International Monetary Fund facts for kids

|

|

| Abbreviation | IMF |

|---|---|

| Formation | 27 December 1945 |

| Type | International financial institution |

| Purpose | Promote international monetary co-operation, facilitate international trade, foster sustainable economic growth, make resources available to members experiencing balance of payments difficulties, prevent and assist with recovery from international financial crises |

| Headquarters | 700 19th Street NW, Washington, D.C., U.S. |

|

Region

|

Worldwide |

|

Membership

|

190 countries (189 UN countries and Kosovo) |

|

Official language

|

English |

|

Managing Director

|

Kristalina Georgieva |

|

First Deputy Managing Director

|

Gita Gopinath |

|

Chief Economist

|

Pierre-Olivier Gourinchas |

|

Main organ

|

Board of Governors |

|

Parent organization

|

|

|

Budget (2023)

|

$1,295 million |

|

Staff

|

2,400 |

The International Monetary Fund (IMF) is a big financial group that is part of the United Nations. It is funded by 190 countries from all over the world. Its main office is in Washington, D.C., in the United States.

The IMF is like a global bank that helps countries when they have money problems. It also works to keep money exchange rates stable. Its main goal is to "help countries work together on money matters, keep finances steady, make international trade easier, create more jobs and economic growth, and reduce poverty everywhere."

The IMF was created in July 1944 after World War II. It started with 29 member countries. The idea was to rebuild the world's money system. Today, it plays a key role in helping countries with their money issues and preventing big financial crises. Countries put money into a shared pool, and other countries can borrow from it if they need help. The IMF also collects and looks at economic information to help its members.

The current head of the IMF is Kristalina Georgieva from Bulgaria. She has been the Managing Director since October 1, 2019. Gita Gopinath is the First Deputy Managing Director, and Pierre-Olivier Gourinchas is the Chief Economist.

Contents

What the IMF Does

The IMF helps countries grow and keep their economies stable. It gives advice and money to developing countries. This helps them manage their money and reduce poverty.

When the IMF was first created, it had three main jobs:

- To watch over the system where countries had fixed exchange rates. This helped governments manage their money and focus on growing their economies.

- To give short-term money to help countries with their balance of payments. This also helped stop financial problems from spreading.

- To help fix the world economy after the Great Depression and World War II. It also provided money for economic growth and big projects like roads and buildings.

After 1971, countries started using floating exchange rates, which meant their money values could change more freely. The IMF's role changed. It began to look closely at how countries managed their economies, especially those asking for loans. The IMF wanted to understand why countries had money problems and what policies would help them recover.

A big concern for the IMF was stopping financial crises from spreading. For example, it helped during crises in Mexico in 1982 and East Asia in 1997–98. The IMF now actively watches the overall economic health of its member countries.

The IMF also sets conditions for its loans. These conditions are called "conditionality." Countries with lower incomes can get loans with no interest for a while. Other loans have interest rates. The IMF also provides emergency help to countries facing urgent money problems.

Watching the Global Economy

The IMF is in charge of watching the world's money and financial system. It also checks the economic policies of its member countries. This is called "surveillance" and helps countries work together.

The IMF looks at each country's economic policies to see if they help the country grow. It also checks how these policies affect other countries and the global economy. For example, the IMF helped countries like Armenia and Belarus with financial support.

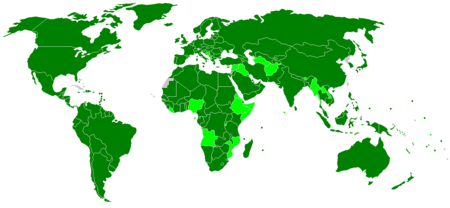

Since 1995, the IMF has worked to help countries share their economic and financial data with the public. They created guidelines for this, split into two levels: the General Data Dissemination System (GDDS) and the Special Data Dissemination Standard (SDDS). These systems help countries improve the quality and openness of their economic information.

Some areas that are not full IMF members also share data, like Hong Kong and Macau. Even parts of the European Union, like the European Central Bank, share data through these systems.

Loan Conditions

IMF conditionality means that countries must agree to certain policies to get money from the IMF. The IMF doesn't usually ask for physical items as collateral. Instead, it asks the government to fix its money problems by changing its economic policies. If a country doesn't follow these rules, the IMF can stop giving them money.

