Barings Bank facts for kids

|

|

| Industry | Banking |

|---|---|

| Fate | Collapsed (Purchased for £1 by ING). |

| Successor |

|

| Founded | 1762 |

| Founder | Sir Francis Baring, Bt |

| Defunct | 26 February 1995 |

| Headquarters | London, England |

Barings Bank was a very old and famous British bank based in London. It was one of England's oldest banks, started in 1762 by Francis Baring. His family, the Baring family, were well-known merchants and bankers.

The bank sadly closed down in 1995. This happened because of huge losses, about £827 million. These losses were caused by one of its employees, Nick Leeson, who made risky and unauthorized investments from the bank's office in Singapore.

Contents

History of Barings Bank

Starting Small: 1762–1889

Barings Bank began in 1762 as a company called John and Francis Baring Company. It was founded by Sir Francis Baring, 1st Baronet, with his older brother John Baring. Their father, Johann Baring, was a wool trader from Germany.

The company started in small offices in London. Soon, it grew and moved to bigger places. Barings began to deal in many different goods, not just wool. They offered financial help for the fast-growing international trade.

The bank became very successful because it built a strong network of partners. One important partner was Hope & Co., a powerful bank in Amsterdam. Amsterdam was a major financial center in Europe at that time.

In 1774, Barings started doing business in North America. By 1790, the bank had grown a lot. In 1796, Barings helped to pay for a huge piece of land. This land later became part of the US state of Maine.

In 1802, Barings and Hope & Co. helped with the biggest land purchase ever. This was the Louisiana Purchase, which doubled the size of the United States. It's seen as one of the most important deals in history. This happened even though Britain was at war with France. The sale helped France's leader, Napoleon, pay for his war efforts.

After 1803, Francis Baring started to step back from running the bank. His sons, Alexander and Henry, became partners in 1804. The bank was then called Baring Brothers & Co. It stayed that way until 1890. In 1806, the company moved to 8 Bishopsgate, where it remained for the rest of its life.

Barings also helped the United States government during the War of 1812. By 1818, some even called Barings "the sixth great European power." However, in the 1820s, the bank faced some challenges. It lost its top spot in London to another bank, N M Rothschild & Sons.

Still, Barings remained a strong bank. In the 1830s, new leaders helped turn things around. They decided to focus more on the Americas, believing there were more opportunities there. In 1832, a Barings office opened in Liverpool to help with North American business. By 1843, Barings became the main agent for the US government.

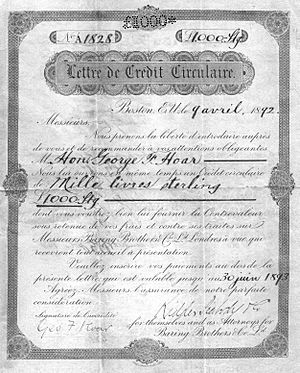

In the 1850s and 1860s, the bank earned most of its money from helping businesses with credit. Later, in the 1870s, Barings got more involved in international investments. This included investments in the United States, Canada, and Argentina. Barings carefully invested in the North American railroad boom after the American Civil War. A new town in Canada was even named Revelstoke, British Columbia, after the bank's leading partner. Barings also helped fund major railways like the Atchison, Topeka and Santa Fe Railway.

A fun fact: "Ned" Baring, one of the bank's leaders, had a daughter named Margaret. She was a great-grandmother of Diana, Princess of Wales. In 1886, the bank helped the famous Guinness brewery become a public company.

Trouble in 1890

In the late 1880s, Barings took on too many risky investments. They lent too much money to Argentina and Uruguay. In 1890, Argentina faced a financial crisis. This showed that Barings didn't have enough money to cover its investments.

To prevent a huge financial disaster, other banks stepped in to help. The governor of the Bank of England, William Lidderdale, organized a group of banks to save Barings. This event caused a lot of panic in financial markets, known as the Panic of 1890.

A Smaller Role: 1891–1929

The rescue saved the financial world from a collapse. But Barings never became as powerful as it once was. A new company, Baring Brothers & Co., Ltd., was formed. The old bank's valuable parts were moved to this new company. The money from the old bank and its partners was used to pay back the banks that helped with the rescue. It took almost 10 years to pay off these debts.

Barings didn't start making big investments again until 1900. They focused on investments in the United States and Argentina. The bank was careful during this time. This caution helped them later. They avoided big losses that other British banks faced when Germany struggled after World War I.

Later Years: 1929–1992

During the Second World War, the British government used Barings. The bank helped sell off assets in the United States and other places. This money helped pay for the war. After the war, other banks grew bigger than Barings. But Barings still played an important role in the financial world until 1995.

The bank decided to get involved in the UK stock market. They bought a stockbroker company in 1984 and another stock trading company in 1985.

The Collapse of 1995

Barings Bank collapsed in 1995 because of huge trading losses. These losses were caused by Nick Leeson, who was the head of the bank's trading in Singapore.

Leeson was supposed to be doing "arbitrage." This means he should have been making small profits by buying and selling Nikkei 225 futures contracts at slightly different prices on two different exchanges. One was in Japan and the other in Singapore. But instead of just doing this for clients, Leeson started using the bank's own money. He was gambling on whether the Japanese markets would go up or down.

How It Happened

Leeson was in charge of both trading and checking the accounts for Barings in Singapore. This was unusual. Normally, different people would do these jobs. Because he had so much control, Leeson could hide his losses. He didn't have anyone checking his work closely from London. Many people later said that the bank's own rules for checking and managing risks were not good enough. Some people even raised concerns about Leeson's activities, but they were not listened to.

Leeson was able to make risky trades. He hid his losses by changing the bank's computer records. He used a special account, known as the "five-eights account," to make it look like he was making profits. He claimed the losses started when a colleague made a small mistake.

By December 1994, Leeson had caused Barings to lose £200 million. But he reported to the tax authorities that the bank had made a £102 million profit. If the bank had found out the truth then, it might have been saved. Barings still had £350 million of its own money.

The Kobe Earthquake

Leeson continued to make big, risky bets using the hidden "five-eights account." He used money that belonged to other parts of the bank. He also changed trading records. He seemed to be making a lot of money. But his luck ran out when the Kobe earthquake hit Japan. This earthquake caused the Asian financial markets to drop, and Leeson's investments lost a lot of value. Leeson had bet that the market would recover quickly, but it didn't.

The Discovery

On February 23, 1995, Leeson left Singapore. Barings Bank auditors soon found out about the fraud. The bank's chairman received a note from Leeson admitting what he had done. Leeson's actions had caused total losses of £827 million. This was twice the bank's available money for trading. The collapse cost another £100 million.

The Bank of England tried to save Barings over a weekend, but they couldn't. Barings was declared unable to pay its debts on February 26, 1995. Leeson was caught after being on the run for 272 days. He was sent to prison in Singapore for his actions.

What Happened Next

The Dutch bank ING bought Barings Bank in 1995 for just £1. ING took over all of Barings' debts and created a new company called ING Barings. In 2001, ING sold some of the US operations. The rest of ING Barings became part of ING's European banking division.

Today, the "Barings" name still exists as a company called Baring Asset Management. In 2016, this company merged with other investment companies. It created a new "Barings" company. Other parts of the original Barings Bank were bought by their own management teams. These now include companies like Baring Vostok Capital Partners in Russia and Baring Private Equity Asia.

See also

- List of trading losses

- Rogue Trader – a 1999 film about Nick Leeson and the Barings Bank collapse.

Images for kids

| Stephanie Wilson |

| Charles Bolden |

| Ronald McNair |

| Frederick D. Gregory |