2008 United Kingdom bank rescue package facts for kids

In 2007 and 2008, the world faced a big money problem called the Global Financial Crisis. During this time, the UK government stepped in to help its banks. This was to stop the country's money system from collapsing.

At its highest point, the government spent about £137 billion. This money went to banks as loans and new investments. Over the years, most of this money has been paid back. By October 2021, the UK's Office for Budget Responsibility said the total cost was £33 billion. This included a big loss from helping NatWest (which used to be called Royal Bank of Scotland), but other investments made some money back.

The first sign of trouble was in February 2007. A bank called HSBC warned that its profits would be lower. This was because of problems with its loans in the US. Later that year, in July, two investment funds from Bear Stearns went broke. This led to a big problem where banks stopped lending money to each other.

A UK bank called Northern Rock needed quick help from the Bank of England. When people found out, they rushed to the bank to take out their savings. This was the first time in 150 years that people had "run" on a British bank. To stop the panic, the UK government promised to protect all Northern Rock savings.

From September 2007 to December 2009, the government helped more banks. These included RBS (now NatWest), Lloyds Banking Group, Bradford & Bingley, and Northern Rock. Northern Rock and Bradford & Bingley were fully taken over by the government. The government also took a large part of RBS and a smaller part of Lloyds.

Besides giving money, the government also promised to back up banks' loans. These promises, called "guarantees," didn't cost cash right away. At their peak, these guarantees were worth over £1 trillion. They helped people trust the banks again. As the crisis eased, these guarantees were slowly removed.

Other countries, like the United States and those in Europe, also took similar steps to help their banks.

Contents

What Caused the Banking Crisis?

Early Signs of Trouble (2007-2008)

The first public sign of the crisis was in February 2007. HSBC, a big UK bank, announced that its profits would be lower. This was because of money lost from its US lending business. In July 2007, two investment funds from Bear Stearns in the US failed. Then, in August 2007, a French bank called BNP Paribas froze some of its investment funds.

These events made banks very nervous about lending money to each other. On August 14, 2007, the UK's financial watchdog, the FSA, told the government and the Bank of England about worries regarding Northern Rock. This bank relied heavily on borrowing from other banks. On September 13, the BBC reported that Northern Rock had received emergency help from the Bank of England.

This news caused a "run" on Northern Rock. People lined up outside branches to take out their money. It was the first time this had happened in the UK in 150 years. To stop the panic, the government promised to protect all savings in Northern Rock. In February 2008, the government fully took over Northern Rock.

In April 2008, the Bank of England started a plan called the Special Liquidity Scheme. This allowed banks to swap risky mortgage loans for safer government bonds. This helped banks get cash when they needed it.

In September 2008, the US government also had to rescue two big mortgage lenders, Fannie Mae and Freddie Mac.

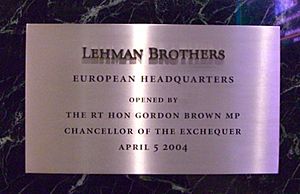

The Collapse of Lehman Brothers (September 2008)

In 2008, Lehman Brothers was a huge US investment bank with offices all over the world. Its main offices were in New York and London. The bank's money was managed from its main company in New York.

On September 14, 2008, Lehman Brothers in London asked its New York head office for money. But the New York office said it was going to declare bankruptcy and couldn't send any funds. So, early on September 15, 2008, the London part of Lehman Brothers also went into a special legal process called "Administration" in the UK.

When Lehman Brothers collapsed, it caused a huge mess. The bank had 142,000 unfinished deals with other companies. Its assets (what it owned) and liabilities (what it owed) were worth billions of dollars. All these were frozen, meaning no one could access them for years.

The failure of Lehman Brothers caused a lot of chaos in the financial markets. Many banks were connected to Lehman Brothers, so when it failed, it created a "domino effect" across the financial world.

HBOS Problems and Lloyds Takeover

After Lehman Brothers collapsed, everyone started looking at HBOS. This was the UK's biggest mortgage lender at the time.

