Mortgage loan facts for kids

A mortgage loan (say "MOR-gij") is a special type of loan people use to buy a home or other property. Imagine you want to buy a house, but you don't have all the money right now. A bank or another financial group can lend you the money. This loan is "secured" by the property itself. This means if you can't pay back the loan, the lender can take ownership of the property and sell it to get their money back. This process is called foreclosure. The word mortgage comes from an old French term meaning "death pledge," because the pledge ends when the loan is paid off or the property is taken.

People who borrow for a mortgage can be individuals buying their home, or businesses buying buildings for their work. The lender is usually a bank or a credit union. Mortgage loans can be very different in how much money is lent, how long you have to pay it back, and the interest rate (the extra money you pay for borrowing). Lenders have a special right to the property you buy, which means if you have other debts and can't pay them, the mortgage lender gets paid first from the property's sale.

In many countries, it's very common for people to buy homes using a mortgage loan. Most people don't have enough savings to buy a house with cash. This is why strong markets for mortgages have grown around the world.

Contents

Understanding Mortgage Loan Basics

What is a Mortgage Loan?

A mortgage happens when a property owner promises their property as security for a loan. This means the property acts as collateral. If the borrower doesn't pay back the loan, the lender can take the property. So, a mortgage is like a promise connected to the property. Because most mortgages are for new loans, the word "mortgage" is often used to mean a loan that's secured by real estate.

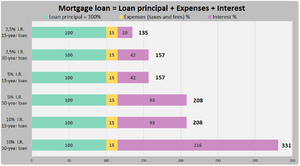

Like other loans, mortgages have an interest rate and are paid back over a set time, often 30 years. All kinds of property can be used for a mortgage. The interest rate usually shows how risky the loan is for the lender.

Key Parts of a Mortgage Loan

Mortgage lending is the main way people in many countries buy homes and business properties. While the words and exact forms might change from country to country, the main parts are usually similar:

- Property: This is the house or building you are buying.

- Mortgage: This is the lender's legal right to the property. It might include rules about how you can use or sell the property. For example, you might need to buy home insurance.

- Borrower: This is the person who is borrowing the money and buying the property.

- Lender: This is the bank or financial group that lends the money. Sometimes, the original lender sells the loan to other investors.

- Principal: This is the original amount of money you borrowed. As you pay it back, the principal amount gets smaller.

- Interest: This is the extra money you pay to the lender for using their money.

- Foreclosure: This is when the lender takes and sells the property if the borrower doesn't make payments. This is a key part of a mortgage loan.

- Completion: This is when the legal documents for the mortgage are finished, and the mortgage officially starts.

- Redemption: This is when you finally pay off the entire loan. This can happen at the end of the planned payment time or if you pay it off early.

Governments often have rules about mortgage lending. They might set legal requirements or control the banks and financial markets.

Mortgage loans are usually long-term loans. You make regular payments, often monthly, over many years (like 10 to 30 years). Each payment slowly pays down the original loan amount. In the beginning, more of your payment goes to interest, and later, more goes to paying off the principal.

Lenders give out money to earn interest. They often get this money by taking deposits from other people or by selling bonds. So, the cost for lenders to get money affects how much you pay to borrow. Lenders can also sell your mortgage loan to others who want to receive your payments.

Lenders also think about how risky a mortgage loan is. They consider if you are likely to pay back the money and if they can sell the property easily if you don't.

Getting Your Mortgage Approved

When you apply for a mortgage loan, a special person called an "underwriter" checks your financial information. They look at your income, job history, credit score (how well you've managed money in the past), and the value of the home you want to buy. They might order an appraisal to check the home's value.

This approval process can take a few days or even weeks. It's a good idea to keep the same job and not open new credit accounts while your loan is being approved. Any big changes to your credit or job could cause the loan to be denied.

Different Kinds of Mortgage Loans

There are many types of mortgages, but they are mostly defined by a few things:

- Interest: The interest rate can stay the same for the whole loan (fixed) or change over time (variable).

- Term: This is the maximum number of years you have to pay back the loan.

- Payment amount: This is how much you pay each period and how often (usually monthly). Sometimes, you can choose to pay more or less.

- Prepayment: Some mortgages might have rules or fees if you want to pay off the loan early.

The two main types of loans are the fixed rate mortgage (FRM) and the adjustable-rate mortgage (ARM).

- With a fixed-rate mortgage, the interest rate stays the same for the entire loan. This means your monthly payment (for principal and interest) will also stay the same.

- With an adjustable-rate mortgage, the interest rate is fixed for a short time (like 1 to 5 years), and then it changes regularly (like once a year) based on market rates. These loans can have a lower starting interest rate, but your payments might go up or down over time.

The cost of your loan also depends on your credit risk. Lenders check your credit scores, how much debt you have compared to your income, your down payment, and your assets.

Loan to Value and Down Payments

When you get a mortgage to buy a property, lenders usually ask you to make a down payment. This is a part of the property's cost that you pay yourself, upfront. The loan to value ratio (or LTV) is the size of the loan compared to the property's value. For example, if you make a 20% down payment, your LTV is 80% (because the loan covers 80% of the value).

A higher LTV means a higher risk for the lender. If the property's value drops, it might not be enough to cover the loan if the lender has to sell it.

Property Value: How It's Decided

The value of the property is very important for the loan's risk. Value can be figured out in a few ways:

- Actual price: This is usually the price you pay for the property.

- Appraised value: A licensed professional usually estimates the property's value. Lenders often need this official appraisal.

- Estimated value: Lenders might use their own estimates, especially if there's no official appraisal process.

Payment and Debt Rules

Lenders also look at how much of your income goes towards payments. They check your "payment to income" ratio (mortgage payments as a percentage of your income) and "debt to income" ratio (all your debt payments as a percentage of your income). Your credit score is also very important. You'll need to show documents like tax returns or pay stubs to prove your income.

Some lenders might also want you to have "reserve assets." This means you should have enough money saved to cover your housing costs (mortgage, taxes, etc.) for a few months, just in case you lose your job or income.

Standard Mortgages

Many countries have a concept of "standard" or "conforming" mortgages. These are loans that meet certain acceptable risk levels. For example, a standard mortgage might have an LTV of no more than 70-80% and mortgage payments that are no more than one-third of your income.

A standard mortgage is important because it often means the loan can be easily sold to other investors. If a loan is not standard, it might be harder to sell or cost more.

Foreign Currency Mortgages

In some countries where the local money tends to lose value, people might get mortgages in a stable foreign currency. This helps the lender, but the borrower takes the risk that their local money might become weaker, making it harder to pay back the loan.

Paying Back Your Mortgage

There are different ways to pay back a mortgage loan, depending on where you live and what works best for you.

Principal and Interest Payments

The most common way to pay back a mortgage is by making regular payments that cover both the principal (the original amount borrowed) and the interest. This is called an amortizing loan or a repayment mortgage. Each payment is calculated so that the loan will be fully paid off by a specific date.

Mortgage terms can be short (like 10 years) or long (like 30 years). In the UK and US, 25 to 30 years is common. Your monthly payments include both principal and interest. In the early years, most of your payment goes towards interest. As time goes on, more of your payment goes towards paying down the principal. This way, you know your loan will be cleared by the end date if the interest rate stays the same. Some people choose to make payments every two weeks instead of monthly, which can help pay off the loan faster.

Interest-Only Mortgages

Another type of mortgage is an interest-only mortgage. With this, you only pay the interest each month, not the principal. This type of mortgage is common in the UK. Borrowers usually have a separate investment plan that is supposed to grow enough money to pay off the main loan amount at the end of the term. This is riskier because it depends on the investment doing well.

Recently, rules have become stricter for interest-only mortgages because many people didn't have enough money saved to pay off the principal at the end.

Interest-Only Lifetime Mortgages

For older borrowers, there are "interest-only lifetime mortgages." Unlike regular interest-only mortgages that have a fixed end date, these continue for the rest of the borrower's life. You pay the interest each month, and the main loan amount stays the same. These are often used by retirees who want to keep their monthly payments low.

Reverse Mortgages

For older homeowners (usually retired), a reverse mortgage is a special type of loan where you don't make any payments at all. Instead, the interest is added to the principal, and the debt grows over time. The loan is typically not paid back until the homeowners pass away or move out of the house permanently. The US government has a program called HECM (Home Equity Conversion Mortgage) that insures reverse mortgages. With a HECM, you can receive money in different ways, like a lump sum, monthly payments, or a credit line.

Other Mortgage Variations

There are many other types of mortgages designed for different situations:

- Graduated payment mortgages have payments that start low and increase over time, good for young borrowers who expect their income to grow.

- Balloon payment mortgages have lower monthly payments, but a large lump sum payment (the "balloon") is due at the end of the loan term.

- Biweekly mortgages have payments every two weeks instead of monthly, which can help pay off the loan faster.

- Budget loans include taxes and insurance in your monthly mortgage payment.

- Equity loans allow homeowners to borrow money using the equity (the part of the house they own outright) in their home as collateral.

- Flexible mortgages give borrowers more freedom to skip payments or pay extra.

- Offset mortgages allow you to use your savings to reduce the amount of interest you pay on your mortgage.

Commercial mortgages are for businesses buying property and often have different rules than personal home loans.

Foreclosure: What Happens If You Can't Pay

If a borrower doesn't make their mortgage payments, the lender can foreclose on the property. This means they can take legal action to sell the property. The money from the sale is used to pay off the loan. In some places, if the sale doesn't cover the whole loan, the borrower might still owe the remaining debt. In other places, the borrower is not responsible for any leftover debt after foreclosure.

There are specific legal steps for foreclosure, and these can vary greatly by country. In some places, it can happen quickly, while in others, it might take many months or even years.

Mortgages Around the World

United States Mortgages

The mortgage industry in the United States is a very large part of its financial system. The US government has created programs like Ginnie Mae, Fannie Mae, and Freddie Mac to help people get mortgages and encourage home ownership.

The US mortgage sector has faced financial challenges in the past, including the subprime mortgage crisis of 2007. In the US, a mortgage loan usually involves two separate documents: a promise to pay (the "note") and the security interest (the "mortgage" document itself).

Canadian Mortgages

In Canada, the Canada Mortgage and Housing Corporation (CMHC) is the national housing agency. It helps by providing mortgage loan insurance and housing programs. The most common mortgage in Canada is a five-year fixed-rate closed mortgage.

Canada's mortgage market has generally been stable, even during financial crises. However, recent low interest rates have led to more mortgage debt. To help control real estate prices, Canada introduced a "mortgage stress test" in 2016. This test checks if a home buyer can afford their mortgage even if interest rates go up. This has made it harder for some people to get approved for large mortgages.

United Kingdom Mortgages

In the UK, building societies used to be the main mortgage lenders, but now banks and other financial groups also offer many mortgages. There are over 200 organizations that provide mortgage loans in Britain.

In the UK, variable-rate mortgages are more common than fixed-rate ones. However, many people choose to fix their interest rate for shorter periods, like the first two, three, or five years of their mortgage. Unlike some parts of the US, in the UK, borrowers are usually responsible for any remaining debt after foreclosure.

Islamic Mortgages

In Islamic countries, Sharia law does not allow paying or receiving interest. This means Muslims cannot use traditional mortgages. Islamic mortgages solve this by having the property change hands twice. In one way, the bank buys the house and then acts as a landlord. The homebuyer pays rent and also contributes money to buy the property over time. Once all payments are made, the property fully belongs to the homebuyer.

Another way is for the bank to sell the property to the buyer using an installment plan at a higher price than the original. Both methods allow the lender to earn money, but they are structured to avoid interest and share some of the financial risks with the homebuyer.

Mortgage Insurance

Mortgage insurance is a special insurance policy that protects the lender (the bank) if the borrower (you) can't pay back the loan. It's often used for loans where the amount borrowed is more than 80% of the property's value.

The borrower usually pays for this insurance. It can be part of your interest rate, a one-time payment upfront, or a separate part of your monthly payment. If the property's value goes up or you pay down enough of your loan, you might be able to stop paying for mortgage insurance.

If the lender has to take back the property through foreclosure, they might have to sell it for less than its full value to get their money back quickly. Mortgage insurance helps cover this potential loss for the lender.

Images for kids

See also

In Spanish: Crédito hipotecario para niños

In Spanish: Crédito hipotecario para niños