History of the British national debt facts for kids

The history of the British national debt tells us how much money the British government has borrowed over time. This debt started way back with King William III. He needed money for wars, so he asked a group of business people to lend the government money. This group later became the the Bank of England.

By 1815, after the Napoleonic Wars, Britain's debt was huge. It reached £1 billion, which was more than double the country's total economic output (GDP).

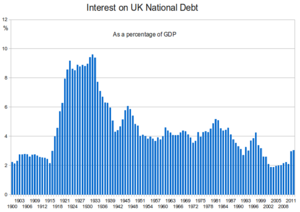

In the early 1900s, the national debt was much smaller, about 30% of GDP. But then World War I happened. The government had to borrow a lot to pay for the war. The debt jumped from £650 million in 1914 to £7.4 billion in 1919.

Later, during World War II, the government borrowed heavily again to fight the Axis powers. After this war, the debt slowly got smaller compared to GDP. However, in the 1970s, Britain faced a money problem called the Sterling crisis. The government had to ask the International Monetary Fund (IMF) for help.

In the 1980s and 1990s, the debt amount changed with the economy. It went up during tough times and down when the economy was strong. By 2002, the debt was down to 29% of GDP. But after that, it started to grow again, even with a good economy. This was because the government, led by Tony Blair, spent more money. By 2007, the debt was 37% of GDP.

After the Great Recession started in 2008, the government borrowed even more. The national debt grew a lot, reaching about 70% of GDP by the end of 2012. As of June 2023, the British national debt was 100.1% of GDP. This means the debt was slightly more than the country's total economic output for a year.

Contents

How the National Debt Started

The idea of the British national debt began with King William III. He needed money to pay for wars. So, he asked a group of London traders and merchants to lend money to the government. This group eventually became the the Bank of England.

The Bank of England was created in 1694. It was designed by Charles Montagu, 1st Earl of Halifax, based on a plan by William Paterson. The plan was simple: the bank would lend £1.2 million to the government. In return, the people who lent the money would form The Governor and Company of the Bank of England. They would get special banking rights, like being able to print money. The King officially approved this with a royal charter on July 27, 1694.

At that time, the government's money situation was very bad. So, the loan came with a high interest rate of 8% per year. There was also a £4,000 yearly fee to manage the loan. The first leader of the bank was Sir John Houblon. You can see his picture on the £50 note from 1994. The bank's special rights were renewed several times over the years.

Creating the Bank of England stopped the government from suddenly stopping payments on its debts. This had happened before, like in 1672 under King Charles II. From then on, the British government always paid back its lenders. By 1776, a lot of Britain's debt was held by Dutch bankers.

By 1815, after the Napoleonic Wars, Britain's government debt hit £1 billion. This was more than 200% of the country's GDP.

The South Sea Company Story

The South Sea Company was set up in 1711 by Robert Harley. It was supposed to be a trading company. But its main job was to help manage the government's debt.

In 1720, a new law made the South Sea Company responsible for all of Britain's national debt. This made people very excited about the company. Its shares became super valuable, reaching ten times their original price! But then, the company ran into money problems and its value crashed. This event is known as the South Sea Bubble. The company continued to manage some of the national debt until it was closed down in 1850.

World War I and Its Debt

At the start of the 20th century, Britain's national debt was about 30% of its GDP. But during World War I, the government needed a lot of money. It had to borrow heavily to pay for the war. The national debt grew from £650 million in 1914 to £7.4 billion by 1919.

Britain borrowed a lot of money from the United States during World War I. Many of these loans were never fully settled. In 1931, President Herbert Hoover paused war loan payments for a year because of a global economic crisis. But by 1934, Britain still owed the US about $4.4 billion from World War I. This would be around £40 billion today, or £225 billion if we compare it to Britain's economic growth. During the Great Depression, Britain stopped making payments on these loans. They are still technically outstanding.

Between the Wars

By the mid-1920s, paying interest on the government's debt took up a huge part of its budget. About 44% of all government spending went to debt interest. This was more than what was spent on defense until 1937, when Britain started preparing for another war.

World War II and More Borrowing

During World War II, the government again had to borrow a lot to fight the Axis powers. By the end of this war, Britain's debt was more than 200% of its GDP. This was similar to the debt level after the Napoleonic Wars.

Just like in World War I, the US was a major source of money for Britain. This time, it was through low-interest loans and the Lend Lease Act. After the war, Lend-Lease ended. Britain still needed to pay for past Lend-Lease supplies and import food. But its factories had been focused on war production, so it couldn't export much to earn money.

In 1946, Britain took a large loan of $3.7 billion from the US. Canada also lent Britain another $1.19 billion. Both loans had a 2% annual interest rate. The debt was supposed to be paid off in 50 yearly payments starting in 1950. Some of these loans were only fully paid off in the early 2000s. On December 31, 2006, Britain made its final payments to the US and Canada.

By the end of World War II, Britain had a massive debt of £21 billion. A lot of this money was owed to other countries, especially the United States. About £3.4 billion was owed overseas, which was roughly one-third of Britain's yearly GDP.

The 1970s Crisis

After World War II, the debt slowly decreased compared to GDP. But in 1976, the British government, led by James Callaghan, faced a big problem. The value of the pound dropped sharply. The government found it hard to get enough money to pay for its plans.

The prime minister had to ask the International Monetary Fund (IMF) for a rescue package of £2.3 billion. This was the biggest loan the IMF had ever given at that time. In November 1976, the IMF set conditions for the loan. These included big cuts in government spending. This meant the IMF was effectively controlling Britain's money decisions. Many people saw this crisis as a national embarrassment.

The 2000s and Rising Debt

In the late 1990s and early 2000s, the national debt got smaller compared to GDP. It fell to 29% of GDP by 2002. But after that, it started to grow again. This happened even though the economy was doing well. The increase was mainly because the government borrowed more money. This extra spending went into areas like health, education, and social security benefits.

Since 2008, the British economy slowed down a lot and went into a recession. This was caused by a global financial crisis. The national debt then rose dramatically. First, huge amounts were needed to help struggling banks. Then, less money came in from taxes because people and businesses were earning less.

From 1986 to 2007, government spending in the UK was usually around 40% of GDP. But because of the financial crisis and the global recession in the late 2000s, government spending went up. It reached a very high level of 48% of GDP in 2009–10. This was partly due to the cost of a series of bank bailouts. In July 2007, Britain's government debt was 35.5% of its GDP. By July 2009, this figure had risen to 56.8% of GDP.

As of June 2023, the British national debt is 100.1% of GDP. The total public sector net debt at the end of May 2023 was £2,567.2 billion.

See also

- Public Sector Net Cash Requirement

- United Kingdom national debt

- Whole of Government Accounts

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |