Dalgety plc facts for kids

|

|

| Public Listed Company | |

| Industry | Wool, farming services, and later a food conglomerate. Since 1998, it has focused on livestock genetics. |

| Fate | PIC retains its own name and a separate identity and continues to display the Dalgety "world" but since 2005 as the major part of an animal genetics company called Genus plc |

| Founded | c.1846 in Melbourne Australia |

| Founder | Frederick Gonnerman Dalgety |

| Headquarters |

100 George Street W1, previously 65 Leadenhall Street EC3, London

,

England

|

|

Areas served

|

In its first century: Australia, New Zealand then from the second half of the 20th century all continents. In 2017 "more than 600 breeding herds in about 40 different countries" |

|

Key people

|

Frederick Gonnerman Dalgety |

| Products | services to agriculture |

|

Number of employees

|

16,073 (1992) |

| Parent | Genus plc |

Dalgety plc was a famous company that started in Australia and New Zealand. For over 100 years, it was a leading business that helped farmers, especially those who raised sheep for wool. The company was known as a stock and station agency, which means it helped farmers sell their animals and buy supplies.

In the mid-20th century, the wool business began to shrink as people started using man-made fabrics. Dalgety adapted by investing in new areas, like the food industry, and expanded into countries in the Northern Hemisphere.

The company became a successful conglomerate, meaning it owned many different types of businesses. However, it faced a major crisis in the 1990s when a cattle illness, known as "mad cow disease," became a serious problem in Britain. This hurt Dalgety's businesses that were connected to beef and farming.

After selling off most of its companies, Dalgety focused on its most successful part: a business that used science to improve pig breeds. The company changed its name to PIC International. In 2005, it merged with Genus plc, another company specializing in cattle breeding, to become a world leader in animal genetics.

Contents

The Story of Dalgety

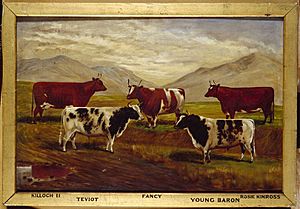

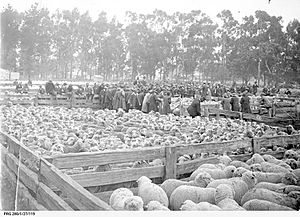

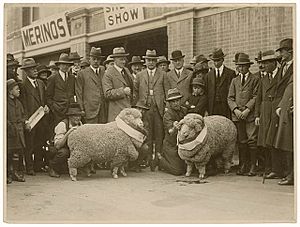

For much of its history, Dalgety's success was tied to the wool trade in Australia. The company helped woolgrowers, who raised huge flocks of sheep. When the company started, Australia had about 20 million sheep. By the 1890s, this number grew to over 100 million.

The United Kingdom was a major buyer of Australian wool. During World War II, the demand for wool was very high. However, after the war, wool prices began to fall. By the 1970s, the number of sheep in Australia reached a record 180 million, but the price for wool was low.

The wool industry faced tough competition from new, cheaper man-made fabrics. By 1998, wool made up only 3% of the fibers used for clothing, while synthetic fibers and cotton were much more popular.

A Young Man's Big Idea

The company was started by a Canadian man named Frederick Gonnerman Dalgety. He arrived in Melbourne, Australia, in 1842. He started a business that sold goods to settlers and bought their farm products, like wool.

The gold rush in the 1850s helped his business grow even more. He sold supplies to the gold miners and also bought gold from them. This made him a very wealthy man.

Growing the Business

In 1854, Frederick Dalgety moved to London to set up the main office for his company. From London, he managed his growing business in Australia and New Zealand. He hired partners to run the offices in cities like Melbourne, Geelong, and later, in New Zealand.

Even though he lived in England, he kept his company focused on helping farmers in Australia and New Zealand. By 1884, the company had partners and offices in many cities across both countries.

Becoming a Public Company

On April 29, 1884, the company changed into Dalgety and Company Limited. This meant it became a public company, and people could buy shares of it on the London Stock Exchange. This helped the company raise more money to grow.

After this change, Dalgety opened more branches in Queensland and Western Australia. The company continued to grow even after its founder, Frederick Dalgety, passed away in 1894. By the early 1900s, Dalgety had offices all over Australia and New Zealand. It even expanded to East Africa in the 1920s.

