- This page was last modified on 17 October 2025, at 10:18. Suggest an edit.

Child & Co. facts for kids

Logo depicting the Marygold motif

|

|

The branch at 1 Fleet Street in 2019

|

|

| Division | |

| Industry | Financial services |

| Founded | 1664 |

| Founders |

|

| Defunct | 2022 |

| Headquarters | 1 Fleet Street, London, EC4, UK (former HQ) |

|

Number of locations

|

0 (2023) |

| Services | Private banking Wealth management |

| Parent | Royal Bank of Scotland |

Child & Co. was a very old and famous private bank in the United Kingdom. It later became part of the RBS and then the NatWest Group. For a long time, the bank was located at 1 Fleet Street in London, close to the Temple Bar Memorial and the Royal Courts of Justice.

In June 2022, the last Child & Co. branch building closed. However, the Royal Bank of Scotland said that the Child & Co. name would continue. No customer accounts were closed. Today, banking services for Child & Co. customers are handled online or at other RBS and NatWest branches.

Contents

The History of Child & Co.

Child & Co. was one of the oldest banks in the world. It was the oldest bank in the United Kingdom. It started about 30 years before the Bank of England even existed!

How the Bank Started

Child & Co. began as a goldsmith business in London in the late 1600s. The shop was known by its sign, which showed a "Marygold." In 1664, Sir Francis Child started his business with a partner named Robert Blanchard.

Francis Child later married Blanchard's stepdaughter. When Blanchard passed away, Child took over the entire business. The company was renamed Child & Co. It became very successful. It was even chosen to be the "jeweller in ordinary" for King William III.

In 1710, Child took over many of the assets from another goldsmith banker, Coggs & Dann. This happened after Coggs & Dann faced a huge fraud case.

From Goldsmith to Bank

After Sir Francis Child died in 1713, his three sons managed the business. During this time, the company changed from just a goldsmith shop to a full bank. Child & Co. is believed to be the first bank to use pre-printed cheque forms. Before this, people just wrote a letter to their bank. The bank issued its first bank note in 1729.

Ownership Changes (1782-1924)

By 1782, Sir Francis Child's grandson, Robert Child, was in charge. He passed away in 1782 without any sons. He did not want his daughter, Sarah Anne Child, to inherit the business. This was because she had run away to marry John Fane, 10th Earl of Westmorland.

To keep his money away from the Earls of Westmorland, Robert Child left it in a special trust. It was meant for his daughter's second son or eldest daughter. This person turned out to be Lady Sarah Sophia Fane, born in 1785.

From 1782 to 1793, Robert Child's widow, Sarah Child, managed the bank. Their granddaughter, Lady Sarah Sophia Fane, married George Child-Villiers, 5th Earl of Jersey, in 1804. When she turned 21 in 1806, she became the main owner. She managed the bank herself until she died in 1867. The Child-Villiers family continued to own the bank until the 1920s.

Sale and Later Years

In 1924, George Child-Villiers, 8th Earl of Jersey, sold Child & Co. to another bank called Glyn, Mills, Currie, Holt & Co. They kept Child & Co. as a separate business. Later, in 1931, The Royal Bank of Scotland bought Glyn, Mills & Co. In 1969, Child & Co. became part of Williams & Glyn's Bank.

By 1985, Williams & Glyn's Bank was fully joined with The Royal Bank of Scotland. Child & Co. no longer operated as a completely separate bank.

A branch of Child & Co. opened in Oxford in 1932. During World War II, the main banking offices moved to Osterley in West London. In 1942, the Oxford branch was transferred to Martins Bank. In 1977, a small office was opened again in Oxford.

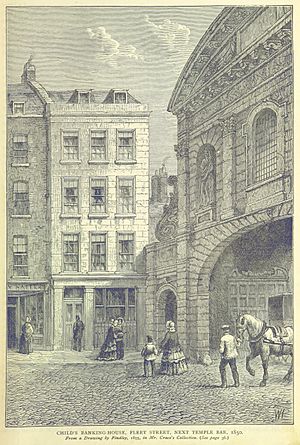

The Famous Fleet Street Location

After the Temple Bar gate was moved and Fleet Street was made wider in 1880, Child & Co. moved into a special building at 1 Fleet Street. This building was designed by John Gibson. It is a very important historical building. The bank had been operating from the same Fleet Street site since 1673. The building was updated in 2015.

In February 2022, Child & Co. told its customers that the Fleet Street branch would close. It officially closed on June 29, 2022.

Who Were Child & Co.'s Clients?

Over its 350-year history, Child & Co. had many important clients. These included the Honourable Societies of Middle Temple and Lincoln's Inn, which are groups of lawyers. Many wealthy families also banked there.

Several colleges at the University of Oxford and other universities, like the London School of Economics and Imperial College London, also had accounts. Child & Co. had a special team that helped many of the biggest law firms. They also worked with three of the four largest accounting firms in the UK.

It is thought that Child & Co. was the inspiration for "Tellson's Bank" in the famous book A Tale of Two Cities (1859) by Charles Dickens.

See also

- Coutts

- Drummonds Bank

- Holt's Military Banking

- The Devil Tavern