Value-added tax facts for kids

A Value-Added Tax (VAT) is a type of tax that is added to products and services at each step of their journey from creation to sale. Think of it as a small extra charge added to the price as a product gets more valuable. It's also known as a Goods and Services Tax (GST) in some places.

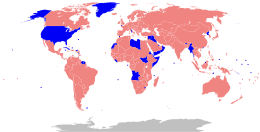

VAT is different from a regular sales tax. With VAT, the tax is collected bit by bit at each stage of making and selling something. But the final customer is the one who actually pays the full tax. This tax helps governments collect money. About one-fifth of all tax money collected worldwide comes from VAT. As of 2023, 175 out of 193 countries use VAT. The United States is one of the few countries that doesn't use it, preferring sales taxes instead.

There are two main ways to figure out VAT. The most common way is the credit-invoice method. Here, businesses charge VAT on what they sell and show it on an invoice. They can then get back the VAT they paid on the materials they bought. Japan uses a different way called the subtraction method. In this method, a business figures out the total value of its sales, subtracts what it spent on purchases, and then applies the VAT rate to the difference.

Contents

History of VAT

Germany and France were the first countries to use a general consumption tax like VAT during World War I. The modern VAT system we know today started in 1954 in the Ivory Coast. It was so successful that France brought it to their own country in 1958. Maurice Lauré, a French tax expert, is known for making VAT a reality. He introduced it on April 10, 1954.

At first, VAT only applied to big businesses. But over time, it grew to include all kinds of businesses. In France, VAT is a huge source of money for the government, bringing in almost half of all their income.

How VAT Works

The government sets the VAT amount as a percentage of a product's price. VAT is designed to tax only the value added by a business. This means a business only pays tax on the extra value it adds to a product or service, not on the full price every time it's sold.

Let's imagine a coffee shop. When they buy coffee beans, they pay VAT on the beans. When they turn those beans into a cup of coffee and sell it, they charge VAT on the coffee. But they can get back the VAT they paid on the beans. So, they only pay the government the VAT on the "value added" by making the coffee. The final customer pays the total VAT for everything, from the beans to the finished drink.

The VAT a company pays to the government is the difference between the VAT it charges on its sales and the VAT it paid on its purchases. It's like paying tax only on the profit margin of each step.

How VAT is Collected

There are two main ways VAT is collected:

- Invoice Method: This is the most common way. Each seller adds VAT to their price and gives the buyer a special invoice showing the tax. If the buyer is another business, they can use this invoice to get back the VAT they paid. The difference between the VAT collected and the VAT paid is what the business sends to the government.

- Accounts Method: Japan is the only country that uses this. Businesses calculate the VAT based on the difference between their total sales and total purchases over a period. No special invoices are needed for tax purposes between businesses.

VAT can also be collected based on when money changes hands:

- Cash Basis: This is simpler. You record income when you receive money and expenses when you pay bills. It focuses on how much cash you have.

- Accrual Basis: This is more detailed. You record income when you earn it (even if you haven't been paid yet) and expenses when you get them (even if you haven't paid yet). This gives a clearer picture of a business's financial health.

Why Businesses Like VAT

VAT encourages businesses to register with the tax authorities and keep good records. This is because registered businesses can get a refund for the VAT they pay on things they buy for their business. This makes it beneficial for them to be part of the VAT system.

Most countries with VAT require businesses to register if they reach a certain level of sales. Registered businesses add VAT to their sales and then pay that VAT to the government. But they can subtract the VAT they paid on their own purchases.

VAT vs. Sales Tax

VAT is often compared to a sales tax, but they work differently.

- A sales tax is usually collected only by the final store that sells to the customer.

- VAT is collected at every stage of making and selling a product.

- A sales tax can cause a "cascade effect." This means if a product is taxed at each step of production, the final price can become very high because the tax is added on top of previous taxes. VAT avoids this by only taxing the value added at each step.

- Because of this, VAT is becoming more popular around the world than traditional sales taxes.

Sales tax can also make businesses want to do everything themselves (like making all parts of a product). This is because they would avoid paying sales tax multiple times. VAT encourages businesses to specialize and trade with each other, as they only pay tax on the value they add.

Examples of VAT in Action

Let's look at how taxes work using a simple example of a "widget." A widget is just a made-up item. We'll use a 10% tax rate.

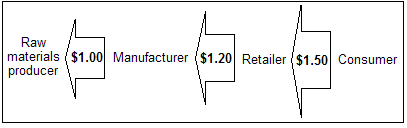

No Tax Example

- A manufacturer buys materials for $1.00 to make a widget.

- They sell the widget to a retailer for $1.20. The manufacturer made $0.20 extra (their gross margin).

- The retailer sells the widget to a customer for $1.50. The retailer made $0.30 extra (their gross margin).

- The customer pays $1.50. No tax is involved.

