Stock market index facts for kids

Imagine a report card for a group of companies. That's a stock index! It's a special number that shows how a part of the stock market is doing. Think of the stock market as a big place where people buy and sell tiny pieces of companies, called stocks.

A stock index helps investors – people who buy stocks – see if prices are going up or down. It's like checking the temperature of the market. If the index goes up, it means the companies in that group are generally doing well.

These indexes are designed to be easy to understand and use. People can even invest in an index by buying something called an index fund. This fund holds all the same stocks as the index, helping investors follow its performance.

Contents

What Do Stock Indexes Cover?

Stock indexes are like different teams in a sports league. Each index covers a specific group of companies. This group is chosen based on what the index wants to show.

For example, some indexes might only include technology companies. Others might focus on companies from a certain country or a specific industry. The idea is to measure how that particular group of companies is performing.

The companies chosen for an index are called its "coverage." This is different from how much each company's stock affects the index's total number.

How Are Stock Indexes Calculated?

The way a stock index is calculated is called its "weighting method." This means how much influence each company's stock price has on the index's overall number.

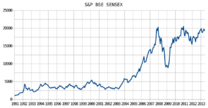

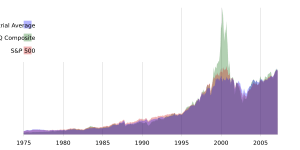

- Market-Cap Weighting: In this common method, bigger companies have a bigger impact on the index. If a company has a very high market capitalization (meaning its total stock value is very high), its stock price changes will affect the index more. The S&P 500 is an example of this.

- Equal Weighting: Some indexes give every company the same importance, no matter how big or small. This means a small company's stock price change affects the index just as much as a large company's.

These methods help make sure the index truly reflects what it's trying to measure.

Investing with Stock Indexes

Stock indexes are very useful for a way of investing called passive investing. This means you don't try to pick individual winning stocks. Instead, you invest in an index fund.

An index fund is a special type of fund that holds all the stocks in a specific index. So, if you buy an S&P 500 index fund, you're basically investing in all 500 companies that make up the S&P 500 index.

Many experts have found that over time, it's often hard for professional investors to pick stocks that do better than a whole index. That's why index funds are a popular choice for many people who want to invest.

Investing with Your Values: Ethical Indexes

Some stock indexes focus on ethical investing. This means they only include companies that meet certain standards for being good citizens.

These standards can include:

- Being good for the environment (like using clean energy).

- Treating workers fairly.

- Having diverse leaders.

- Avoiding certain industries like tobacco or gambling.

For example, there are indexes like the Dow Jones Sustainability Index that look for companies committed to being sustainable. The idea is to help people invest in companies that match their personal values.

Some people wonder if these "ethical" companies perform better or worse financially. It's a complex question, but many believe that companies that act responsibly might also be better run in the long term. They might have happier employees and customers, which could help them succeed.

See also

- Index of accounting articles

- Index of economics articles

- Index of management articles

- List of stock exchanges

- List of stock market indices

- Outline of accounting

- Outline of marketing

| Frances Mary Albrier |

| Whitney Young |

| Muhammad Ali |