These conditions help make sure that the borrowing country can pay back the IMF. They also ensure that the country doesn't try to fix its money problems in a way that would hurt the rest of the world economy. The IMF wants to be sure the money is used for the right reasons. It also wants to make sure the country can fix its problems and pay back the loan.

As of 2004, most countries that borrowed from the IMF have paid back their loans on time. This shows that IMF lending usually doesn't create a burden for the countries that lend money to the IMF.

Structural Adjustment

Some of the conditions for loans can include:

- Spending less money or collecting more taxes. This is often called austerity.

- Focusing on making goods for export or using natural resources.

- Making a country's money worth less compared to other currencies.

- Allowing more free trade by removing import and export limits.

- Making it easier for foreign companies to invest.

- Keeping government budgets balanced and not spending too much.

- Removing price controls and government help (subsidies).

- Selling off government-owned businesses to private companies.

- Making sure foreign investors have strong rights under national laws.

- Improving how the government is run and fighting corruption.

These conditions are sometimes called the "Washington Consensus."

History of the IMF

The IMF was created as part of the Bretton Woods system agreement in 1944. Before this, during the Great Depression, many countries tried to fix their economies by making trade harder. This led to countries making their money less valuable and a big drop in world trade.

Because countries weren't working together on money matters, there was a need for an organization to oversee things. Representatives from 45 governments met in Bretton Woods, New Hampshire, in the United States. They talked about how to rebuild Europe and create a plan for world economic cooperation after the war.

There were two main ideas for the IMF's role. The American delegate, Harry Dexter White, thought the IMF should act more like a bank, making sure countries could pay back their debts. The British economist, John Maynard Keynes, thought the IMF should be a shared fund that countries could use to keep their economies active during hard times. Most of White's ideas were used in the end.

The IMF officially started on December 27, 1945. The first 29 countries agreed to its rules. By the end of 1946, it had 39 members. On March 1, 1947, the IMF started lending money, and France was the first country to borrow.

The IMF became a very important part of the world's economic system. Its influence grew as more countries joined, especially in the 1950s and 1960s when many African countries became independent. However, the Cold War limited its membership, as many countries linked to the Soviet Union did not join until later.

The Bretton Woods system of fixed exchange rates lasted until 1971. That's when the United States stopped allowing other countries to exchange their US dollars for gold. This event is known as the "Nixon shock." The IMF's rules were changed to reflect this in 1976.

In the 1980s, the IMF's role changed again. It started focusing more on encouraging market-friendly reforms in countries through "structural adjustment programs." This meant pushing countries to open up their economies more.

In the 21st century, the IMF provided big loans to Argentina and Uruguay in the early 2000s. It also helped Greece with its debt problems in 2010 and 2012. In 2013, it helped Cyprus with a financial bailout. In 2014, the IMF provided an $18 billion loan to Ukraine.

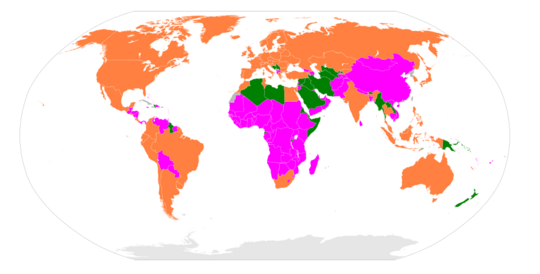

Member Countries

Not all IMF members are independent countries. Some are areas with special rules, like Aruba, Curaçao, Hong Kong, and Macau. Kosovo is also a member. All IMF members are also members of the International Bank for Reconstruction and Development (IBRD).

Some countries have left the IMF, like Cuba in 1964. Taiwan was replaced by the People's Republic of China in 1980. Poland left in 1950 but rejoined in 1986. The former Czechoslovakia was removed in 1954 but rejoined in 1990.

Besides Cuba, other countries that are not part of the IMF include Liechtenstein, Monaco, and North Korea. However, Andorra became the 190th member in October 2020.