HBOS had been on the government's radar because it used a similar way of getting money as Northern Rock. It offered very cheap home loans and took big risks with business loans. By July 2008, HBOS's profits had dropped by half, and its bad debts had gone up a lot.

On September 16, HBOS lost a third of its value in just one day. The UK financial regulator, the FSA, quickly stopped people from betting against the bank's shares. At the same time, the UK government helped Lloyds Bank agree to buy HBOS. This deal was announced on September 18, just three days after Lehman Brothers failed.

Planning to Help the Banks

By the end of September 2008, the heads of the Bank of England, the FSA, and the government's money chief, Alistair Darling, agreed that banks needed more money. Before this, the problem was that banks couldn't get cash. Now, the problem was that banks didn't have enough capital (their own money). The only place to get this much money was the UK government.

Alistair Darling told the Treasury (the government's money department) to prepare a plan. This plan would involve the government putting billions of pounds into UK banks in exchange for ownership shares. The government would raise this money by selling special bonds.

Royal Bank of Scotland Close to Collapse

On October 7, 2008, the share price of Royal Bank of Scotland (RBS) dropped by 35%. Trading in its shares was stopped. The bank's chairman told Alistair Darling that RBS was only hours away from running out of money.

Darling later said that when a bank's shares are stopped from trading, "it is all over." He knew RBS was finished. If such a huge bank could fail, it meant the whole financial system was in danger. This moment was the key event that made the government put its plan to save the banks into action.

How the Government Helped

The government's plan provided different ways to help banks. At its peak, this included £137 billion in cash and loans. There were also £1,029 billion in guarantees. By October 2021, the total cost was £33 billion. This was mainly a loss from helping NatWest (RBS), but other investments made money.

Cash Support for Banks

The government used a special fund to buy shares in the struggling banks. They bought both common shares and preferred shares. The amount of money and the ownership stake varied for each bank. Banks that accepted help had rules about how much their bosses could be paid and how much they could pay out to existing shareholders. They also had to promise to lend money fairly to homeowners and small businesses.

The government's long-term goal was to earn money from these shares and then sell them when the market got better. This plan was like the government partly or fully taking over the banks.

Here's a summary of the cash support and how it worked out by October 2021:

| Lloyds | NatWest | UKAR | FSCS | CGS | SLS | Other | Total | |

|---|---|---|---|---|---|---|---|---|

| Cash outlays at peak | -20.5 | - 45.8 | - 44.1 | - 20.9 | 0.0 | 0.0 | - 5.3 | - 136.6 |

| Principal repayments | 21.1 | 8.9 | 43.7 | 20.9 | 0.0 | 0.0 | 5.3 | 99.9 |

| Other fees received | 3.2 | 6.4 | 11.9 | 3.5 | 4.3 | 2.3 | 0.3 | 31.8 |

| Net cash position | 3.8 | - 30.5 | 11.5 | 3.5 | 4.3 | 2.3 | 0.2 | 5.0 |

| Outstanding payments | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 |

| Market value | 0.0 | 13.0 | 5.4 | 0.0 | 0.0 | 0.0 | 0.0 | 18.4 |

| Implied balance | 3.8 | -17.5 | 16.9 | 3.5 | 4.3 | 2.3 | 0.3 | 13.5 |

| Exchequer financing | - 4.5 | - 18.0 | - 14.5 | - 9.3 | 0.0 | 0.4 | 0.6 | - 46.5 |

| Overall balance | - 0.8 | - 35.5 | 2.4 | - 5.8 | 4.3 | 2.7 | - 0.3 | - 33.0 |

Source: OBR Economic and fiscal outlook October 2021

Notes

- UKAR: UK Asset Resolution – managed the government's shares in Bradford & Bingley and Northern Rock.

- FSCS: Financial Services Compensation Scheme - protects customers' money if a financial firm fails.

- CGS: Credit Guarantee Scheme - helped banks borrow money by having the government guarantee their debts.

- SLS: Special Liquidity Scheme - helped banks get cash by swapping risky assets for safer government bonds.

Other Ways the Government Helped

Credit Guarantee Scheme

The Credit Guarantee Scheme was part of the government's plan announced in October 2008. It started on October 13, 2008.

