the last chance to solve the 2011 US debt-ceiling crisis. There were big disagreements between and within political parties. Earlier ideas, like a "Grand Bargain" or the "Cut, Cap and Balance Act," failed. The deadline for the U.S. to potentially not pay its bills was getting very close.

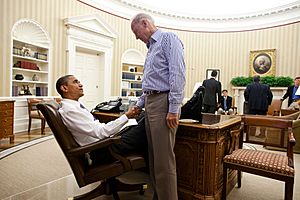

The solution came from Gene Sperling, a White House advisor. He suggested a plan where automatic cuts would happen if a new agreement on taxes or budget cuts wasn't made by a certain date. President Obama and House Speaker John Boehner eventually agreed to this idea.

On July 31, 2011, President Obama announced that leaders from both parties had reached a deal. A key part of reaching this deal was Vice President Joe Biden's talks with Senate Minority Leader Mitch McConnell.

| Party | Yes | No | Not Voting | Total |

|---|---|---|---|---|

| Democrats | 95 | 95 | 3 | 193 |

| Republicans | 174 | 66 | 0 | 240 |

| Total | 269 | 161 | 3 | 433 |

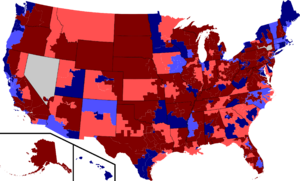

House Vote

The House of Representatives passed the Budget Control Act on August 1, 2011. The vote was 269 in favor and 161 against. Many Republicans (174) and some Democrats (95) voted for it. Some Republicans (66) and many Democrats (95) voted against it.

| Party | Yes | No | Not Voting | Total |

|---|---|---|---|---|

| Democrats | 45 | 6 | 0 | 51 |

| Republicans | 28 | 19 | 0 | 47 |

| Independents | 1 | 1 | 0 | 2 |

| Total | 74 | 26 | 0 | 100 |

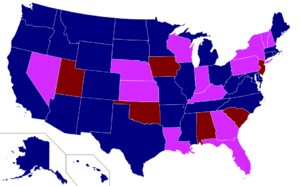

Senate Vote

The Senate passed the Act on August 2, 2011, with a vote of 74 in favor and 26 against. Six Democrats and 19 Republicans voted against it.

President Obama Signs the Bill

President Obama signed the bill shortly after the Senate passed it. He said that while it wasn't his first choice, it was a good step toward reducing the national debt.

What Happened Next

The Budget Control Act immediately raised the debt limit to $14.694 trillion.

- In October 2011, the President asked for the next $500 billion increase, which was approved.

- On November 18, 2011, the Balanced Budget Amendment failed to pass in the House. It needed a two-thirds majority, but didn't get enough votes. Two similar amendments also failed in the Senate in December 2011.

- On November 21, 2011, the "super committee" announced they couldn't agree on a plan to cut the deficit. This meant the automatic spending cuts (sequestration) would likely happen.

- In January 2012, the U.S. debt reached the new limit. The President asked for the final increase, to $16.394 trillion, which was approved.

Impacts of the Act

The Act didn't actually reduce the total U.S. debt. Instead, it slowed down how fast the debt was growing by reducing future spending increases. Even with these changes, government spending and debt were still expected to grow faster than the U.S. economy.

Some people worried that cutting government spending could lead to job losses and less consumer spending. The Economic Policy Institute, for example, thought the cuts could mean 1.8 million fewer jobs in 2013.

Three days after the Act passed, Standard & Poor's, a company that rates how risky it is to lend money to countries, lowered the U.S. credit rating. This was the first time in their history they had done this. They felt that Congress and the government might not be able to fix the country's debt problems quickly. Other rating agencies, like Fitch and Moody's, kept the U.S. rating high but changed their outlook to "negative," meaning they were worried about the future.

Impact on Jobs and Layoffs

A federal law from 1988 requires large companies to give 60 days' notice before major layoffs. In the summer of 2012, as the automatic spending cuts were set to begin in January 2013, some companies with government contracts started talking about needing to lay off workers.

The White House released a report in September 2012, explaining the billions of dollars in cuts that would happen if the law wasn't changed. Some companies later said they wouldn't send out layoff notices, based on assurances from the White House.

Defense Spending Cuts

The Department of Defense eventually started planning for the automatic spending cuts in December 2012. These cuts mostly affected areas like training and maintaining military equipment. For example, in 2016, only about 30% of the U.S. Marine Corps' F/A-18 Hornet fighter jets were ready to fly.

Later Changes to the Act

- The start of the automatic spending cuts was delayed from January 2, 2013, to March 1, 2013, by the American Taxpayer Relief Act of 2012. This new law also lowered the spending cap for 2014 to make up for the delay.

- In December 2013, the Bipartisan Budget Act of 2013 increased the spending limits for 2014 and 2015. In exchange, the automatic cuts to some mandatory spending were extended into 2022 and 2023.

See also

- Budget sequestration

- Budget Enforcement Act of 1990

- Gramm–Rudman–Hollings Balanced Budget Act

- United States fiscal cliff

- United States public debt

| Delilah Pierce |

| Gordon Parks |

| Augusta Savage |

| Charles Ethan Porter |