External debt facts for kids

A country's external debt (also called foreign debt) is like the money it owes to people or groups outside its own borders. This money can be owed by the country's government, big corporations, or even regular citizens. It might be owed in the country's own money or in a foreign currency. This debt can be to private commercial banks, other governments, or large international groups like the International Monetary Fund (IMF) and the World Bank.

External debt shows how much a country needs to pay back in the future. It helps us understand if a country might have trouble paying its bills. Another helpful idea is net external debt. This is the total external debt minus any money other countries owe to it.

What is External Debt?

The International Monetary Fund (IMF) has a clear definition for external debt. They say it's the total amount of money that a country's residents owe to non-residents. This money must be a real debt that needs to be paid back, including both the original amount borrowed (called principal) and any extra fees (called interest).

Let's break down what the IMF means:

- Money owed right now: This includes any payments that are late, both for the original amount and for interest.

- Principal and interest: When you borrow money, you usually pay back the original amount (principal) plus an extra fee (interest) over time. External debt includes both of these. The definition doesn't care if you know the exact payment dates, just that payments are expected.

- Who owes whom: For a debt to be "external," it must be owed by someone living in the country (a resident) to someone living outside the country (a non-resident). It's about where they usually live and do business, not their nationality.

- Real and certain debts: Only debts that are definite and current are counted. Debts that might happen only if certain conditions are met (called contingent liabilities) are not included. However, experts still look at these "what if" debts to understand a country's possible risks.

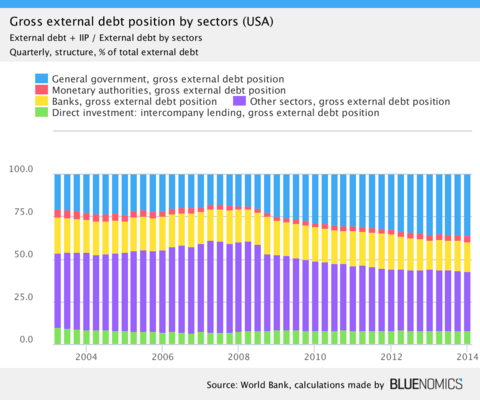

Generally, external debt is put into four main groups:

- Public and publicly guaranteed debt (money owed by the government or guaranteed by it)

- Private non-guaranteed credits (money owed by private companies without government backing)

- Central bank deposits (money held by the country's main bank)

- Loans from the IMF

However, how countries group their debt can be different. For example, Egypt uses these four groups, but India uses seven:

- Multilateral (from groups like the World Bank)

- Bilateral (from other countries)

- IMF loans

- Trade credit (money owed for goods bought on credit)

- Commercial borrowings (loans from banks or other private lenders)

- Non-resident Indian and person of Indian origin deposits (money deposited by Indians living abroad)

- Rupee debt (debt in India's currency)

- NPR debt (debt in Nepal's currency)

Can a Country Pay Its Debts?

Sustainable debt means a country can pay all its current and future debts without needing special help, like getting debt canceled or rescheduled. It also means the country can keep growing its economy.

Experts often study how sustainable a country's external debt is. They look at how the economy might behave in the future. This helps them see if debt levels will stay reasonable and what risks the economy faces. They also figure out if the country needs to change its policies, like how it manages its money.

The World Bank and IMF believe a country has sustainable debt if it can pay its bills without problems and without stopping its economic growth. They suggest that if a country's public debt is about 150 percent of its exports or 250 percent of its income, it can be a big problem for long-term debt sustainability. High external debt is generally seen as bad for a country's economy.

How Do We Measure Debt?

There are many ways to measure if a country's external debt is sustainable. Each method has its own strengths. There isn't one perfect way that all economists agree on. These measurements are usually ratios, which compare two different numbers. This helps leaders manage their country's external debt. These ratios show how well a country can earn money to pay back what it owes.

Some common ways to measure debt burden include:

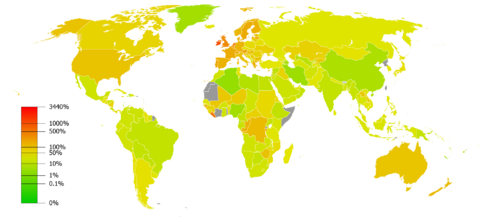

- Debt-to-GDP ratio: This compares a country's total debt to its total economic output (Gross Domestic Product).

- Foreign debt to exports ratio: This compares the debt to how much the country earns from selling goods and services to other countries.

- Government debt to current income ratio: This compares the government's debt to the money it collects from taxes and other sources.

These measurements also look at the type of debt, such as:

- How much of the debt is foreign.

- How much is short-term debt (needs to be paid back soon).

- How much is "concessional debt" (loans with very good terms, like low interest rates).

Another set of measurements looks at how much money a country needs in the short term to pay its debt. These are like early warning signs for problems. They show how past borrowing decisions affect current payments. Examples include:

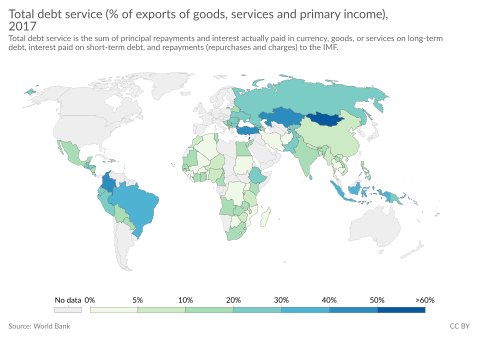

- Debt service to GDP ratio: How much of the country's economic output goes to paying debt.

- Foreign debt service to exports ratio: How much of the money from exports goes to paying debt.

- Government debt service to current income ratio: How much of the government's income goes to paying debt.

Finally, some measurements look ahead to see how the debt burden might change over time. They consider the current debt and the average interest rate. These "dynamic ratios" show if the debt burden is stable. For example, they compare the average interest rate on debt to how fast the country's economy is growing.

See also

In Spanish: Deuda externa para niños

In Spanish: Deuda externa para niños

- Eurodad

- Jubilee Debt Campaign

- List of countries by external debt

- Net international investment position

- Odious debt

- Public debt

- Sovereign default

- The Accumulation of Capital

- Third-world debt

- World debt