ING Group facts for kids

|

|

ING's headquarters in Amsterdam, Netherlands

|

|

| Public | |

| Traded as | Euronext Amsterdam: INGA NYSE: ING AEX component |

| ISIN | [https://isin.toolforge.org/?language=en&isin=NL0011821202 NL0011821202] |

| Industry | Financial services |

| Founded | 1991 through merger (est. 1743 as Kooger Doodenbos) |

| Headquarters | Amsterdam, Netherlands |

|

Area served

|

Europe, Asia, Oceania, North America, South America |

|

Key people

|

|

| Products |

|

| Revenue | €18.561 billion (2022) |

|

Operating income

|

€5.5 billion (2022) |

| €3.78 billion (2022) | |

| Total assets | €967.8 billion (2022) |

| Total equity | €50.4 billion (2022) |

|

Number of employees

|

60,778 (2022) |

| Subsidiaries | AFP Capital Bank Mendes Gans Makelaarsland and The Baring Archive |

ING Group N.V. (Dutch: ING Groep) is a large Dutch company. It offers many financial services around the world. Its main office is in Amsterdam, Netherlands.

ING helps people and businesses with banking, managing money, and insurance. It is one of the biggest banks globally. In 2022, it had total assets of about US$967.8 billion.

ING is part of a group of important European banks. It is also supervised by the European Central Bank. In 2020, ING served over 53 million customers in more than 40 countries.

The name ING stands for Internationale Nederlanden Groep. This means "International Netherlands Group". The orange lion in ING's logo shows its Dutch roots. Orange is a national color of the Netherlands.

Contents

How ING Started

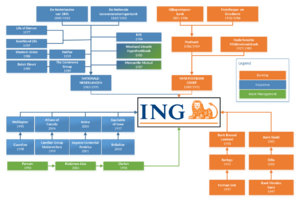

ING Group began when two big Dutch companies joined together. One was an insurance company called Nationale-Nederlanden. The other was a banking group called "NMB Postbank Groep". They merged in 1991 to form ING.

Early Insurance Companies

In 1845, a fire insurance company started in the Netherlands. It was called Assurantie Maatschappij tegen Brandschade de Nederlanden van 1845. This company grew to be a leader in Dutch insurance. It had offices in many countries.

Later, in 1863, a life insurance company began in Rotterdam. It was named Nationale Levensverzekerings Bank. These two companies bought other smaller companies. In 1963, they merged to create Nationale-Nederlanden. This new company grew a lot in the 1970s and 1980s.

Early Banking Services

In 1881, the Dutch government created the Rijkspostspaarbank. This was a savings bank run through post offices. It encouraged people to save money. Later, they added services for making payments through post offices.

In 1927, the government helped create the Nederlandsche Middenstands Bank (NMB). NMB offered banking services to people and businesses. In 1986, the post office banking services became a private company called Postbank N.V.. Three years later, Postbank merged with NMB bank. They formed NMB Postbank Groep.

In January 2025, ING agreed to sell its business in Russia. This will reduce its operations there.

Joining Banking and Insurance

In 1991, the banking part of NMB Postbank Groep and the insurance part of Nationale-Nederlanden merged. This created the ING Group.

Growing Through Acquisitions

Since it started, ING Group has bought many other companies. This helped it grow bigger and offer more services. Some important acquisitions include:

- Barings Bank in 1995, which boosted its investment banking.

- Banque Bruxelles Lambert (BBL) in Belgium in 1998.

- US insurance companies like Equitable of Iowa and ReliaStar.

- The Polish Bank Śląski in 2001.

- The German bank DiBa in 2002.

Expanding Globally

ING expanded its business around the world in the 1990s. It bought banks and insurance companies in different countries. For example, it bought a Belgian bank and US insurance companies.

After buying Barings Bank in 1995, ING's investment banking business grew stronger. ING also started direct banking services in many countries. This meant customers could bank online or by phone without going to a physical branch. The first direct bank opened in Canada in 1997. Others followed in the US, UK, Germany, and Australia.

