Excise tax facts for kids

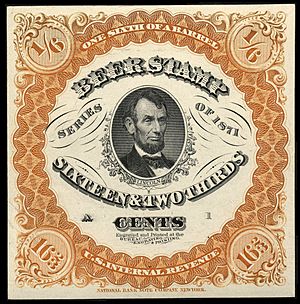

An excise tax is a special kind of tax that is added to the price of certain products. It's called an indirect tax because the company that makes or sells the product pays the tax to the government, but they usually add it to the price you pay. This is different from a sales tax, which is added when you buy something.

Excise taxes are often included in the final price of items like gasoline, some beverages, or cigarettes. Both state governments and the federal government can charge these taxes.

What is the Difference Between Excise and Sales Tax?

Excise taxes and sales taxes are different in two main ways:

- What they tax: Excise taxes are only charged on specific products. A sales tax, however, can apply to almost anything you buy, though some places might not tax food or clothes. Excise taxes are often put on items that are considered luxury goods or products that might be linked to health concerns, like tanning services or cigarettes.

- How they are charged: A sales tax is a percentage of the price you pay. For example, if sales tax is 5%, you pay 5% of the item's cost. An excise tax is usually a set amount added to the price, no matter how much the item costs. It can be hard to see how much excise tax you pay because it's already part of the product's price. Sales tax is usually added at the end and shown on your receipt.

Excise Taxes in the United States

In the United States, excise taxes make up about 4% of all the money the federal government collects. This is a smaller amount compared to many other countries. The U.S. Constitution mentions excise tax as an indirect tax.

Some states in the U.S. have different names for excise taxes. For example, in Massachusetts, the excise tax on cars is called an "ad valorem tax." This means the tax amount depends on the value of the car.

See also

In Spanish: Impuestos sobre consumos específicos para niños

In Spanish: Impuestos sobre consumos específicos para niños