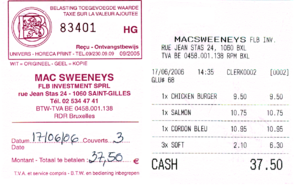

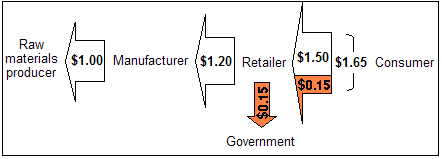

Sales Tax Example

Now, let's add a 10% sales tax.

- The manufacturer buys materials for $1.00. They don't pay sales tax because they are not the final customer.

- The manufacturer sells to the retailer for $1.20. No sales tax is added here. The manufacturer still makes $0.20.

- The retailer sells to the customer for $1.50 plus 10% sales tax. So, the customer pays ($1.50 × 1.10) = $1.65.

- The retailer collects $0.15 in tax and sends it to the government. The retailer still makes $0.30.

The customer pays $0.15 extra, and the government gets $0.15. The retailer has to handle the paperwork for the tax.

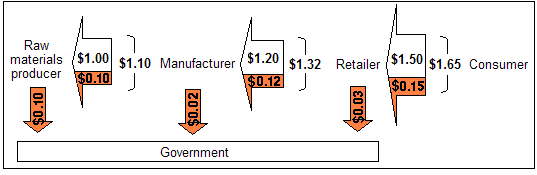

Value-Added Tax Example

Now, with a 10% VAT.

- The manufacturer buys materials for $1.00 plus 10% VAT, so they pay $1.10. The seller of the raw materials sends $0.10 to the government.

- The manufacturer sells to the retailer for $1.20 plus 10% VAT, so the retailer pays $1.32.

- The manufacturer sends ($0.12 collected from retailer minus $0.10 paid for materials) = $0.02 to the government. The manufacturer still makes $0.20.

- The retailer sells to the customer for $1.50 plus 10% VAT, so the customer pays $1.65.

- The retailer sends ($0.15 collected from customer minus $0.12 paid to manufacturer) = $0.03 to the government. The retailer still makes $0.30.

In this example, the customer still pays $1.65, and the government still gets a total of $0.15 ($0.10 + $0.02 + $0.03). Each business pays tax only on the value they added. For example, the manufacturer added $0.20 in value ($1.20 - $1.00), and their tax was $0.02 (10% of $0.20).

VAT and Global Trade

VAT is a tax on consumption. This means it's usually applied where the product is used, not where it's made. This is important for goods that are bought from other countries (imports) or sold to other countries (exports).

To make trade fair, most countries with VAT have special rules:

- Imports: When goods come into a country with VAT, they are charged VAT on their full price when they are first sold.

- Exports: When goods are sent out of a country, they are usually exempt from VAT. This means the VAT paid on materials used to make them can be refunded.

This system is approved by the World Trade Organization (WTO). It helps make sure goods are taxed fairly, no matter where they come from or go to.

VAT Around the World

Many countries around the world use VAT or a similar tax. Here are a few examples:

- Armenia: The VAT rate is 20%. Some things have zero VAT.

- Australia: They have a Goods and Services Tax (GST) of 10%. Some items like fresh food and education are GST-free.

- Canada: They have a Goods and Services Tax (GST) of 5%. Some provinces also have a Harmonized Sales Tax (HST) that combines the federal GST with a provincial sales tax.

- China: VAT was introduced in 1984. The standard rate is 13%.

- European Union: All EU countries must have VAT. The standard rate must be at least 15%, but countries can set higher rates. Hungary has the highest at 27%.

- India: VAT was introduced in 2005. They now have a national Goods and Services Tax (GST).

- Japan: They have a Consumption Tax, which is 10% for most goods, but 8% for groceries.

- New Zealand: Their Goods and Services Tax (GST) is 15%. It's known for having very few items exempt from the tax.

- United Kingdom: The standard VAT rate is 20%. Some goods and services have a reduced rate of 5% or 0%.

Why Some People Criticize VAT

Even though VAT is widely used, it has some criticisms:

- Fairness: Some people argue that VAT is a "regressive tax." This means it might affect poorer people more because they spend a larger part of their income on basic goods, which are taxed. However, others argue it's a "proportional tax" because everyone pays the same percentage.

- Cost to Businesses: Businesses, especially smaller ones, have to spend time and money on paperwork to collect and report VAT. This is called "compliance cost."

- Fraud Risk: VAT systems can be open to certain types of fraud, especially when goods are exported and then brought back into the country without proper tax payment. This is known as "carousel fraud."

- Price Increase: When VAT is added, the final price for customers goes up. This can make things more expensive.

Despite these criticisms, many governments prefer VAT because it can be more efficient at collecting tax money compared to other types of taxes, especially in countries where collecting income tax is difficult.

Images for kids

See also

In Spanish: Impuesto al valor agregado para niños

In Spanish: Impuesto al valor agregado para niños

- Excise

- Flat tax

- Income tax

- Indirect tax

- Sales taxes in the United States

- Tax

- Tax rates around the world