This scheme allowed banks to issue debt that the government would guarantee. This meant banks could borrow more easily and at a lower cost. In turn, they could then lend more money to people and businesses.

Many banks took part, including RBS, Lloyds, Barclays, and Nationwide Building Society. The scheme stopped taking new requests in February 2010 and fully ended in October 2012.

Special Liquidity Scheme

The Special Liquidity Scheme (SLS) was started by the Bank of England in April 2008.

The SLS let banks swap assets like mortgage-backed securities for UK government bonds. This made it easier for banks to get cash. Before this, many of these assets couldn't be sold or used to get funds, which made banks nervous about lending to each other.

Under the SLS, banks could swap their hard-to-sell assets for government bonds. Key features of the SLS were:

- The swaps were long-term, lasting up to three years.

- Banks were still responsible for any losses on their loans.

- The scheme only covered existing assets from before 2008; it couldn't be used for new loans.

The SLS ended in January 2012.

Quantitative Easing (QE)

The Bank of England's Asset Purchase Facility, better known as Quantitative easing (QE), began in 2009.

QE was mainly a way to control the economy. The Bank of England bought government bonds from the market, creating new money to do so. This made the bonds more expensive, which lowered interest rates for long-term loans. The goal was to help the economy grow.

QE happened in several stages between 2009 and 2020. At its highest point in 2020, the Bank held £895 billion in bonds.

In February 2022, the Bank of England announced it would start reducing its QE holdings. This would happen by not replacing bonds as they matured and later by actively selling them.

In August 2022, the Bank confirmed it would speed up bond sales. However, on September 28, 2022, the Bank of England announced it would temporarily buy long-term government bonds again. This was to calm the markets after a UK government announcement caused disruption. The Bank said its plan to reduce QE still stood, but bond sales would be delayed until October 31, 2022.

Banks That Received Help

The government's plan was open to all UK banks and building societies. These included Abbey, Barclays, Clydesdale Bank, HBOS, HSBC, Lloyds, Nationwide Building Society, Royal Bank of Scotland, and Standard Chartered.

Not all banks needed the same amount of help. HSBC said it was strong enough and didn't need government money. Standard Chartered also didn't take capital from the government. Barclays raised its own money from private investors.

Royal Bank of Scotland (Now NatWest)

The UK government invested a total of £45.8 billion in RBS. At one point, the government owned 84% of the bank.

The government bought RBS shares in stages between 2008 and 2009. The average price the government paid was 499 pence per share.

In August 2015, the government started selling its RBS shares. It sold a 5.4% stake at 330p per share, losing £1.9 billion for taxpayers. A second sale in June 2018, at 271p per share, lost another £2.1 billion.

In March 2021, the government sold more shares in NatWest (the new name for RBS) at 190.5p per share. By January 2022, the government's ownership in NatWest was down to 51%.

After more sales in 2022, the government's share in NatWest dropped below 50% for the first time since 2008. It sold 550 million shares at 220.5p each, making £1.2 billion.

Lloyds Banking Group

HBOS and Lloyds together raised £17 billion. The government bought £13.5 billion worth of special shares and also helped with the sale of ordinary shares.

Bradford & Bingley

The UK government took over Bradford & Bingley on September 29, 2008.

The bank was split into two parts. Its customer savings accounts and branches were sold to Santander Bank. The other part, which held its mortgage loans, was combined with Northern Rock's mortgage loans under a new company called UK Asset Resolution (UKAR).

Northern Rock

The Bank of England gave Northern Rock emergency loans of £25 billion in 2007 because it couldn't get money from other banks. This led to people rushing to withdraw their savings. After attempts to find a private buyer failed, Northern Rock was taken over by the government in February 2008.

The government then split Northern Rock into a "good bank" and a "bad bank." The "good bank," Northern Rock plc, handled customer savings and some mortgages. The government gave it £1.4 billion to prepare it for sale.

The "bad bank," Northern Rock (Asset Management) plc, held the remaining mortgage loans. In 2010, this "bad bank" was put under UK Asset Resolution (UKAR) along with Bradford & Bingley's mortgages.

On January 1, 2012, Virgin Money bought Northern Rock plc. Later, in July 2012, Virgin Money also bought a large part of Northern Rock's mortgages from UKAR.

Timeline of Key Events

2007

| Date | Event | Description |

|---|---|---|

| 8 February 2007 | HSBC profit warning | UK bank HSBC announced that its profits would be lower for the first time in 142 years. |

| 17 July 2007 | Bear Stearns losses | US investment bank Bear Stearns announced losses on two of its investment funds. |

| 9 Aug 2007 | French bank BNP Paribas freezes funds | French bank BNP Paribas froze three investment funds because of problems with risky mortgage loans. The European Central Bank (ECB) put 5 billion euros into the money market to help. |

| 14 Aug 2007 | Worries about Northern Rock | The Financial Services Authority (FSA) told the government and the Bank of England about concerns regarding Northern Rock. |

| 1 September 2007 | Northern Rock gets emergency loan | The Bank of England gave Northern Rock an emergency loan because it had trouble borrowing money from other banks. |

| 13 September 2007 | BBC reports Northern Rock loan | BBC News reported details of the Bank of England's emergency loan to Northern Rock. |

| 14 September 2007 | Run on Northern Rock begins | People lined up at Northern Rock branches to take out their savings. This was the first time a "run" on a UK bank had happened in 150 years. |

| 17 September 2007 | Government guarantees Northern Rock deposits | UK Chancellor Alistair Darling announced that the UK government would protect all existing Northern Rock savings. |

| 19 September 2007 | Bank of England injects money | The Bank of England put £10 billion into the money markets to try and lower interest rates between banks. |

| 9 October 2007 | More protection for Northern Rock savers | The government announced that its promise to protect savings would also apply to any new money put into Northern Rock after September 19. |

What UK Leaders Said

Alistair Darling, who was the government's money chief (Chancellor of the Exchequer), told the House of Commons on October 8, 2008, that the plans were meant to "restore confidence in the banking system." He said the money would "put the banks on a stronger footing." Prime Minister Gordon Brown suggested that the UK's actions showed other countries what to do. The opposition leader, George Osborne, supported the plan but called it "the final chapter of the age of irresponsibility."

Darling later said in 2018 that the country was just hours away from chaos if Royal Bank of Scotland hadn't been saved. He believed people wouldn't have been able to get their money, which could have led to a breakdown of law and order.

How Other Countries Reacted

Central Banks Working Together

On October 8, 2008, seven major central banks around the world worked together to calm the financial crisis. They all cut interest rates by 0.5%. These banks included the Bank of England, the European Central Bank, and the U.S. Federal Reserve, along with central banks in China, Switzerland, Canada, and Sweden.

UK Plan vs. US Plan

The UK's plan to save its banks was different from the United States' $700 billion bailout, called the Troubled Asset Relief Program (TARP). The UK government bought shares in its banks. The US program mostly bought risky mortgage-backed investments from its banks. While the US plan also took some ownership in banks, it mainly focused on the immediate money shortage. The UK's plan tackled both the banks' lack of capital and their funding problems. The US later also invested in banks and guaranteed their debts.

Global Impact

Paul Krugman, a famous writer for The New York Times, said that "Mr Brown and Alistair Darling... have defined the character of the worldwide rescue effort." He also wrote that they "may have shown us the way through this crisis." Other experts noted that even though capitalism usually lets weak businesses fail, these banks were "too big to fail."

Other countries, including the rest of Europe and the US, closely watched the British bank bailout. On October 14, 2008, the US announced its own $250 billion plan to buy shares in banks to restore confidence.

The international efforts to deal with the financial crisis had a big impact on stock markets worldwide. Even though shares in the affected banks fell, the Dow Jones went up by more than 900 points. London shares also bounced back, with the FTSE100 Index closing more than 8% higher on October 13, 2008.

See also

- Government intervention during the subprime mortgage crisis

- Banking (Special Provisions) Act 2008

- 2009 United Kingdom bank rescue package

- UK Financial Investments Limited

- List of banks in the United Kingdom