Mount Keith Mine facts for kids

Satellite image of the mine in 2010

|

|

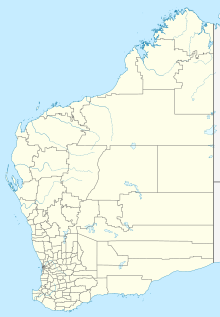

| Location | |

|---|---|

| Location | Wiluna |

| State | Western Australia |

| Country | Australia |

| Coordinates | 27°12′48″S 120°33′06″E / 27.21333°S 120.55167°E |

| Production | |

| Products | Nickel |

| Production | 80,000 tonnes |

| Financial year | 2022–23 |

| History | |

| Opened | 1995 |

| Closed | 2024 |

| Owner | |

| Company | BHP |

| Website | BHP website |

| Year of acquisition | June 2005 |

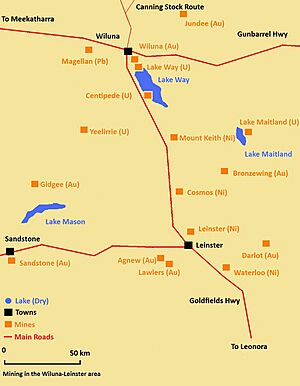

The Mount Keith Mine is a large open pit nickel mine located in Western Australia. It is run by a company called BHP. The closest town to the mine is Wiluna, which is about 85 kilometres (53 miles) to the north.

The mine first opened in 1995. It was originally built by a company called WMC Resources. In 2005, BHP bought WMC Resources and took over the mine. Mount Keith is now part of BHP's Nickel West operations.

Contents

What is the Mount Keith Mine?

The Mount Keith Mine is found at the northern end of a long area called the Norseman-Wiluna Greenstone belt. This belt is about 800 kilometres (500 miles) long. The nickel found here is in special rock formations that look like walls or sheets of rock.

The important nickel deposits are found in very old rocks, about 2.7 billion years old. In 1992, experts thought the mine held about 270 million tonnes of nickel ore. This ore contained about 0.6% nickel, which was enough for about twenty years of mining.

History of the Mine

The nickel deposits at Mount Keith were first found in 1969 by a company exploring the area. However, the mine was not built right away. This was because nickel prices were low in the 1970s. Also, building all the necessary facilities for the mine would have been very expensive.

In the 1980s, new ways of working in Western Australian mines became popular. Instead of building whole towns for workers, companies started using "fly-in fly-out" systems. This meant workers would fly to the mine for their shifts and then fly home. This new system helped reduce the cost of building the Mount Keith project. So, in 1988, the company that owned the land started looking at the project again.

In 1992, a company called WMC Resources decided to buy the Mount Keith project. They started building the mine soon after. Construction work was busiest in 1994, with about 1,000 people working on site. The mine began operating in 1995, and the first nickel ore was shipped out that year.

In 2005, BHP bought WMC Resources. All of WMC's nickel mines, including Mount Keith, became part of BHP's Nickel West group. At that time, Mount Keith employed 950 people.

In 2009, BHP reduced the mine's activity and about 300 employees were laid off.

Future of the Mine

In 2024, the price of nickel dropped a lot because there was too much nickel available. Because of this, BHP announced in July 2024 that it would temporarily close all its Nickel West operations, including Mount Keith. The closure is planned for October 2024.

BHP will keep spending money on the mines to make sure they can be restarted later. The company plans to review this decision in February 2027. This closure is expected to affect about 1,600 workers. BHP has said it will try to find new jobs for these employees or offer them other options.

How Nickel is Produced

Mount Keith is part of BHP's Nickel West operations. This group also includes other mines and processing plants. These are the Leinster Nickel Mine, the Kambalda Nickel Concentrator, the Kalgoorlie Nickel Smelter, and the Kwinana Nickel Refinery.

At the Mount Keith mine, the nickel ore is first crushed and processed. After this, the concentrated nickel material is transported by road to Leinster. There, it is dried and then shipped further for more processing.

BHP usually shares production numbers for all its Nickel West operations together, not for each mine separately. In 2020–21, the Nickel West group produced 89,000 tonnes of nickel. This was an 11% increase from the year before. In 2021–22, the production of nickel from Nickel West went down to 77,000 tonnes.

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |