Federal Farm Loan Act facts for kids

|

|

| Other short titles | Federal Farm Loan Act of 1916 |

|---|---|

| Long title | An Act to provide capital for agricultural development, to create standard forms of investment based upon farm mortgage, to equalize rates of interest upon farm loans, to furnish a market for United States bonds, to create Government depositaries and financial agents for the United States. |

| Enacted by | the 64th United States Congress |

| Effective | July 17, 1916 |

| Citations | |

| Public law | 64-158 |

| Statutes at Large | 39 Stat. 360 |

| Legislative history | |

|

|

The Federal Farm Loan Act of 1916 was a U.S. law created to help farmers get loans. Before this act, it was hard for many farmers to borrow money. This law made it easier for them to get the money they needed to run their farms.

The act set up a special board, twelve regional banks, and many local groups for farm loans. President of the United States Woodrow Wilson signed this important law.

Why the Act Was Needed

Helping Rural Families

In 1908, the government looked into problems faced by families in the countryside. At that time, most Americans lived in rural areas. The study found that getting loans was a big problem for farmers. They suggested creating a system where farmers could work together to get credit.

Learning from Europe

A few years later, Presidents William Howard Taft and Woodrow Wilson sent a group to Europe. This group studied how European farmers got loans. They saw systems like cooperative banks and credit unions.

The group learned that the best way to help farmers was to offer two types of loans. Farmers needed long-term loans for buying land. They also needed short-term loans for everyday farm expenses.

How the Act Helped Farmers

Loans for Farmers

The most direct way the Act helped was by giving loans to individual farmers. Farmers could borrow money based on the value of their land. They could also borrow based on the value of any improvements they had made.

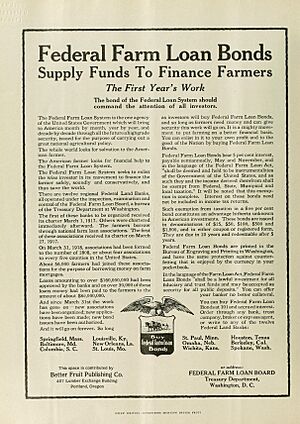

The smallest loan a farmer could get was $100. The largest loan was $10,000. Farmers paid back these loans over a long time, usually from 5 to 40 years. This way of paying back loans is called amortization. It means you make regular payments until the loan is fully paid off.

Working Together: National Farm Loan Associations

Farmers who borrowed money also bought shares in a group called the National Farm Loan Association. This meant that farmers were helping other farmers get loans. It was like a cooperative, where members work together for a common goal. This idea was inspired by a successful system in Germany.

Fairer Interest Rates

The Act also created special bonds that were backed by farm mortgages. The interest rate on the loans for farmers could not be much higher than the interest rate on these bonds. This difference covered the costs of running the loan program. But it did not allow for big profits.

The highest interest rate for these bonds was 6 percent. This helped make sure that farmers' borrowing costs were much lower than before the Act. This made it easier for small farmers to compete with larger businesses. It also helped prevent big companies from taking over all of farming.

What Was Missing

The original study suggested that farmers needed short-term loans too. However, the Federal Farm Loan Act did not include these. Later, in 1923, a new law called the Agricultural Credits Act of 1923 added a system for short-term loans. This was important because farmers needed money for new farm machinery and other daily needs.

The Federal Farm Loan Act was supported by Senator Henry F. Hollis and Representative Asbury Francis Lever. It was a new version of an earlier bill that had not passed.

How the Act Was Organized

Federal Farm Loan Board

The Act created the Federal Farm Loan Board. This board was in charge of watching over the federal land banks and the local farm loan associations. It also set the interest rates for loans and bonds. The board could step in if banks were making risky loans.

Federal Land Banks

There were twelve Federal Land Banks set up across the country. Each bank needed to have at least $750,000 to start. These banks were owned by the local farm loan associations and other investors. If a bank did not have enough money, the U.S. Treasury would help. As more people invested, the government's ownership in the banks would decrease.

National Farm Loan Associations

National Farm Loan Associations were groups of 10 or more farmers who had mortgages. Together, they owned a part of a federal land bank. Once a group was formed, the Federal Farm Loan Board had to approve it. This system made sure that farmers had a say in how the banks worked. Farmers were both borrowers and lenders, which helped everyone work together.

Later Changes

Later, under President Herbert Hoover, the Agricultural Marketing Act of 1929 changed the Federal Farm Loan Board. It became the Federal Farm Board. This new board had a large fund to help farmers.

| Madam C. J. Walker |

| Janet Emerson Bashen |

| Annie Turnbo Malone |

| Maggie L. Walker |