History of inheritance taxes in the United Kingdom facts for kids

The history of inheritance taxes in the United Kingdom is about how the UK has taxed money and property passed down when someone dies. These taxes have changed a lot since they first started way back in 1694. They were created to help the government pay for things, especially wars.

Contents

Early Taxes Before 1894

The first tax was called Probate Duty. It began in 1694 to help pay for a war. This tax was on the official documents needed to handle a dead person's personal belongings. At first, it was a fixed amount. But in 1780, Lord North changed it to a graduated rate. This meant richer people paid a higher percentage.

Later, in 1795, rules were added to punish people who didn't file the right documents. In 1804, a similar tax called Inventory Duty was created for Scotland.

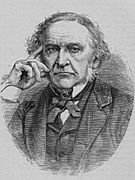

Another tax, Legacy Duty, started in 1780. This tax was on gifts of money or property left in a will. At first, it didn't collect much money. But William Pitt the Younger improved it. He made sure that the people handling the will had to report the property. The tax rate also changed depending on how closely related the person receiving the gift was to the person who died.

These early taxes mainly focused on personal property, like money or furniture. They didn't tax land or buildings. To fix this, William Gladstone introduced Succession Duty in 1853. This new tax aimed to collect money from inherited land and buildings too. However, it only taxed the value of the income from the land, not its full market price.

By 1881, the way these taxes were managed became more organized. People had to file a sworn statement about the estate's value. If they didn't, they faced penalties. A new tax called Account Duty was also added. This tax covered certain gifts and voluntary arrangements made before someone died.

In 1888, more succession duties were introduced. These added small percentages to the tax, depending on the relationship between the person who died and the person inheriting.

Finally, in 1885, Corporation Duty was introduced. This taxed the income of certain companies and organizations. A temporary Estate Duty was also created in 1889. These new taxes aimed to cover things the older taxes had missed.

Estate Duty: 1894 to 1949

The old system was very complicated and seemed unfair. For example, the way land was taxed meant that older heirs might pay less tax than younger heirs, even for the same property.

In 1894, a politician named William Harcourt pointed out how messy the tax system had become. He said it was like a patchwork quilt, with new rules added over time that just made things more confusing.

So, in 1894, a major change happened. A new Estate Duty replaced several older taxes, including probate duty and account duty. Legacy duty and succession duty still existed, but Estate Duty was the main one.

For land and buildings, succession duty no longer taxed just the income. Instead, it was based on the full value of the property.

The new Estate Duty was designed to be a progressive tax. This means that the more valuable an estate was, the higher the percentage of tax it paid. Over the years, the tax rates increased significantly, especially for very large estates. For example, by 1949, the highest tax rate for estates over £1,000,000 was 80%.

Estate Duty: 1949 to 1975

In 1949, Stafford Cripps, who was in charge of the country's money, talked about how unfair the old legacy and succession duties were. He explained that these taxes often hit smaller estates harder than very large ones. He also noted that many wealthy people arranged their wills so these specific taxes became just an extra charge on the main estate tax.

Because of this, the Legacy Duty and Succession Duty were officially removed in 1949. Corporation Duty was also abolished in 1959.

The rules around gifts made before death also changed. Initially, gifts made within three years of death were taxed. This period was extended to five years in 1946 and then to seven years in 1969.

Estate Duty continued to become more progressive. By 1969, the highest tax rate reached 85% for amounts over £750,000. However, the total tax paid could not be more than 80% of the entire estate's value.

Capital Transfer Tax: 1975 to 1986

People criticized Estate Duty because it didn't tax gifts made more than seven years before someone died. This meant wealthy people could give away their assets long before death to avoid the tax.

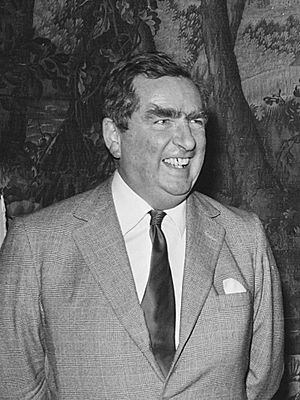

In 1974, Denis Healey, the government's finance minister, said that it was unfair that rich people could avoid taxes using loopholes. He wanted a tax that would cover all transfers of wealth, not just those at death.

So, in 1975, the Capital Transfer Tax (CTT) was introduced. This new tax replaced Estate Duty. Its main features were:

- It taxed all transfers of value, not just those made at death. This included gifts made during a person's lifetime.

- The value of property was usually its market price.

- Gifts made during a person's life were added up, and tax was charged on a sliding scale.

- Transfers made at death or within three years before death were taxed at a higher rate.

- If someone lived in the UK, all their property was taxed. If they lived abroad, only property in the UK was taxed.

During the time Margaret Thatcher was Prime Minister, the CTT was changed. The rates for gifts were adjusted to encourage people to give business property away during their lifetime. A ten-year period was also introduced to limit how much the graduated rates could affect someone.

Inheritance Tax: 1986 to Today

In 1986, Nigel Lawson, another finance minister, decided to get rid of the tax on gifts made during a person's lifetime. He felt that this tax was harming family businesses and stopping people from taking risks.

He explained that the Capital Transfer Tax was really two taxes: one on inheritances and one on lifetime gifts. He wanted to keep the inheritance part but remove the lifetime gifts part. He said that taxing lifetime gifts made people hold onto their assets, especially family businesses, which wasn't good for the economy.

So, in 1986, the Capital Transfer Tax was renamed Inheritance Tax (IHT).

Estate on Death

For Inheritance Tax, a person's "estate" includes all their property and money when they die. This includes things they own, property outside the UK, and even things they could have sold or given away. Debts are usually taken into account, which reduces the value of the estate.

Some property is "excluded" from IHT:

- Property outside the UK if the person lived outside the UK.

- Medals for bravery that have never been sold.

- Certain types of investments.

There are also tax breaks for specific types of property, like business property, farmland, and woodlands.

Taxable Gifts Before Death

Gifts made during a person's lifetime can still affect Inheritance Tax. If someone makes a gift more than seven years before they die, it's usually not taxed. These are called "potentially exempt transfers." Gifts within certain small limits are also "exempt transfers."

However, if someone makes a large gift within seven years of their death, it might be taxed. The tax is usually paid by the people who receive the gift. Gifts can also include situations where:

- Something is sold for much less than its market value (like selling a house to a child for a very low price).

- Money is put into certain types of trusts.

- Payments are made for a life insurance policy that benefits someone else.

Tax Rate

The standard Inheritance Tax rate is 40% of the estate's value, after a certain amount (called the nil rate band) is deducted. The nil rate band is the amount that can be passed on without any tax. This amount changes over time.

Since 2012, if at least 10% of an estate is left to charity, the tax rate can be reduced to 36%. This encourages people to leave money to good causes.

Extra Nil Rate Band for Homes

In 2015, a new rule was introduced to help families pass on their home without paying too much tax. This is an extra tax-free amount called the residence nil rate band. It applies when a home is left to direct family members, like children or grandchildren.

This extra amount has increased over the years:

- £100,000 in 2017-18

- £125,000 in 2018-19

- £150,000 in 2019-20

- £175,000 in 2020-21

After 2021, this amount will increase with inflation. There are also rules to help if someone sold their home to move to a smaller one or no longer owned a home before they died.

Pre-Owned Assets

Since 2005, there's also a rule about "pre-owned assets." This applies if someone gives away property but still benefits from using it. For example, if a parent gives their house to their child but continues to live in it for free. In these cases, the parent might have to pay income tax on the benefit they receive. However, they can choose to have it treated as a gift that is subject to Inheritance Tax instead.

See also

|

| Charles R. Drew |

| Benjamin Banneker |

| Jane C. Wright |

| Roger Arliner Young |