Richard Thaler facts for kids

Quick facts for kids

Richard Thaler

|

|

|---|---|

Thaler in 2015

|

|

| Born | September 12, 1945 East Orange, New Jersey, U.S.

|

| Education | Case Western Reserve University (BA) University of Rochester (MA, PhD) |

| Spouse(s) | France Leclerc |

| Children | 3 |

| Awards | Nobel Memorial Prize in Economic Sciences (2017) |

| Scientific career | |

| Fields | Behavioral economics, Behavioral finance, Nudge theory |

| Institutions | University of Rochester Cornell University University of Chicago |

| Thesis | The Value of Saving a Life: A Market Estimate (1974) |

| Doctoral advisor | Sherwin Rosen |

Richard H. Thaler, born on September 12, 1945, is an American economist. He is a professor at the University of Chicago Booth School of Business. In 2015, he was the president of the American Economic Association.

Thaler is a leading expert in a field called behavioral economics. This field studies how people's feelings and thinking habits affect their economic decisions. He worked with famous psychologists like Daniel Kahneman and Amos Tversky to help create this field. In 2018, he became a member of the National Academy of Sciences.

In 2017, he won the Nobel Memorial Prize in Economic Sciences. He received this award for his important work in behavioral economics. The Nobel committee said his ideas helped connect economics with how people actually make choices. His research helped create the fast-growing field of behavioral economics.

Contents

About Richard Thaler

Richard Thaler was born in East Orange, New Jersey. His mother was a teacher and real estate agent. His father worked in insurance. He grew up with two younger brothers. He has three children from his first marriage. He is now married to France Leclerc, who used to be a marketing professor.

His Education

Thaler went to Newark Academy for high school. He earned his first degree, a Bachelor of Arts (B.A.), in 1967 from Case Western Reserve University. He then went to the University of Rochester for his advanced degrees. He received his Master of Arts (M.A.) in 1970 and his Doctor of Philosophy (Ph.D.) in 1974. His Ph.D. paper was about "The Value of Saving A Life: A Market Estimate."

His Career in Academia

After finishing his studies, Thaler started teaching at the University of Rochester.

From 1977 to 1978, Thaler spent a year at Stanford University. There, he worked with Daniel Kahneman and Amos Tversky. They helped him understand why people sometimes make economic choices that don't seem logical. One idea they explored was the endowment effect. This is when people value something more just because they own it.

From 1978 to 1995, he taught at Cornell University. Cornell even started a center for behavioral economics with Thaler as its first director.

Thaler became well-known for writing a regular column called Anomalies in a respected economics journal. These columns were later published as a book. In 1995, he joined the University of Chicago's Booth School of Business, where he has taught ever since.

His Books and Ideas

Thaler has written several books that explain behavioral economics to everyone, not just economists. These include Quasi-rational Economics and The Winner's Curse. He often points out that traditional economics assumes people are perfectly logical, like computers. But he believes people are often not super-rational and can have trouble controlling themselves.

The Nudge Book

Thaler co-wrote a famous book called Nudge: Improving Decisions About Health, Wealth, and Happiness with Cass Sunstein. This book, published in 2008, talks about how organizations can help people make better choices. Thaler and Sunstein explain that people often make mistakes and regret them later. This is because humans have many common biases that can lead to blunders in areas like money, health, and happiness. They came up with the term "choice architecture." This means how choices are presented to us.

Thaler and Sunstein support an idea called "libertarian paternalism." This means guiding people toward good decisions without taking away their freedom to choose. It uses "nudges" to help people. For example, if joining a retirement savings plan is the default option, many more people join. This is a nudge because it makes the good choice easier.

In 2021, Thaler and Sunstein updated Nudge. They added new ideas, including a concept they call "sludge."

What is Sludge?

While nudges make good choices easier, "sludge" is the opposite. It refers to things that make it harder for people to do something that would benefit them. For example, it can be very difficult to cancel a subscription compared to signing up for one. Other examples include mail-in rebates or confusing pricing. These practices are also known as "dark patterns."

Misbehaving: The Making of Behavioral Economics

In 2015, Thaler wrote Misbehaving: The Making of Behavioral Economics. This book tells the story of how behavioral economics developed. It's partly his own story and partly a critique of older economic ideas.

Other Writings and Research

Thaler wrote a column called Anomalies for the Journal of Economic Perspectives. In these columns, he showed examples of economic behaviors that didn't fit traditional economic theories.

He also studied how people make choices on TV game shows like Deal or No Deal and Golden Balls. He found that people's willingness to take risks can change during the game.

As a writer for The New York Times, Thaler has suggested economic solutions for financial problems. For example, he wrote about how selling parts of the radio spectrum could help the U.S. government.

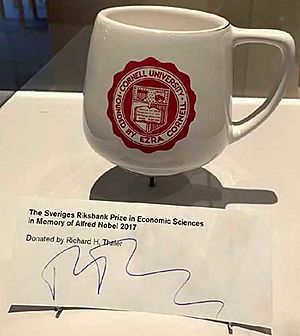

Nobel Memorial Prize in Economics

In 2017, Richard Thaler won the Nobel Memorial Prize in Economic Sciences. He won for adding realistic ideas about human psychology into economic studies. He showed how human traits like limited rationality, social preferences, and lack of self-control affect decisions and markets.

Thaler said that much of the work he won the prize for was done during his years at Cornell University.

After the prize was announced, Professor Peter Gärdenfors, a member of the Nobel committee, said that Thaler had "made economics more human."

When he received his prize, the committee chair, Per Strömberg, said that Thaler's work on self-control helped connect two main ideas from Adam Smith, a famous economist. Smith's first idea was about human feelings and imperfect logic. His second was about rational forces in markets. Thaler's work helped bring these two ideas together.

After winning, Thaler said his most important contribution was showing that people in economic models are "human." He also joked that he planned to spend his prize money "as irrationally as possible."

Paul Krugman, another Nobel winner, praised Thaler's work, calling behavioral economics "the best thing to happen to the field in generations." However, not everyone agreed. Some economists still question adding psychology to economics.

Other Awards and Honors

Besides the Nobel Prize, Thaler has received many other honors. He is a member of the National Academy of Science and the American Academy of Arts and Sciences. He is also a Fellow of the American Finance Association.

Real-World Applications

Thaler also helped start an investment company called Fuller & Thaler Asset Management. This company believes that investors can make money by understanding common thinking mistakes, like the endowment effect (valuing what you own more) and loss aversion (feeling the pain of a loss more than the joy of a gain).

From 1991 to 2015, Thaler was a co-director of the Behavioral Economics Project at the National Bureau of Economic Research.

He also helped create the Behavioural Insights Team, which started in the British Government. This team uses behavioral economics to help improve public policies.

Thaler even appeared as himself in the 2015 movie The Big Short. In the movie, he helped explain the 'hot hand fallacy' to Selena Gomez. This fallacy is when people wrongly believe that something happening now will keep happening in the future.

See also

In Spanish: Richard Thaler para niños

In Spanish: Richard Thaler para niños

- List of Jewish Nobel laureates

| Ernest Everett Just |

| Mary Jackson |

| Emmett Chappelle |

| Marie Maynard Daly |