Lloyds Banking Group facts for kids

|

|

25 Gresham Street

|

|

|

Formerly

|

|

|---|---|

| Public | |

| Traded as | |

| Industry | |

| Founded | 16 January 2009 |

| Headquarters | |

|

Area served

|

United Kingdom |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

63,000 (2025) |

| Divisions |

|

| Subsidiaries |

|

Lloyds Banking Group plc is a big British company that helps people with their money. It was created in 2009 when two large banks, Lloyds TSB and HBOS, joined together. It is one of the largest financial groups in the UK.

The company serves about 30 million customers and has 63,000 employees. Lloyds Bank started way back in 1765. But the history of the whole group goes back even further, over 320 years, to the Bank of Scotland which began in 1695.

The main office for daily operations is in London, England. Its official registered office is in Edinburgh, Scotland. The group also has offices in other UK cities like Birmingham and Glasgow. They even have offices in the US and Europe, with their main European Union office in Berlin, Germany.

Lloyds Banking Group uses several well-known brand names. These include Lloyds Bank, Halifax, Bank of Scotland, and Scottish Widows. The company keeps these different brands because they serve different types of customers.

The group's shares are traded on the London Stock Exchange. It is also part of the FTSE 100 Index, which lists the 100 biggest companies in the UK.

Contents

A Look at Lloyds Banking Group's History

How Lloyds Banking Group Started

Lloyds Bank is one of the oldest banks in the UK. It began in 1765 in Birmingham. Two people, John Taylor and Sampson Lloyd II, started it. Over time, Lloyds grew by joining with other banks. It became one of the four biggest banks in the UK.

The Bank of Scotland is even older, starting in the 1600s. It is the second-oldest bank in the UK after the Bank of England. In 2001, the Halifax Building Society, which started in 1853, joined with the Bank of Scotland.

The Trustee Savings Bank (TSB) has roots going back to 1810. This was when the first savings bank was founded by Henry Duncan. TSB itself was formed in 1985 by bringing together many smaller savings banks.

Lloyds and TSB Join Forces

In 1995, Lloyds Bank and TSB Group merged. This created a new company called Lloyds TSB Group plc.

In 2000, the group bought Scottish Widows. This company helps people with life insurance and pensions. This made Lloyds TSB Group a very large provider of these services in the UK. They also bought Chartered Trust to offer car and personal loans. This part of the business is known as Black Horse.

Lloyds TSB tried to buy another bank, Abbey National, in 2001, but the deal was stopped. Over the next few years, Lloyds TSB sold some of its businesses in other countries. These included operations in New Zealand, Argentina, and Colombia.

In 2005, Lloyds TSB sold its credit card business, Goldfish. In 2007, they sold their Abbey Life insurance business.

How HBOS Became Part of Lloyds

In September 2008, there were news reports that HBOS was in talks to be bought by Lloyds TSB. This happened because HBOS's share price had dropped a lot. The deal was agreed quickly. It created a huge banking group that would handle a large part of UK mortgages.

Lloyds TSB shareholders approved the deal in November 2008. HBOS shareholders also agreed in December. The takeover was completed on January 19, 2009. At this point, Lloyds TSB Group changed its name to Lloyds Banking Group.

After the takeover, some people questioned how much checking Lloyds had done on HBOS. The CEO of Lloyds Banking Group, Eric Daniels, explained that companies can only do so much checking before a deal is final. The losses from HBOS were a bit higher than first thought. This was due to property loans losing value as property prices fell.

Government Support for Banks

In October 2008, the UK government stepped in to help major banks. This was to prevent a big problem in the financial system. The government invested a lot of money into banks like Lloyds TSB and HBOS.

After the government's help and Lloyds' purchase of HBOS, the UK Government owned 43.4% of Lloyds Banking Group. This meant the government became a major shareholder in the bank.

In early 2009, experts checked if banks could handle a very difficult economic situation. They found that Lloyds would need more money if such a situation happened. So, in March 2009, Lloyds made a deal with the UK government.

The government's special shares were repaid by Lloyds in June 2009. This meant Lloyds no longer had to pay interest to the government. Lloyds also decided not to join a government plan that would protect it from future losses on old loans. Instead, Lloyds raised money from its existing shareholders. The government, as a shareholder, also took part in this.

Recent Developments at Lloyds

By mid-2009, the bank's financial situation started to improve. The government's share in Lloyds Banking Group changed over time. In February 2010, the government's share went down to about 41%.

Lloyds Banking Group sold its share in an insurance company called Esure in 2010. In April 2013, Lloyds sold its Spanish banking business to Banco de Sabadell.

