Christmas club facts for kids

A Christmas club was a special way people used to save money for Christmas shopping. It was like a special savings account offered by banks and credit unions, mostly in the United States. These clubs started in the early 1900s, even during tough times like the Great Depression. People would put a set amount of money into this account each week. Then, at the end of the year, they would get all their saved money back to buy presents and celebrate the holidays.

How Christmas Clubs Started

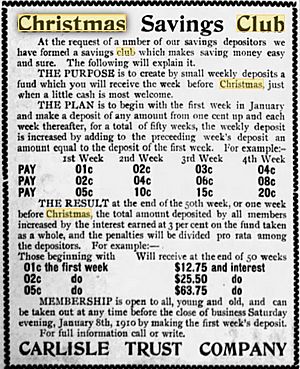

The very first Christmas Club began in 1909. A man named Merkel Landis, who worked at the Carlisle Trust Company in Carlisle (Pennsylvania), created this new savings plan. It was a big hit! About 350 customers joined, and each saved around $28. They received their money back on December 1st of that year, just in time for holiday shopping.

Later, in 1920, a newspaper in Belvidere, Illinois shared news about the town's State Farmers Bank. The bank encouraged parents to sign up their children for a Christmas Banking Club. The goal was to help kids learn to be responsible and get into the habit of saving money.

Why People Liked Them

For many years, financial institutions worked hard to attract people to their Christmas savings programs. They would offer fun gifts and special advertising items, like small tokens. For example, the Dime Saving Bank in Toledo, Ohio, gave out a brass token in 1922–1923 that was "good for 25 cents in opening a Christmas account."

Another bank in Atlantic City, New Jersey, the Atlantic Country Trust Co., gave out numbered tokens. These tokens had a message on the back: "Join our Christmas Club and Have Money When You Need It Most." People liked these clubs because it helped them save money specifically for Christmas. They knew if the money was in a regular account, they might spend it too soon.

Why They Became Less Popular

Christmas Club accounts had some downsides. One big problem was that they offered very low interest rates. This meant your money didn't grow much while it was saved. Also, there were often many rules and restrictions. For example, you usually couldn't take money out of the account early without paying extra fees.

Over time, these clubs became less popular with people. Banks also found them expensive to manage. For instance, in 1984, one credit union had 3,500 Christmas Club members. For each member, the bank had to create, sign, and mail a check. Then, about 70% of those checks were simply returned to the bank to be put into another account. This made the process costly and time-consuming for banks.

See also

- Dynamic inconsistency - This is a fancy idea in economics that helps explain why people might choose to use special savings plans, even if they cost a bit more.

| Precious Adams |

| Lauren Anderson |

| Janet Collins |