A Time of Big Changes

By the 1960s, the wool industry was not as profitable as it used to be. Dalgety was the world's largest wool-selling company, but it needed to make changes to stay successful.

The company sold its old, multi-story wool warehouses in valuable city locations. It replaced them with modern, single-story buildings on the outskirts of cities. These new buildings were more efficient for handling wool.

Joining with a Competitor

In 1961, Dalgety merged with one of its biggest competitors, the New Zealand Loan and Mercantile Agency Company. The new, larger company was called Dalgety and New Zealand Loan Limited. This merger made it the largest company of its kind in Australia and New Zealand.

Moving into the Food Business

In the 1970s, Dalgety began to invest in the food industry, especially in the Northern Hemisphere. In 1970, the company was split into two main parts: Dalgety Australia and Dalgety New Zealand.

The company started buying businesses in different areas:

- Catering Supply: It bought a company in London that supplied meat to restaurants.

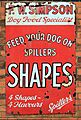

- Animal Feeds: It purchased an English company that made food for farm animals.

- North America: It bought a business in San Francisco that was involved in lumber (wood) and poultry (chickens).

A New Focus on Animal Science

One of the most important purchases Dalgety made was in 1970. It bought a British company called the Pig Improvement Company (PIC). PIC used science to breed healthier and better pigs for farmers. This small company would later become the heart of the entire business.

Buying Famous Food Brands

In 1972, Dalgety bought Associated British Maltsters, a company that made malt, an ingredient used in drinks and food.

A few years later, in 1978, Dalgety bought Spillers, a large British company famous for making flour, bread, and pet food. This was a huge purchase that made Dalgety a major player in the food industry. It also bought Martin-Brower, an American company that supplied food and packaging to fast-food restaurants like McDonald's.

By the end of the 1970s, more than half of Dalgety's business was in Britain and North America.

A Global Food Company

In the 1980s, Dalgety continued to grow as a food and agriculture group. It merged its Australian farming business to create Dalgety Farmers Limited, which became one of the largest in the country.

The company also bought the animal feed business from another large company, Ranks Hovis McDougall. By this time, Dalgety was known more as a food company than a wool company.

In 1986, Dalgety bought Golden Wonder, a popular brand of potato chips in the UK. It also launched Homepride Foods, which sold flour and cooking sauces.

More Changes and a Big Challenge

In the early 1990s, Dalgety continued to buy and sell businesses to focus on its most profitable areas. It bought Sooner Snacks to make its Golden Wonder brand even bigger.

Then, the company made a huge move. It bought the European pet food business from Quaker Oats for £442 million. This made Dalgety's Spillers brand the second-largest pet food company in Europe.

To pay for this, Dalgety sold some of its famous food brands, including Pot Noodle, Homepride sauces, and Golden Wonder.

A Crisis in the Cattle Industry

In the mid-1990s, a serious problem hit Britain's cattle industry. A disease called BSE, or "mad cow disease," was discovered. The government had to take drastic steps, which included a ban on British beef exports.

This crisis was a disaster for Dalgety. Sales of its animal feed dropped because there were fewer cattle. The ban on beef products was very costly. The problems distracted the company's leaders and caused its profits to fall sharply.

To recover, Dalgety decided to sell most of its businesses. It sold its food ingredients company and its fast-food supplier, Martin-Brower. In total, the company sold parts worth £1.2 billion.

PIC International

After selling off most of its parts, Dalgety was left with its most promising business: pig breeding. The company was renamed PIC International Group plc, after the Pig Improvement Company it had bought back in 1970.

PIC International focused on animal genetics, using science to help farmers raise healthier pigs. In 2002, it was renamed Sygen International.

In 2005, Sygen merged with Genus plc, a company that specialized in cattle breeding. Genus was a leader in providing high-quality bull semen to farmers. The merger created a global leader in animal genetics.

The new company, Genus plc, became very successful. It developed new technologies, such as creating semen that produces only female calves, which is very helpful for dairy farmers. The company that grew from the old Dalgety business is now worth hundreds of millions of pounds and is a world leader in its field.

Images for kids

| William Lucy |

| Charles Hayes |

| Cleveland Robinson |