Kirtland Safety Society facts for kids

The Kirtland Safety Society (KSS) was a financial group started by leaders and followers of the Church of the Latter Day Saints in Kirtland, Ohio. It began on January 2, 1837, as a type of company called a joint stock company. Its main goal was to help with the money needs of the growing Latter Day Saint community in Kirtland. The group wanted to support farming, crafts, and trading. However, by November 1837, the KSS failed and closed its business. After this, Joseph Smith, who founded the Latter Day Saint movement, faced legal issues for running the institution. Many Latter Day Saints who lost money left the church. They believed Smith had started the KSS to benefit himself and other church leaders.

Contents

Money Matters in Kirtland

By late 1836, many new Latter Day Saint members had moved to Missouri and Kirtland, Ohio. Kirtland's population grew a lot, from about 1,000 people in 1830 to 3,000 in 1836. Land prices also went up very quickly between 1832 and 1837. For example, the average price for an acre of land in Kirtland rose from about $7 in 1832 to $44 in 1837. This price later dropped to $17.50 in 1839.

Part of this price increase was due to general inflation, which means money was worth less. The church owned a lot of land, but it also needed cash to pay back loans. The growing community and land deals meant Kirtland needed a local bank. In those days, before the Civil War, banks in the United States often printed and backed their own money.

How the KSS Was Formed

Church leaders discussed starting a bank. Orson Hyde, a church apostle, went to the Ohio government to ask for a bank license. At the same time, Oliver Cowdery went to Philadelphia to get plates for printing money for the new Kirtland Safety Society bank.

On January 2, Hyde returned without a license. He couldn't convince any lawmaker to support a bill for the KSS bank. Joseph Smith believed this was because lawmakers didn't like the Mormons. Hyde tried again in February with a new request for a bank with less money. This time, he found lawmakers to support it, but the bill was still defeated. A person named Grandison Newell, who was against the Latter Day Saints, influenced some lawmakers to reject the request.

The Ohio government at this time was very strict about giving out bank licenses. They were worried about problems like land speculation (buying land hoping its price will rise quickly), wildcat banking (banks that operate without enough money), and counterfeiting (fake money). Because of these issues, the government refused almost all bank requests in 1836 and 1837.

Under legal advice, the Kirtland Safety Society Anti-Banking Company (KSSABC) was created on January 2, 1837. It was set up as a joint stock company to act like a bank, even without a formal bank license. These "quasi-banks" (meaning "sort of" banks) were common in Ohio because banking rules were not very strict.

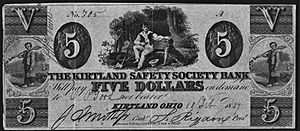

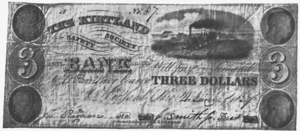

The words "Anti" and "ing" were added in smaller letters to the printing plates Cowdery had bought, making it "Kirtland Safety Society Anti-Bank-ing Company." People from Kirtland, like merchants and farmers, became shareholders. Sidney Rigdon was the chairman and president, and Joseph Smith was the cashier. They hoped to get a real bank license later. In the meantime, the KSSABC started printing its own money notes in early January 1837.

The KSSABC planned to have a huge amount of money, $4 million. This was much more than the money available from its supporters. One historian, Robert Kent Fielding, noted that this amount was too large for the company's actual worth. The rules for the company also allowed managers to decide how much money shareholders had to pay. There were no clear limits on how much money could be printed compared to the company's assets. This made it look risky to other bankers.

National Money Problems

The failure of the KSS was part of a bigger money crisis across the country called the Panic of 1837. This crisis started in May 1837. One reason for the nationwide problem was too much speculation in public lands in western states like Michigan, Ohio, and Missouri. Also, the money policies of former President Andrew Jackson, like his "Specie Circular" (which required land to be bought with gold or silver), added to the crisis.

On May 10, 1837, in New York, almost all banks stopped paying out gold and silver coins. This left banks and local groups like the KSS with paper money but not enough real gold or silver. Within two months, banks in New York alone lost nearly $100,000,000. Many banks across the United States closed completely or partly. Smaller financial groups, like the KSS, also failed in large numbers. The Panic of 1837 led to a five-year economic downturn, with many businesses closing and high unemployment.

Challenges and Closure

In February 1837, Samuel D. Rounds filed a legal complaint against Smith and Rigdon for illegal banking. The trial was delayed until autumn. Eventually, Rounds dropped most of his cases, keeping only those against Smith and Rigdon. Even though Smith was only the cashier for KSSABC, he faced legal challenges while other officers were not. The KSSABC continued to issue notes until June but eventually failed because it ran out of money. Most of its funds were tied up in land, not in silver as some people thought.

Smith transferred his property to Oliver Granger and J. Carter in June and left the KSSABC in July. Warren Parrish and Frederick G. Williams took over managing the KSSABC. The institution finally closed in November, owing about $100,000. Smith asked Granger to help sort out his financial matters in Kirtland. Smith faced many legal claims for debts from the KSSABC failure. According to LDS Church scholars, some of these claims were settled, some were dropped, and some resulted in judgments against Smith and others. The church also provided $38,000 in bail money for Smith.

On July 28, Smith, Rigdon, and Thomas B. Marsh traveled to Upper Canada for church business and returned in late August. On September 27, Smith and Rigdon left Kirtland for Missouri. They returned to Kirtland on December 10. While they were away in October, they were fined $1,000 for operating a bank without a proper license. However, other larger quasi-banks had been operating in Ohio for longer than KSSABC and were not being prosecuted.

Among the KSSABC's problems, Smith also accused Parrish of misusing $25,000 from the KSSABC. In June, Smith tried to get a search warrant to check these claims against Parrish, but it was denied.

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |