Behavioral economics facts for kids

Behavioral economics is a fascinating part of economics that mixes ideas from psychology with traditional economic thinking. Usually, economics assumes people always make perfect, logical choices. It simplifies how humans think to make economic models easier to understand.

But in real life, people don't always act perfectly. They might struggle with self-control or make different choices depending on how options are shown to them. Behavioral economists study how real humans make decisions, considering all these everyday challenges and limits.

Contents

How It Started

The study of behavioral economics really grew in the mid-to-late 1900s. Two psychologists, Amos Tversky and Daniel Kahneman, wrote an important paper called "Prospect Theory." This paper showed that how choices are presented can be just as important as the choices themselves when someone decides.

Later, researchers Hersh Shefrin and Richard Thaler looked at how people save money. They found that people often prefer to spend more now, even if it means saving less for the future. This is because humans often want good things right away!

By 1994, Harvard University even started teaching behavioral economics as its own subject. Today, this field helps explain many complex things people do. It's used to make public policies better and to improve marketing and advertising. There's even a related field called behavioral finance, which looks at how people make investment choices.

Cool Topics in Behavioral Economics

Behavioral economics helps us understand many different human actions. Here are some key ideas:

Loss Aversion and Prospect Theory: People usually feel worse about losing something than they feel good about gaining the same amount. This idea is super important for understanding how people take risks. For example, investors might hold onto stocks that are losing money for too long, hoping they'll bounce back. They don't want to admit the loss! This is also related to the "status quo bias," where people tend to prefer things to stay just as they are, even if a change might be better.

Mental Accounting: Imagine you have different "jars" in your mind for different types of money. People tend to put money into separate mental accounts for spending or saving. Each "jar" might have its own rules about how willing you are to spend that money.

Anchoring and Status Quo Bias: If you're given an option automatically, you'll likely stick with it. This is called the "status quo bias." For example, if you're automatically signed up for something, you're less likely to opt out. "Anchoring" means that the first piece of information you get can strongly influence your later decisions, even if it's not the most important information.

Unbounded Willpower: This idea suggests that people often lack self-control. Even when they know what's best for them, they might do something else. For instance, you might know eating healthy is good, but still choose a sugary snack. People are often aware that their willpower isn't endless.

How It's Used

Behavioral economics is becoming very popular, and scientists are finding more ways to use its ideas. If presenting a choice in a certain way can "nudge" (or gently push) someone to make a better decision, then those in charge can use this.

These "nudges" can lead to many good outcomes. They can help people become more active, eat healthier, use less energy, or even improve government policies. The hope is that small changes can lead to big benefits for everyone.

For example, in Denmark, the government used the idea of "anchoring" to get more drivers to become organ donors. In the United States, the White House has even hired experts like Cass Sunstein and Richard Thaler to help guide policymakers using behavioral economics. Countries like the U.S. and Britain have also looked at using "default options" to help people save more for retirement.

Some Challenges

Not everyone agrees with everything in behavioral economics. One common argument is that much of its research comes from small studies, often using college students. Critics say that college students might not represent the average person very well, so the results might not always apply to everyone.

Some psychologists also feel that while behavioral economics is a good step, it still needs to go deeper. They think it mostly just changed older economic ideas, instead of truly exploring the deeper psychological reasons behind why people act the way they do.

Images for kids

-

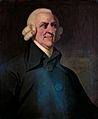

Adam Smith, who wrote famous books like The Wealth of Nations (1776).

-

Herbert A. Simon, who won important awards for his work in computer science and economics.

-

Daniel Kahneman, who won the Nobel Prize in economics in 2002.

-

David Laibson, an economics professor at Harvard University.

See also

In Spanish: Economía conductual para niños

In Spanish: Economía conductual para niños

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |