Bob Benmosche facts for kids

Quick facts for kids

Bob Benmosche

|

|

|---|---|

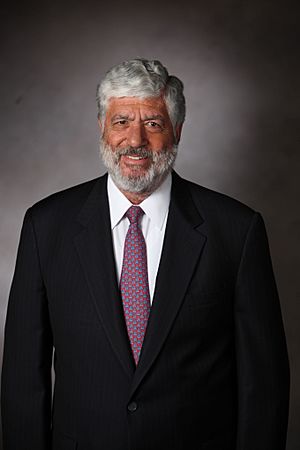

Benmosche c. 2012

|

|

| Born |

Robert Herman Benmosche

May 29, 1944 Brooklyn, New York, U.S.

|

| Died | February 27, 2015 (aged 70) New York City, U.S.

|

| Nationality | American |

| Education | B.A. 1966 |

| Alma mater | Alfred University |

| Occupation | CEO |

| Employer | AIG |

| Title | President/CEO of American International Group |

| Term | August 2009 – August 2014 |

| Predecessor | Edward M. Liddy |

| Political party | Libertarian |

| Spouse(s) | Denise Benmosche |

| Children | 2 |

Robert Herman Benmosche (pronounced ben-moh-SHAY; May 29, 1944 – February 27, 2015) was a very important American business leader. He is best known for being the President and Chief Executive Officer (CEO) of American International Group (AIG). AIG is a huge company that provides insurance and other financial services around the world. Robert Benmosche was chosen by the U.S. government and AIG's board of directors to lead the company. He is famous for helping AIG recover and become profitable again after it faced big financial problems. He helped the company pay back a lot of money it owed to the government.

Contents

Early Life and Education

Robert Benmosche was born in Brooklyn, New York. His family had a long history, tracing back to Lithuania. His great-grandfather was one of the first Jewish people to serve in the tsar's army in the 1830s. Later, his grandfather, Rabbi Herman Benmosche, moved the family to the United States in 1894.

When Robert was just 10 years old, his father passed away. His family then owned a motel in the Catskills, a popular summer spot for people from New York City. They also had a large debt of $250,000. Robert took on many jobs to help his family. He worked at the motel, carried golf clubs as a caddy, and drove a delivery truck. He graduated from New York Military Academy in 1962. In 1966, he earned a Bachelor of Arts degree in Mathematics from Alfred University. After college, from 1966 to 1968, Benmosche served as a lieutenant in the U.S. Army. He was stationed in Korea with the U.S. Signal Corps, where he helped set up important communication systems.

Career Journey

Robert Benmosche started his professional life as a consultant. He worked for companies like Arthur D. Little and Information Science. In 1975, he joined the systems group at Chase Manhattan Bank. He learned a lot about how big companies work.

In 1982, Benmosche moved to Paine Webber. There, he helped create a new financial product called the Central Asset Brokerage Account. During his 14 years at Paine Webber, he gained experience in many areas. He worked in marketing and operations for different parts of the business. This knowledge helped him become the Chief Financial Officer (CFO) of the company's retail business. He kept getting more responsibilities. Eventually, he became an executive vice president. In this role, he helped combine the operations of Kidder Peabody with Paine Webber.

Leading MetLife

In 1995, Benmosche joined the Metropolitan Life Insurance Company, known as MetLife. He quickly moved up the ranks. He became president and chief operating officer (COO). As COO, he was in charge of both individual and large-scale insurance operations, including international business. In 1998, he was named chairman of the board and CEO of MetLife. He retired from MetLife in 2006. During his time there, he successfully guided MetLife through a big change. The company went from being owned by its policyholders to being a publicly traded company. This meant its shares could be bought and sold on the stock market.

Saving the Lafayette Theatre

Robert Benmosche cared deeply about his hometown of Suffern, New York. In 2001, he bought the historic Lafayette Theatre, which was built in 1923. He then led a successful effort to preserve and restore the theater. This helped keep an important part of the town's history alive.

Becoming an Innkeeper and Vintner

Benmosche also had interests outside of corporate finance. He owned a beautiful property called Villa Splendid in Dubrovnik, Croatia. In 2001, he bought what used to be a discothèque and spent six years making it into a wonderful villa.

In 2006, he bought land in Croatia and started a vineyard. He brought 1500 Zinfandel grape plants all the way from Napa Valley, California. By 2011, his vineyard was producing wine. They made 3,000 bottles of wine under "The Benmosche Family Dingac" label.

The AIG Turnaround

In mid-2009, Robert Benmosche was asked to become the CEO of AIG. He took on this challenging role on August 10, 2009. He was chosen by the U.S. Department of the Treasury because of his strong leadership skills.

AIG had received a huge amount of money from the U.S. government to prevent it from collapsing during the 2008 financial crisis. Benmosche's main goal was to help AIG recover and pay back this money. He worked hard to sell parts of AIG's business that were not central to its main operations. These included companies like Alico, American General Finance, 21st Century Insurance, Nan Shan, and AIA. Selling these assets helped AIG raise money.

In 2010, Benmosche promised that AIG would repay the U.S. government and taxpayers. He said that the government would even make a profit from its investment. On December 14, 2012, Benmosche announced that AIG had fully repaid the U.S. government. Not only did they repay the money, but the government also made a profit of $22 billion! Benmosche's leadership was praised for bringing AIG back to being a successful company. He helped reduce the government's ownership in AIG and repaid the large federal loan from 2008.

Later Years and Legacy

In 2010, Robert Benmosche was diagnosed with lung cancer. Despite his illness, he continued to work as CEO of AIG. He underwent treatment while still leading the company. In December 2012, he said he would stay at AIG for two more years. However, in August 2014, he decided to retire earlier because his cancer was getting worse. Peter Hancock took over as CEO on September 1, 2014. Robert Benmosche passed away on February 27, 2015, in Manhattan, at the age of 70.

Honors and Recognition

Robert Benmosche received many awards and recognitions for his work:

- Insurance and Technology magazine called him one of the insurance industry's "Tech-Savvy CEOs" in 2010.

- Fortune magazine ranked him 42nd in their Top 50 Business Leaders of 2010.

- The New York Times DealBook named him “2010 Executive of the Year.”

- Harvard Business Review listed him as #59 of the Top 100 CEOs in January 2010.

- Insurance and Technology magazine named him a “Mover and Shaker” in 2011.

- The New York Police & Fire Widows’ & Children's Benefit Fund honored him in 2012.

- He was a winner of the Insurance Hall of Fame in 2013.

Past Roles

Here are some of the important roles Robert Benmosche held during his career:

- AIG, CEO, 2009–2014

- Metropolitan Life, CEO, 1998–2006

- Metropolitan Life, President, 1997–2004

- Metropolitan Life, EVP Individual Business, 1995–1997

- Paine Webber, EVP Southern Division Sales Group, 1994–1995

- Paine Webber EVP and Director of Operations, Administration and Technology, 1987–1994

- Paine Webber, CFO Retail Business, 1986–1987

- Paine Webber, Senior VP Marketing, 1982–1985

- Chase Manhattan Bank, VP Technology, 1975–1982

- Arthur D. Little, Staff Consultant, 1969–1975

Works

- Benmosche, Bob (2016). Good for the Money: My Fight to Pay Back America. with Peter Marks and Valerie Hendy. Macmillan: St. Martin's Press. ISBN 978-1250072184. https://books.google.com/books?id=T0ytCwAAQBAJ. Retrieved April 12, 2016.