Credit card facts for kids

A credit card is a special payment card that lets you buy things now and pay for them later. It's like getting a small loan from a bank or company. When you use a credit card, the bank pays the store for you. Then, you promise to pay the bank back later.

The bank gives you a certain amount of money you can borrow, called a "line of credit." You can use this money to pay for items or even get cash. This means you don't need to carry cash with you to make purchases.

If you don't pay back the money you borrowed within a certain time (usually about a month), you might have to pay extra money. This extra charge is called interest.

Contents

Why People Use Credit Cards

Benefits of Using Credit Cards

One big reason people use credit cards is for convenience. You can quickly get small, short-term loans to buy things you need. If you pay back the full amount you borrowed on time, you usually don't have to pay any interest. This time period is called the "grace period."

Many credit cards also offer cool benefits. Some cards give you extra protection for things you buy, like longer warranties or help if something gets damaged. Other cards might offer travel insurance, like for rental cars or if your trip is delayed.

Credit cards can also have a loyalty program. This means you earn rewards every time you buy something. These rewards might be "cashback," where you get a small percentage of your money back. Or, you might earn "points" that you can use for gift cards, products, or even travel like airline tickets.

Challenges of Using Credit Cards

While credit cards are handy, they can also have some downsides. All credit cards charge fees and interest if you don't pay on time. If someone isn't careful, they can end up owing a lot of money to the credit card company. This is called getting into "debt."

Sometimes, if a payment is missed, the interest rate can become very high. This can make it even harder to pay back the money. It's like a snowball effect where the amount owed keeps growing.

Studies have also shown that people tend to spend more money when they use a credit card instead of cash. It can feel less like "real" money when you're just swiping a card. Some research even suggests that using credit cards might make people buy more unhealthy food!

Images for kids

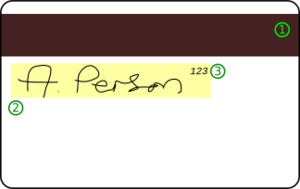

-

Visa, MasterCard, American Express are card companies that set rules for stores and banks.

-

Acceptance mark at an automated teller machine (ATM)

See also

In Spanish: Tarjeta de crédito para niños

In Spanish: Tarjeta de crédito para niños