Becoming a Member

Any country can apply to join the IMF. In the early days, the rules for joining were quite flexible. Members had to pay their share, avoid currency restrictions without IMF permission, follow the IMF's rules, and share their economic information. Countries that asked for money had stricter rules.

Benefits of Membership

Countries that are members of the IMF get several benefits:

- They can access information about the economic policies of all other member countries.

- They have a chance to influence other countries' economic policies.

- They can get expert help with banking, money matters, and exchange rates.

- They receive financial support when they have payment difficulties.

- They get more chances for trade and investment.

People at the IMF

Board of Governors

The Board of Governors is made up of one main governor and one alternate governor from each member country. They usually meet once a year. This Board is responsible for big decisions like approving new members or changing the IMF's rules. However, they usually let the Executive Board handle most of the day-to-day work.

The Board of Governors gets advice from two committees: the International Monetary and Financial Committee and the Development Committee. These committees look at global money issues and how to help developing countries.

Executive Board

The Executive Board has 24 Executive Directors. These directors represent all 190 member countries. Countries with large economies, like the United States, Japan, China, Germany, France, the United Kingdom, and Saudi Arabia, have their own director. Most other countries are grouped together and share a director. This Board meets several times a week to make decisions.

Managing Director

The IMF is led by a Managing Director. This person is the head of all the staff and also leads the Executive Board. The Managing Director is the most powerful person at the IMF. Traditionally, the IMF's Managing Director has been from Europe, and the head of the World Bank has been from the United States. However, this tradition is being questioned, and people from other parts of the world might get these jobs in the future.

In August 2019, the IMF removed the age limit for its Managing Director position.

List of Managing Directors

| Term | Dates | Name | Citizenship |

|---|---|---|---|

| 1 | 6 May 1946 – 5 May 1951 | Camille Gutt | |

| 2 | 3 August 1951 – 3 October 1956 | Ivar Rooth | |

| 3 | 21 November 1956 – 5 May 1963 | Per Jacobsson | |

| 4 | 1 September 1963 – 31 August 1973 | Pierre-Paul Schweitzer | |

| 5 | 1 September 1973 – 18 June 1978 | Johan Witteveen | |

| 6 | 18 June 1978 – 15 January 1987 | Jacques de Larosière | |

| 7 | 16 January 1987 – 14 February 2000 | Michel Camdessus | |

| 8 | 1 May 2000 – 4 March 2004 | Horst Köhler | |

| 9 | 7 June 2004 – 31 October 2007 | Rodrigo Rato | |

| 10 | 1 November 2007 – 18 May 2011 | Dominique Strauss-Kahn | |

| 11 | 5 July 2011 – 12 September 2019 | Christine Lagarde | |

| 12 | 1 October 2019 – present | Kristalina Georgieva |

In 2011, Christine Lagarde was chosen as the Managing Director of the IMF. She was re-elected for a second term in 2016.

First Deputy Managing Director

The Managing Director gets help from a First Deputy Managing Director (FDMD). This person has traditionally been a citizen of the United States. The FDMD also serves a five-year term.

List of First Deputy Managing Directors

| No. | Dates | Name | Citizenship |

|---|---|---|---|

| 1 | 9 February 1949 – 24 January 1952 | Andrew Overby | |

| 2 | 16 March 1953 – 31 October 1962 | Merle Cochran | |

| 3 | 1 November 1962 – 28 February 1974 | Frank Southard | |

| 4 | 1 March 1974 – 31 May 1984 | William Dale | |

| 5 | 1 June 1984 – 31 August 1994 | Richard Erb | |

| 6 | 1 September 1994 – 31 August 2001 | Stanley Fischer | |

| 7 | 1 September 2001 – 31 August 2006 | Anne Kreuger | |

| 8 | 17 July 2006 – 11 November 2011 | John Lipsky | |

| 9 | 1 September 2011 – 28 February 2020 | David Lipton | |

| 10 | 20 March 2020 – 20 January 2022 | Geoffrey Okamoto | |

| 11 | 21 January 2022 – present | Gita Gopinath |

Chief Economist

The Chief Economist leads the research part of the IMF.

