History of taxation in the United Kingdom facts for kids

The history of taxation in the United Kingdom is all about how governments in the UK have collected money from people and businesses over time. This money, called tax, helps pay for public services like schools, hospitals, and roads.

Contents

How Taxes Started

Before the United Kingdom was formed in 1707, different parts of it, like England, already had taxes.

- In 1203, King John of England started a tax on wool that was sent out of the country.

- Later, in 1275, King Edward I introduced taxes on wine.

- A special tax called the Poor Law tax began in 1572 to help people who were struggling. It started as a local tax and became a national one in 1601.

In 1628, England's Parliament passed the Petition of Right. This important document said that the King couldn't just create new taxes whenever he wanted. He needed Parliament's agreement first. This stopped kings from making up taxes without asking the people's representatives.

After the Great Fire of London in 1666, King Charles II introduced a coal tax to help rebuild the city. This tax lasted a long time, until 1889.

In 1692, England's Parliament also brought in a national land tax. This tax was based on the rent value of land in both the countryside and cities.

Taxes After 1707

Window Tax

When the United Kingdom of Great Britain was created in 1707, the window tax continued. It had started in England and Wales in 1696. The idea was to tax people based on how rich they seemed, without directly asking about their income. Many people didn't like the idea of an income tax because they felt it was too nosey and invaded their privacy. The first regular income tax in Britain didn't arrive until 1842.

The window tax had two parts:

- A flat fee of 2 shillings for every house.

- An extra tax if a house had more than ten windows. For example, houses with 10 to 20 windows paid 4 shillings, and those with more than 20 windows paid 8 shillings.

Income Tax

The very first income tax in Great Britain was introduced by William Pitt the Younger in 1798. He needed money to pay for weapons and equipment during the Napoleonic Wars against France.

Pitt's new income tax was a graduated tax. This means people with higher incomes paid a higher percentage of their earnings in tax.

- It started at a small amount (2 old pence for every pound) for incomes over £60.

- It went up to a maximum of 2 shillings (10%) for incomes over £200.

Pitt hoped to raise £10 million, but he only got about £6 million in 1799.

The 1800s

Pitt's income tax was used from 1799 to 1802. It was stopped for a short time by Henry Addington, who became prime minister. But when the wars started again in 1803, Addington brought the income tax back. It was finally stopped for good in 1816, a year after the Battle of Waterloo.

Addington made some important changes to the income tax:

- He allowed tax to be collected "at the source." This meant, for example, that the Bank of England would take out tax money directly from interest paid to people who owned government bonds.

- He introduced different categories, called "schedules," for different types of income:

* Schedule A: Tax on income from land in the UK. * Schedule B: Tax on using land for business. * Schedule C: Tax on income from government investments. * Schedule D: Tax on business profits, professional earnings, interest, and other income. * Schedule E: Tax on money earned from jobs.

Even though Addington's highest tax rate was lower (5% compared to Pitt's 10%), these changes helped collect 50% more money. This was because more people had to pay the tax, and it covered more types of income.

When Pitt became prime minister again in 1805, he brought the tax rate back up to 10%. The income tax stayed mostly the same during the rest of the Napoleonic Wars.

After the Battle of Waterloo in 1815, people really wanted the income tax to be removed. It was so unpopular that Parliament even ordered all documents about it to be destroyed! (But some copies were kept).

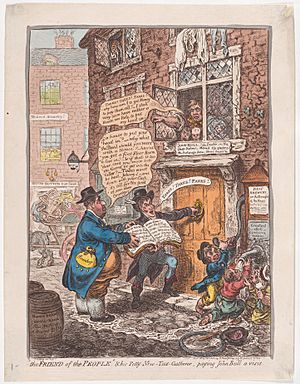

Under Robert Peel

In 1841, Robert Peel became Prime Minister. Even though he had said he was against the income tax, the government didn't have enough money. So, in 1842, he brought it back.

- Peel only taxed people with incomes above £150 a year.

- He also lowered taxes on many imported goods. This helped poorer people and boosted trade.

- Peel's income tax was about 3% (7 pence for every pound).

It was meant to be temporary, but it stayed because the country needed the money.

Gladstone and Disraeli

The second half of the 1800s was a time of big changes, led by two famous politicians: Benjamin Disraeli (Conservative) and William Ewart Gladstone (Liberal).

They often disagreed, but both promised to get rid of income tax in the 1874 election. Disraeli won, but the tax stayed.

Gladstone, who was Chancellor of the Exchequer many times, tried to get rid of income tax over seven years in 1853. He also made it possible to deduct expenses from tax if they were "wholly, exclusively and necessarily" for work, like keeping a horse for business.

Disraeli called income tax "unjust" and said it should only be temporary. But when Gladstone was Chancellor again from 1859 to 1866, he had to admit that the tax was too important. It raised £10 million a year, and the government needed the money.

Gladstone still wanted to end income tax. He even tried to make sure a committee looking into tax reforms wouldn't find ways to keep it.

Important changes happened in this period, like the Reform Bills of 1867 and 1884. These laws gave more working-class people the right to vote for the first time.

Even though people kept hoping income tax would end, it remained. By 1874, it brought in about £6 million of the government's £77 million income. It was a small percentage, and most people didn't pay it, so it wasn't the top priority to remove.

The 1900s

First World War

The First World War (1914–1918) cost a lot of money. The government paid for it by borrowing, introducing new taxes, and through inflation (when money buys less).

- They avoided indirect taxes (like sales taxes) because these could make life harder for working people.

- There was a focus on making taxes seem fair.

- People generally supported the new taxes.

- An "excess profits tax" was introduced, taking 50% of profits above normal pre-war levels. This went up to 80% in 1917.

- Taxes were added to luxury imports like cars and watches.

- The biggest increase in money came from income tax. In 1915, it went up to 17.5% (3 shillings 6 pence for every pound). By 1918, it was 30% (6 shillings).

Overall, taxes paid for about 30% of the war costs. The rest was borrowed, which made the national debt grow hugely. Inflation meant that money was worth much less after the war.

Purchase Tax

Between 1940 and 1973, the UK had a "Purchase Tax." This was a tax on goods, and the rate changed depending on how "luxurious" the item was.

- It started at 33.3% of the wholesale price.

- It went up to 100% during the war, then back down.

Unlike today's VAT, Purchase Tax was added when goods were made or distributed, not when they were sold to customers. In 1973, the UK joined the European Economic Community (now the EU), and Purchase Tax was replaced by Value Added Tax (VAT).

Income Tax Changes

UK income tax has changed a lot.

- Since 1965, income tax only applies to individuals. Companies now pay a separate "corporation tax."

- The highest income tax rate reached 99.25% during the Second World War. It was around 90% in the 1950s and 60s.

- In 1971, the top rate on earned income was cut to 75%. But with an extra charge on investment income, the highest rate on investment income was 90%.

- In 1974, the top rate on earned income went up to 83%. With the investment income charge, the highest rate on investment income reached 98%. This was for incomes over £20,000.

During the 1980s, under Prime Minister Margaret Thatcher, income tax rates were cut. She preferred taxes on spending (indirect taxes) rather than income.

- In 1979, the top rate was cut from 83% to 60%. The basic rate went from 33% to 30%.

- The basic rate was cut further to 25% by 1988. The top rate was cut to 40%.

Under Prime Minister John Major, the basic rate was gradually lowered to 23% by 1997.

The 2000s

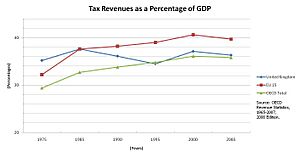

Under Labour Chancellor Gordon Brown, the basic rate of income tax was further reduced to 20% by 2007. While the basic rate has gone down a lot since 1976, other taxes like National Insurance and VAT have increased, balancing it out.

In 2010, a new top rate of 50% was introduced for incomes over £150,000 a year. This was later cut to 45% in 2013.

In 2022, there were plans to cut the top 45% rate and the basic rate from 20% to 19%. However, these plans were later cancelled.

Business Rates

"Business rates" were introduced in England and Wales in 1990. They are a modern version of a very old tax system that goes back to the Elizabethan Poor Law of 1601. This tax is paid by businesses based on the value of their property.

Devolution of Tax Powers

The Scotland Act 2016 gave the Scottish Parliament more control over income tax rates. This means Scotland can set its own income tax rules, which can be different from the rest of the UK.

Why the Tax Year Starts on 6 April

Have you ever wondered why the tax year in the UK starts on 6 April? It's a bit of a historical puzzle!

Back in the 1700s, the tax year officially began on 25 March, which was an old quarter day called Lady Day. However, there was an old legal rule that said if something was to run "from" a certain date, it actually started the *next* day. So, the tax year really began on 26 March.

Then, in 1752, Britain changed its calendar to the new "Gregorian calendar." This meant that 11 days were skipped in September 1752 to catch up with the rest of Europe. So, September 2nd was followed by September 14th!

To keep the tax year the same length, those 11 skipped days were added to the end of the tax year.

- The old start date was 26 March.

- Add 11 days to 26 March, and you get 6 April.

So, the tax year shifted from starting on 26 March to starting on 6 April. When income tax was first introduced by William Pitt in 1799, it followed this new date, starting "from" 5 April (meaning 6 April). This date has stayed the same ever since.

|

See also

- History of inheritance taxes in the United Kingdom

- Taxation history of the United States

| Jewel Prestage |

| Ella Baker |

| Fannie Lou Hamer |