Breedlove v. Suttles facts for kids

Quick facts for kids Breedlove v. Suttles |

|

|---|---|

|

|

| Argued November 16–17, 1937 Decided December 6, 1937 |

|

| Full case name | Breedlove v. Suttles, Tax Collector |

| Citations | 302 U.S. 277 (more)

58 S. Ct. 205; 82 L. Ed. 252

|

| Prior history | Appeal from the Supreme Court of Georgia |

| Court membership | |

| Case opinions | |

| Majority | Butler, joined by unanimous |

| Laws applied | |

| U.S. Const. amends. XIV, XIX | |

|

Superseded by

|

|

| U.S. Const. amend. XXIV | |

|

Overruled by

|

|

| Harper v. Virginia State Board of Elections, 383 U.S. 663 (1966) | |

Breedlove v. Suttles was an important case decided by the United States Supreme Court in 1937. The Court decided that it was okay for states to make people pay a special fee, called a poll tax, if they wanted to vote in state elections. This decision was later changed by a different Supreme Court case in 1966.

Contents

What Was the Case About?

The Georgia Poll Tax

At the time of this case, the state of Georgia had a rule about voting. To vote, most people had to pay a yearly fee of $1.00. This fee was called a poll tax.

Not everyone had to pay this tax. People under 21 years old or over 60 years old did not have to pay it. Also, women who did not register to vote were exempt. If you were supposed to pay the tax, you had to pay it, plus any money you owed from previous years, before you could sign up to vote.

Nolan Breedlove's Challenge

Nolan Breedlove was a 28-year-old man. He did not want to pay the poll tax. Because he refused to pay, he was not allowed to register to vote.

Mr. Breedlove decided to take legal action. He sued the state of Georgia. He argued that the poll tax went against parts of the United States Constitution. He specifically mentioned the Fourteenth Amendment (which is about equal protection and rights) and the Nineteenth Amendment (which gives women the right to vote).

The person he sued was T. Earl Suttles. Mr. Suttles was the tax collector for Fulton County, Georgia.

The Supreme Court's Decision

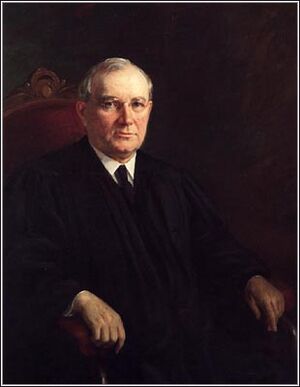

The Supreme Court heard the case. Justice Pierce Butler wrote the official decision for the Court. All the judges on the Court agreed with his decision. They decided that the Georgia poll tax law was allowed under the Constitution.

Why Women Were Exempt

One of the arguments was about why women were exempt from the tax if they didn't register to vote. The Court said that women could be treated differently. They explained that women have "special considerations" because of the "burdens necessarily borne by them for the preservation of the race." This meant the state could reasonably choose to not make women pay the poll tax.

Why Older People Were Exempt

Mr. Breedlove also argued that it was unfair to exempt people over 60 from the tax. The Court said that this was similar to other laws. For example, laws often exempt older people from things like military service or jury duty. So, the age exemption was also allowed.

The Nineteenth Amendment Argument

Mr. Breedlove also said the tax went against the Nineteenth Amendment. This amendment says that the right to vote cannot be taken away because of a person's sex. He argued that the tax unfairly affected men. However, the Court disagreed. They said the tax was not meant to stop men from voting because they were men.

What Happened Next?

Changes in Georgia

Georgia eventually stopped using the poll tax in 1945.

Overturned by a New Case

The Supreme Court's decision in Breedlove v. Suttles was the law for many years. But in 1966, the Supreme Court heard a new case called Harper v. Virginia State Board of Elections. In this case, the Court decided that poll taxes were unconstitutional. This meant the Breedlove decision was overturned.

The 24th Amendment

Two years before the Harper decision, in 1964, the 24th Amendment was added to the Constitution. This amendment made it illegal to use a poll tax (or any other tax) to stop people from voting in federal elections, like for president or members of Congress.

Justice Hugo Black was on the Supreme Court for both the Breedlove case and the Harper case. He disagreed with the decision to make poll taxes unconstitutional in the Harper case.

| Frances Mary Albrier |

| Whitney Young |

| Muhammad Ali |