Allen v. Wright facts for kids

Quick facts for kids Allen v. Wright |

|

|---|---|

|

|

| Argued February 29, 1984 Decided July 3, 1984 |

|

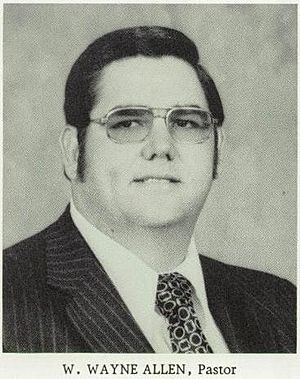

| Full case name | Allen v. Wright, et al. |

| Citations | 468 U.S. 737 (more)

104 S. Ct. 3315; 82 L. Ed. 2d 556; 1984 U.S. LEXIS 149; 52 U.S.L.W. 5110; 84-2 U.S. Tax Cas. (CCH) ¶ 9611; 54 A.F.T.R.2d (RIA) 5361

|

| Prior history | Wright v. Miller, 480 F. Supp. 790 (D.D.C. 1979); reversed sub. nom., Wright v. Regan, 656 F.2d 820 (D.C. Cir. 1981); cert. granted, 462 U.S. 1130 (1983). |

| Holding | |

| Parties lack standing to sue where the policies of a government agency are alleged to be insufficient to prevent school segregation. | |

| Court membership | |

| Case opinions | |

| Majority | O'Connor, joined by Burger, White, Powell, Rehnquist |

| Dissent | Brennan |

| Dissent | Stevens, joined by Blackmun |

| Marshall took no part in the consideration or decision of the case. | |

| Laws applied | |

| U.S. Const. art. III | |

Allen v. Wright, a important case from the U.S. Supreme Court in 1984, decided that people generally cannot sue a federal government agency just because they think the agency's actions might indirectly affect other people. The case focused on whether parents could sue the Internal Revenue Service (IRS) over how it handled tax breaks for private schools.

Contents

What Was Allen v. Wright?

This case was about whether a group of parents could sue the IRS. The parents believed the IRS was not doing enough to stop private schools from being racially segregated. They argued that the IRS's rules for giving out tax breaks were not strict enough. This meant some private schools that practiced racial discrimination might still get tax-exempt status.

Why Was This Case Important?

The case was important because it helped define what it means to have "standing" in a lawsuit. In simple terms, "standing" means you have a good enough reason to bring a case to court. The Supreme Court decided that these parents did not have standing to sue the IRS in this situation.

What Was the Problem?

The Internal Revenue Service (IRS) is the part of the U.S. government that collects taxes. It has rules that say private schools cannot get special tax-exempt status if they discriminate based on race. This means people who donate to these schools cannot get a tax deduction.

However, some parents of African-American children felt these rules were not working. They lived in states where public schools were trying to become desegregated (meaning students of all races could attend together). They noticed that many private schools were created or grew larger around this time. These schools were sometimes called "segregation academies" because they allowed white parents to avoid sending their children to desegregated public schools.

The parents believed that some of these private schools were still getting tax breaks, even if they were discriminatory. They argued that this made it easier for white parents to send their children to these private schools. This, in turn, made it harder for public schools to become truly integrated.

What Were the Main Complaints?

The parents who sued the IRS had two main complaints:

- They felt the government was indirectly helping discriminatory schools by allowing them to get tax breaks. This felt like the government approved of discrimination against Black people.

- They argued that tax breaks for these schools made it harder to desegregate public schools. If white parents could easily send their children to private schools with tax benefits, they would not push for integration in public schools.

The parents did not say their own children tried to get into these private schools. They were concerned about the overall effect on desegregation.

What Did the Court Decide?

The Supreme Court decided that the parents did not have standing to bring this lawsuit. This means the Court would not hear the case based on its actual issues.

The Court explained that to have standing, a person must show two main things:

- They must have suffered a direct, personal injury.

- This injury must be clearly caused by the government's actions.

- The court must be able to fix the injury with its decision.

The Court said that simply wanting the government to follow the law better is not enough to have standing. Also, discrimination is not enough unless the person suing was personally denied equal treatment by the government.

Why Did the Court Decide This Way?

The Court found that the connection between the IRS's rules and the alleged discrimination in schools was too weak. It was not clear that changing the IRS rules would directly fix the problem of segregated schools. Many other things could cause schools to be segregated.

The Court also mentioned the idea of the "separation of powers" in government. This means that the government's powers are divided among different branches: the legislative (Congress), the executive (President and agencies like the IRS), and the judicial (courts). The Court felt that if they allowed this lawsuit, courts might end up telling the executive branch how to do its job too much. They believed it was Congress's job to make laws about tax exemptions and the IRS's job to enforce them.

What Did the Judges Who Disagreed Say?

Not all the judges agreed with the majority decision. Some wrote "dissenting opinions" to explain why they disagreed.

Justice Brennan's View

Justice Brennan disagreed. He felt that the harm to the children's opportunities for a good education was enough to give the parents standing to sue. He thought the majority's use of "separation of powers" was not a strong enough reason to dismiss the case.

Justice Stevens' View

Justice Stevens also disagreed. He argued that the parents were essentially saying the government was helping "white flight" (when white families moved their children out of public schools to avoid integration). He believed this was a clear enough harm caused by the government's actions. Justice Stevens also felt that standing should not be directly linked to the idea of separation of powers.

See Also

| George Robert Carruthers |

| Patricia Bath |

| Jan Ernst Matzeliger |

| Alexander Miles |