List of Chief Economists

| Term | Dates | Name | Citizenship |

|---|---|---|---|

| 1 | 1946–1958 | Edward Bernstein | |

| 2 | 1958–1980 | Jacques Polak | |

| 3 | 1980–1987 | William Hood | |

| 4 | 1987–1991 | Jacob Frenkel | |

| 5 | August 1991 – 29 June 2001 | Michael Mussa | |

| 6 | August 2001 – September 2003 | Kenneth Rogoff | |

| 7 | September 2003 – January 2007 | Raghuram Rajan | |

| 8 | March 2007 – 31 August 2008 | Simon Johnson | |

| 9 | 1 September 2008 – 8 September 2015 | Olivier Blanchard | |

| 10 | 8 September 2015 – 31 December 2018 | Maurice Obstfeld | |

| 11 | 1 January 2019 – 21 January 2022 | Gita Gopinath | |

| 12 | 24 January 2022 – present | Pierre-Olivier Gourinchas |

How Voting Works

Voting power in the IMF is based on a "quota system." Each member country is given a quota, which is like a contribution. This quota shows how big the country's economy is in the world. The quota also decides how many votes the country gets.

So, countries that give more money to the IMF have more say in how things are run. This is similar to how a company works, where shareholders with more shares have more power. This means richer countries have more influence than poorer countries. However, the IMF also tries to help redistribute wealth.

In 2015, the United States agreed to reforms that changed the voting power. This meant that more power shifted to fast-growing countries like Brazil, China, India, and Russia. These four countries are now among the top ten largest members of the IMF.

Challenges with Voting Power

The IMF's voting shares don't change easily. Countries that grow economically might not get more voting power right away. This means that developing countries, whose economies are a big part of the world, might not have enough say in the IMF's decisions. Some people, like Joseph Stiglitz, argue that developing countries need a stronger voice.

The IMF's members are divided into "creditors" (richer countries that provide money) and "borrowers" (developing countries that use the money). This can cause tension because these two groups have different interests. Borrowers want more access to loans, while creditors want to be sure the loans will be paid back.

How IMF Loans Are Used

Studies show that the use of IMF loans has increased over the years. For example, since 1950, African countries have received billions of dollars from the IMF and other related groups.

Research suggests that democratic countries benefit more from IMF programs than countries with strict rulers. This is because decisions about how to use the loaned money are more open in democracies. Some studies also found that IMF programs can help improve a country's balance of payments.

Criticisms of the IMF

The IMF has faced some criticisms:

- Some people say that richer countries have too much control over poorer countries.

- Critics argue that the IMF sometimes assumes all money problems are caused by a country's own actions. They say the IMF doesn't always consider outside reasons, like global oil price changes.

- Some IMF policies, like cutting spending, can hurt a country's economy. They might lead to job losses and make poverty worse, especially for people who are already struggling.

- Critics also say that the IMF's policies are based on theories that don't always fit the real situations in different countries.

Argentina, which followed the IMF's advice, had a big economic crisis in 2001. Some people believe this was caused by IMF rules that limited government spending. This made many people in Argentina and other South American countries angry at the IMF.

In 2006, a group called ActionAid said that IMF policies in Africa were stopping countries from reaching important development goals. This was because the policies limited spending on things like education and health.

Former Romanian Prime Minister Călin Popescu-Tăriceanu said in 2008 that the IMF often makes mistakes when judging his country's economy. Former Tanzanian President Julius Nyerere famously asked, "Who elected the IMF to be the ministry of finance for every country in the world?" He meant that the IMF has too much power over countries.

Raghuram Rajan, a former chief economist of the IMF, criticized it for not doing enough to help developing countries. He also said the IMF praised the money policies of rich countries that were causing problems in other parts of the world.

Loan Conditions and Their Impact

The IMF has been criticized for not understanding local conditions and cultures in countries where it asks for policy changes. The economic advice might not consider how cuts in spending affect people's daily lives. Some say that countries don't feel like they "own" the programs because the conditions are forced on them.

Jeffrey Sachs said that the IMF often tells poor countries to "tighten their belts" even when they are too poor to do so. He believes the IMF needs to work more closely with other groups that specialize in different areas.

One view is that IMF conditions can weaken a country's own political system. Governments might have to give up some control over their policies to get money. This can make people angry at their leaders for accepting the IMF's rules. IMF conditions are often criticized for reducing government services and increasing unemployment.