Changes After the 2008 Financial Crisis

In 2008, during a global financial crisis, the Dutch government helped ING. As a condition for this help, ING had to sell some of its businesses. This included insurance businesses in different parts of the world. It also sold its ING Direct units in the US, Canada, and the UK. For example, ING Direct US was sold to Capital One.

By April 2016, ING had sold off its last shares in NN Group. This made ING a bank again, focusing only on banking services.

In 2018, ING reached a settlement of €775 million with prosecutors. This was related to preventing money laundering. The bank worked to improve its systems to stop such activities.

Where ING Operates

As of 2022, ING operates in many countries. It has "core markets" where it has a strong presence. It also has "challenger markets" and "growth markets" where it is expanding.

- Core markets:

* Netherlands * Belgium * Luxembourg

- Challenger markets:

* Australia * Germany * Italy * Spain

- Growth markets:

ING also has "Wholesale Banking" operations in many other countries. These services are for large companies and institutions.

ING's Main Offices

ING's main office is in Amsterdam, Netherlands. It is located in a modern building in the Cumulus Park area. This area is known for innovation. The building has a glass front and is designed to be sustainable.

The ING House was a former head office for ING. It was known for its unique design.

Recent Important Events

Government Support and Repayment

In October 2008, the Dutch government gave ING €10 billion to help it during the financial crisis. This support helped ING stay strong. As a condition, ING had to sell its insurance and investment businesses by the end of 2013.

ING repaid the government in several steps. The final payment of €1.025 billion was made in November 2014. This was ahead of schedule.

Settlement with US Treasury Department

In June 2012, ING Bank reached a settlement with the US Department of the Treasury. This was for moving money illegally for certain entities. ING Bank paid US$619 million. The bank also agreed to review its systems to prevent such issues in the future.

Other Activities

- In 2005, ING bought a share in the Bank of Beijing in China.

- In 2013, ING sold its share in an Indian insurance company.

- In 2016, ING invested in a Chinese financial technology company called WeLab.

- In 2018, ING bought a fintech company called Payvision.

- ING has also invested in projects using blockchain technology.

ING US Changes

In 2013, ING's US insurance and investment business became a separate company. It was renamed Voya Financial. By 2014, ING Group no longer owned most of Voya Financial.

What ING Does

Retail Banking

ING offers banking services to everyday people in many countries. These include Australia, Belgium, Germany, Italy, Netherlands, and Spain. In the Netherlands, ING is the largest retail bank. It holds 40% of current account deposits.

ING in Belgium

ING Belgium is ING Group's Belgian branch. It used to be called Bank Brussel Lambert (BBL). It offers banking services to people and businesses in Belgium. It also provides insurance and money management products.

ING owns a 17% share in the Bank of Beijing. This is a large bank in China. ING also has a share in TMB Bank in Thailand. In Poland, ING is the main owner of ING Bank Śląski.

Direct Banking

ING offers "branchless banking" services. This means customers can do their banking online, by phone, or through ATMs. This service focuses on simple savings accounts. These services were originally called ING Direct. They were renamed to ING between 2017 and 2019.

ING in Australia

ING in Australia started in 1999. It offers banking services online and by phone. Its products include savings accounts, credit cards, and home loans. It is regulated by Australian government bodies.

ING in Germany

ING-DiBa is Germany's third-largest bank by customer numbers. ING bought parts of this bank starting in 1998. By 2007, it was known as ING-DiBa. In 2018, its name changed to ING.

ING in Italy

ING in Italy started in 2001. It has about 1.3 million customers. It is also opening "bank shops" where customers can get help with online services.

ING in the Philippines

In the Philippines, ING operates mainly through a mobile app. It started in 2019. It was one of the first banks to allow check deposits using a mobile phone camera.

Wholesale Banking

ING Wholesale Banking provides services to large companies and institutions. Its main focus is in the Netherlands, Belgium, Poland, and Romania. It offers services from managing cash to corporate finance.

When ING took over Barings Bank in 1995, it strengthened its wholesale banking. This helped ING become more recognized globally. ING's investment banking division was called ING Barings until 2004.

