Earthquake Commission facts for kids

| Kōmihana Rūwhenua | |

|

|

| Agency overview | |

|---|---|

| Formed | 1945 |

| Headquarters | Level 11, Majestic Centre, 100 Willis Street, Wellington 41°17′18.13″S 174°46′28.09″E / 41.2883694°S 174.7744694°E |

| Minister responsible |

|

| Agency executives |

|

The Earthquake Commission (EQC), known in Māori as Kōmihana Rūwhenua, is a special New Zealand government group. Its main jobs are to help people after natural disasters, like earthquakes, and to learn more about these events. EQC also provides insurance to homeowners for damage caused by natural disasters. It was first set up in 1945 and has been helping New Zealanders ever since.

Contents

What EQC Does

The EQC has three main roles:

- It offers natural disaster insurance for homes, belongings inside homes, and the land around them. This insurance is called EQCover.

- It manages a special fund called the Natural Disaster Fund. This fund holds money to pay for claims when disasters happen.

- It supports research and education about natural disasters. This helps New Zealanders understand how to be safer and reduce the damage from future events.

To pay for this, a small fee is added to all home insurance policies in New Zealand. This fee goes into the Natural Disaster Fund. A group of Commissioners, chosen by the government, oversees the EQC.

How Claims Are Settled

When a natural disaster happens and your property is damaged, you can make a claim with EQC. The money to pay for these claims comes from a few places:

- First, from the Natural Disaster Fund.

- Then, from other insurance companies that EQC works with.

- Finally, if needed, the New Zealand government helps pay.

EQCover helps protect your house, your personal items, and your land. When you make a claim, you usually pay a small part of the cost yourself, called an 'excess'. EQC also has a maximum amount it will pay for each type of damage, called 'the cap'. For example, in 2018, EQC would pay up to $100,000 for building damage and $20,000 for personal belongings. If the damage costs more than EQC's cap, your private home insurance usually covers the rest.

EQC's History

New Zealand has had many earthquakes. After some big ones between 1929 and 1942, the government decided to create a special insurance plan. This led to the Earthquake & War Damage Act in 1945. This law created a fund to help people after earthquakes and war damage.

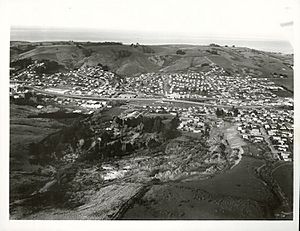

At first, a small fee was added to fire insurance policies to pay for this fund. Over time, the insurance was expanded to cover other natural disasters and damage to land. This became very important after a large 1979 Abbotsford landslip in Dunedin where many homes were destroyed.

In 1993, the laws were updated, and the EQC Act was created. This new law made the insurance, now called EQCover, specifically for homes. It also changed how damage was paid for, focusing on the cost to rebuild a new home, not just its old value. War damage cover was removed. These changes helped EQC focus on natural disaster recovery for homes.

For many years, EQC mostly handled smaller claims, and its disaster fund grew to over $6 billion by 2010. One of the biggest events before 2010 was the 1979 Abbotsford landslip, which led to land damage being covered. Another important event was the 2007 Gisborne earthquake, where EQC paid out over $16 million.

The Canterbury Earthquakes

On 4 September 2010, a very strong earthquake hit near Darfield in Canterbury. This was the start of many earthquakes and aftershocks that lasted for several years. The most damaging one was on 22 February 2011, near Christchurch, which sadly caused 185 deaths.

EQC received over 470,000 claims from these earthquakes. More than 15,000 families lost their homes, and the total cost of repairs was estimated to be over $40 billion. EQC said that the scale of this disaster was much bigger than anything they had dealt with before.

By 2016, many claims from the Christchurch earthquakes were still being processed. If the damage was "under cap" (meaning less than $100,000 plus tax), EQC would handle the claim. If it was "over cap," the claim was passed to the homeowner's private insurance company. This system caused some delays and problems. In 2015, insurance companies suggested that they should handle all assessments, and the government agreed to this after the 2016 Kaikoura earthquake.

EQC has a large fund, but if the cost of a disaster is very high, the New Zealand government steps in to cover the remaining costs.

EQC's Response to the Earthquakes

After the 2010 earthquake, EQC decided to focus on repairing damaged homes rather than just paying out money. This was to help manage building costs and reduce stress for homeowners. EQC worked with Fletcher Building, a large construction company, to manage the repairs through The Canterbury Home Repair Programme.

EQC faced a huge challenge. They had to assess thousands of damaged properties. Assessors would visit homes to figure out the damage and estimate repair costs. EQC acknowledged that the earthquakes caused damage similar to what you might see in wartime. Despite the difficulties, they worked hard to complete assessments and manage repairs.

EQC also had to deal with many legal issues during this time. The High Court even set up a special "Earthquake List" to handle all the related cases. There were also some challenges, like an employee accidentally sending out a file with details of many claims.

Changes and Improvements

Over time, there were many reports about how EQC was handling the claims. In 2017, a new government came into power. The new minister, Megan Woods, was concerned that many claims were still not settled after seven years. She appointed an independent advisor to help improve the process.

Following this, Maarten Wevers, the chairman of EQC, resigned, saying that the minister had lost confidence in the board. Annette King was then appointed as an interim chairperson. Many people, including newspapers, felt that EQC had faced a huge test and needed to improve its speed and efficiency in helping people recover from disasters. EQC continues to work on improving its services to ensure New Zealanders are well-supported after natural disasters.

Images for kids