Another criticism is that IMF policies only focus on problems like bad government or too much government spending. This means they might ignore other issues and treat all countries the same, even if their situations are very different. A country might also have to accept conditions it wouldn't normally agree to if it wasn't in a financial crisis.

Some studies suggest that countries with IMF policies see an increase in income inequality. It is also claimed that these conditions can harm social stability and increase poverty. The IMF sometimes suggests "austerity programs," which means cutting public spending and raising taxes, even when the economy is weak. This is done to balance budgets.

Joseph Stiglitz, a former chief economist at the World Bank, criticized these policies. He said that the IMF's purpose has changed and that it now reflects the interests of Western financial groups.

Some researchers argue that the IMF's policies are like a new form of colonization. They say that countries get caught in a cycle of debt, and the IMF then controls their economic policies without needing a military presence.

International politics also play a big role in IMF decisions. Countries that contribute more money have more power. The United States has the most votes and therefore the most influence.

Supporting Dictatorships

The IMF has been criticized for supporting military dictatorships that were friendly to American and European businesses. Critics say the IMF doesn't care enough about human rights or workers' rights. For example, the IMF continued to support Mobutu's rule in Zaire, even though there were reports of corruption.

Some people argue that economic stability is needed before a country can become a democracy. However, critics point to examples where democratic countries struggled after receiving IMF loans. A 2017 study found that IMF loans did not harm democracy and might even have a small positive effect.

Impact on Food and Health

Some groups have criticized the IMF's policies for hurting access to food, especially in developing countries. In 2008, former U.S. president Bill Clinton said that the World Bank and IMF were wrong to treat food like any other product in trade. He said they should go back to supporting more sustainable farming.

A 2009 study found that strict IMF conditions led to thousands of deaths from tuberculosis in Eastern Europe. This happened because public health care was weakened. In 21 countries that received IMF loans, tuberculosis deaths went up by 16.6%.

Reforms

Functions and Policies

The IMF is just one of many international organizations. It focuses only on big economic issues. One idea for reform is for the IMF to work more closely with other groups like UNICEF (which helps children) and the Food and Agriculture Organization (FAO, which deals with food).

Jeffrey Sachs believes that the problem isn't the IMF itself, but how development economics is understood. He says that IMF loan conditions should be combined with other changes, like fairer trade rules for rich countries and more money for basic infrastructure.

U.S. Influence and Voting Reforms

Many experts agree that IMF decisions are not just technical; they are also guided by politics and economics. The United States is the most powerful member of the IMF. It has historically not wanted to lose its "leadership role."

For a long time, fast-growing economies were not well-represented. For example, China had fewer votes than its size in the world economy suggested. In 2010, the G20 group of countries agreed to give more power to these emerging economies. However, these changes needed to be approved by the United States Congress, which took until the end of 2015. Even after the reforms, the United States still has a very strong voting share.

IMF and Globalization

Globalization involves global financial markets, large international companies, national governments working together, and "global governments" like the World Trade Organization (WTO), IMF, and World Bank. Some people argue that these groups create a new global power system. This system takes power away from individual nations and gives it to global markets and international organizations.

The creation of these global economic groups has both been a result of globalization and has helped it grow. They show that countries are no longer the only main players in international affairs. Globalization has limited how much control a country has over its own economy.

Other Options

In 2011, African Union countries suggested creating an African Monetary Fund.

In 2014, the BRICS nations (Brazil, Russia, India, China, and South Africa) created the BRICS Contingent Reserve Arrangement. This is a way for them to help each other with money problems.

Also in 2014, China led the creation of the Asian Infrastructure Investment Bank.

In the Media

The documentary film Life and Debt looks at how the IMF's policies affected Jamaica's economy. Debtocracy, a Greek documentary from 2011, also criticizes the IMF. The 2015 movie Our Brand Is Crisis mentions the IMF as a political issue, with people in Bolivia fearing its influence.

See also

In Spanish: Fondo Monetario Internacional para niños

In Spanish: Fondo Monetario Internacional para niños

- Bank for International Settlements

- Conditionality

- Currency crisis

- Globalization

- International financial institutions

- List of IMF people

- New Development Bank

- World Bank residual model