Wholesale Banking includes different areas like Structured Finance and Corporate Finance. The name changed from ING Commercial Banking to ING Wholesale Banking in 2016. This new name better shows its focus on large international clients.

Corporate Finance

ING's Corporate Finance team advises businesses on big deals. These include mergers, buying other companies, and selling shares.

Insurance

ING's insurance business operates in America, Asia, and Europe.

In 2009, ING planned to separate its insurance business from its banking operations. This was done through selling shares to the public.

In February 2009, ING Canada (the insurance part) became a separate company. It was renamed Intact Financial Corporation. ING Group continued to run ING Bank of Canada.

In October 2012, ING sold its Malaysian insurance business.

ING Australia Insurance

ING Insurance Australia was bought by ANZ in 2009. It was then renamed "OnePath". However, ING Australia (the banking part) is still a part of ING Group.

Former Divisions

NN Investment Partners

In 2014, ING announced it would separate its investment management business. This business became part of NN Group. It was later renamed NN Investment Partners. In 2021, Goldman Sachs bought NN Investment Partners. The sale was completed in April 2022.

ING Direct Canada

ING started ING Direct Canada in 1997. It was the first ING Direct operation in the world. By 2011, it had over 1.7 million customers. It offered savings accounts, mortgages, and other banking products.

In August 2012, Scotiabank bought ING Direct Canada. The sale was completed in November 2012. In 2013, Scotiabank renamed ING Direct Canada to Tangerine.

ING Direct France

ING in France started in 2000. It had about 1 million customers at its peak. It offered current accounts and home loans. The bank changed its name to ING in 2019.

In 2022, ING closed its direct banking business in France. It sold its retail customers to Boursorama, another direct bank. ING kept its wholesale and investment banking business in France.

ING Direct United Kingdom

ING Direct started in the UK in May 2003. It had over one million customers by 2009. Its offices were in Reading and Cardiff.

In October 2008, ING took over the savings accounts of a collapsed Icelandic bank. This helped protect 160,000 UK customers.

ING Direct UK offered savings accounts, mortgages, and home insurance. In August 2012, ING decided to leave the UK market. In October 2012, Barclays bought ING Direct UK. This included its deposits and mortgages.

ING Direct United States

In 2000, ING launched a direct bank in the United States. Its main office was in Wilmington, Delaware. In 2007, ING Direct acquired customers and assets from NetBank. It also bought Sharebuilder, a financial company.

In February 2012, Capital One bought ING Direct USA from ING. Between November 2012 and February 2013, ING Direct's US operations were renamed Capital One 360.

Sponsorships

ING supports many sports events and art exhibitions around the world.

Sports Sponsorships

ING has sponsored many marathons. These include the New York City Marathon and the Luxembourg Marathon.

ING also supports football (soccer). It sponsors the Royal Dutch Football Association and the Royal Belgian Football Association. It also sponsors the Asian Football Confederation (AFC).

ING was the main sponsor of the Renault Formula One racing team from 2007 to 2009. It also sponsored several Grand Prix races. ING stopped its sponsorship due to changes in advertising spending and some controversy around the team.

It also sponsored the ING Cup cricket competition in Australia from 2001 to 2006.

Arts Sponsorships

ING supports art institutions like the Rijksmuseum Amsterdam in the Netherlands. It also supports the New York Museum of Modern Art. ING owns art collections in several countries.

ING has sponsored the Amsterdam Gay Pride since 2008.

Images for kids

Education Support

ING works with the Duisenberg school of finance. It offers internships and helps students with loans. ING also organizes events for students to learn about the financial industry.

The ING Unsung Heroes program gives grants to teachers in the United States. This program helps teachers from kindergarten to 12th grade.

Money Laundering Settlement

In September 2018, ING agreed to pay €775 million to settle an investigation. This investigation was about preventing money laundering. ING has since worked to improve its systems to stop such activities.

See also

In Spanish: Grupo ING para niños

In Spanish: Grupo ING para niños