Black Wednesday facts for kids

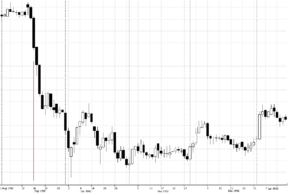

Black Wednesday was a big financial event that happened on September 16, 1992. On this day, the UK government had to take the British currency, the pound, out of a European money system called the European Exchange Rate Mechanism (ERM). They tried hard to keep the pound's value high enough, but they couldn't.

This event made many people lose trust in the UK government's ability to manage the economy. The ruling Conservative Party lost the next election in 1997 and didn't win again until 2010. After Black Wednesday, the UK economy actually got better. This was partly because the pound became cheaper, which helped British goods sell more easily. Also, the UK changed its money rules to focus on controlling inflation, which is when prices go up.

Contents

Why Did Black Wednesday Happen?

Joining the ERM

The ERM was set up in 1979, but the UK didn't join at first. Later, in October 1990, the UK decided to join. This meant the government promised to keep the pound's value stable against other European currencies, especially the German currency (the Deutsche Mark). If the pound's value dropped too low, the government had to step in and buy pounds to make its value go up.

At the time, the UK had higher inflation (prices rising faster) and higher interest rates (the cost of borrowing money) than Germany. This made it harder for the UK to keep its currency stable within the ERM.

Problems with the ERM

In the early 1990s, Germany raised its interest rates to deal with its own economic issues after German reunification. This put a lot of pressure on other countries in the ERM, including the UK. The UK also faced problems because its exports were becoming more expensive for other countries to buy.

Many people believed that keeping exchange rates fixed within the ERM was a step towards a single European currency. However, some countries were struggling to keep their currencies stable.

George Soros's Big Bet

A famous investor named George Soros believed that the British pound was valued too high in the ERM. He thought the UK's inflation was too high and that its interest rates were hurting the economy. So, he made a huge bet against the pound. He "short sold" a lot of pounds, meaning he borrowed pounds and sold them, hoping to buy them back later at a lower price and make a profit.

The Day Itself: September 16, 1992

Government Tries to Help

As currency traders started selling off pounds very quickly, the UK government tried to stop the pound's value from falling. John Major, who was the Prime Minister, allowed the government to spend billions of pounds from its foreign money reserves. They used this money to buy pounds, hoping to make the pound's value go back up. But it wasn't enough.

The Deutsche Bundesbank, which is Germany's central bank, made some comments that also increased the pressure on the pound. This led to even more people selling their pounds.

Interest Rates Go Up (and Down!)

On the morning of September 16, 1992, currency traders were selling pounds much faster than the Bank of England (the UK's central bank) could buy them.

At 10:30 AM, the British government announced a big change: they would raise the base interest rate from 10% to 12%. This was meant to make people want to buy pounds, as they would earn more interest. But even with this, and a promise to raise rates again to 15% later that day, traders kept selling. They didn't believe the government could keep its promise.

By 7:00 PM that evening, the government announced that Britain would leave the ERM. The interest rate went back to 12% that day, but then returned to 10% the very next day.

What Happened Next?

Impact on the Economy

Many people in the UK felt that Black Wednesday was a disaster for the country. However, some people, especially from the Conservative Party, later called it a "Golden Wednesday" or "White Wednesday." They argued that leaving the ERM actually helped the UK economy.

After leaving the ERM, the UK changed its money policy to focus on controlling inflation. This new approach led to economic growth, with more jobs and lower inflation.

Impact on Politics

Black Wednesday greatly damaged the Conservative Party's reputation for managing the economy. They had just won an election in 1992, but after Black Wednesday, their support in public polls dropped sharply.

This event was a major reason why the Conservatives lost the 1997 general election by a huge amount to the Labour Party. The Conservatives did not win another election until 2010, 13 years later.

George Soros, the investor who bet against the pound, made over £1 billion in profit from Black Wednesday.

How Much Did It Cost?

In 1997, the UK government estimated that Black Wednesday cost the country about £3.14 billion. This number was updated to £3.3 billion in 2005. Most of this cost came from the government's attempts to keep the pound's value high before it eventually fell.