The UK government began selling its shares in Lloyds Banking Group in September 2013. They sold parts of their shares over several years. By March 2017, the British government had sold all its remaining shares in Lloyds Banking Group.

In February 2025, Lloyds Banking Group set aside more money to help cover issues related to car finance loans. This was because a court ruling in October 2024 said that some payments made to car dealers were not properly shared with customers.

In early 2025, Lloyds Banking Group won a contract to provide banking services for HM Revenue & Customs (HMRC). This means they will handle banking for the UK tax department.

As of 2025, customers can use any branch of Lloyds, Halifax, or Bank of Scotland for their banking needs. This makes it easier for customers to access services.

Creating TSB Bank

Because the UK government helped Lloyds Banking Group, the company had to sell off some of its business. This was to follow rules about fair competition. The plan was to create a new bank from 632 branches. This new bank would be called TSB Bank plc.

Lloyds Banking Group first planned to sell these branches to The Co-operative Bank. However, this deal did not happen. So, Lloyds Banking Group decided to sell TSB Bank through an IPO. This means selling shares of the new bank to the public.

TSB Bank started operating on September 9, 2013. Lloyds Banking Group sold 35% of TSB's shares in June 2014. Later, in March 2015, Banco Sabadell bought TSB. This meant Lloyds no longer owned any part of TSB.

How Lloyds Banking Group is Organized

The company is split into different parts to manage its various services:

- Private equity (investing in companies)

- Consumer lending and consumer relationships (loans and services for individuals)

- Business & commercial banking (services for businesses)

- Corporate & institutional banking (services for large companies and organizations)

- Insurance, pensions and investments (helping people plan for the future)

Who Leads Lloyds Banking Group

This section lists the main leaders of Lloyds Banking Group since it was formed in 2009.

Current Leaders

- Chairman: Robin Budenberg (since January 2021)

- Chief Executive: Charlie Nunn (since August 2021)

Past Chairmen

- Sir Victor Blank (2009)

- Sir Winfried Bischoff (2009–2014)

- Lord Blackwell (2014–2020)

Past Chief Executives

- Eric Daniels (2009–2011)

- Sir António Horta-Osório (2011–2021)

Helping the Community

Lloyds Banking Group supports disability rights. They are a Gold member of the Employers' Forum on Disability. In 2010, they helped create the RADAR Radiate network. This network helps people with disabilities find and develop their talents.

In 2011, Lloyds Banking Group started the Lloyds Scholars Programme. This program helps UK students from less wealthy backgrounds. It works with nine top UK universities. Students get money to help with living costs, a mentor from Lloyds, and two internships. To be part of the program, students must volunteer 100 hours in their community each year.

Awards and Recognition

Lloyds Banking Group and its brands have won many awards over the years.

- In July 2007, Euromoney named Lloyds TSB a winner of its Awards for Excellence.

- In June 2008, Lloyds TSB Group was top in a survey by Race for Opportunity.

- In May 2009, Lloyds TSB Corporate Markets was named 'Bank of the Year' for the fifth time.

- In October 2009, Halifax won 'Best Savings Account Provider' and 'Best Share Dealing Service' from "What Investment" magazine.

- Halifax also won 'Best First Time Mortgage Provider' in the "Consumer Money Awards" in October 2009.

- In November 2009, Halifax won 'Best Overall Mortgage Lender' for the eighth year in a row at the "Your Mortgage Awards".

Images for kids

-

The Lloyds Bank branch in Park Row, Leeds, with a black horse sculpture

-

The main office of the Bank of Scotland in Edinburgh

-

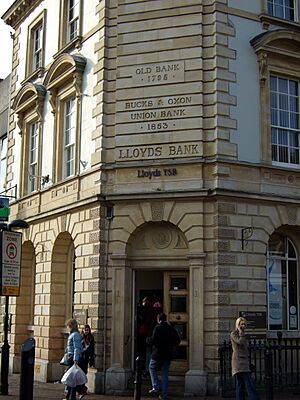

The Lloyds Bank branch in Aylesbury, which used to be the Bucks and Oxon Union Bank

-

The Lloyds Bank branch in King Street, Manchester, built in 1915

-

The Edgbaston branch of Lloyds Bank in Five Ways, Birmingham, designed in 1908

-

The Lloyds Bank branch in Carfax, Oxford, designed in 1901

| Victor J. Glover |

| Yvonne Cagle |

| Jeanette Epps |

| Bernard A. Harris Jr. |