Bank of Scotland facts for kids

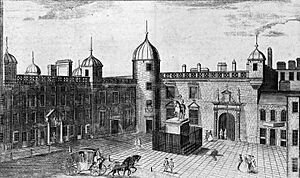

Headquarters building on The Mound

|

|

|

Native name

|

|

|---|---|

| Public | |

| Industry | Financial services |

| Founded | 17 July 1695 |

| Headquarters | The Mound Edinburgh, Scotland, UK |

| Products | Banking and Insurance |

| Total assets | £359 billion (2016) |

|

Number of employees

|

20,000 |

| Parent | Lloyds Banking Group |

| Divisions |

|

The Bank of Scotland plc (in Scottish Gaelic: Banca na h-Alba) is a major bank located in Edinburgh, Scotland. It is part of the Lloyds Banking Group. The bank was started by the Parliament of Scotland in 1695. Its main goal was to help Scotland's trade grow and create a stable banking system.

It was the first bank ever created in Scotland. It is also the oldest bank still operating in the country. Globally, it is the ninth oldest bank that has been open continuously. The Bank of Scotland is also known for being the longest continuous issuer of banknotes in the world.

The Bank of Scotland was the first bank in Europe to successfully print its own banknotes. It still prints its own sterling banknotes today. This is allowed by special laws for Scottish banks. In 2009, the Bank of Scotland became a part of the Lloyds Banking Group.

Contents

History of the Bank

How the Bank Started

| Bank of Scotland Act 1695 | |

|---|---|

| Act of Parliament | |

|

|

| Long title | Act of Parliament for erecting a Bank in Scotland. |

| Citation | 1695 c. 88 |

In the 1690s, Scotland's money situation was uncertain. It was hard to get loans, and there wasn't much cash. A group of business people thought a public bank could solve these problems. So, the Bank of Scotland was created by an Act of the Parliament of Scotland on July 17, 1695. It opened for business in February 1696.

The Bank of Scotland was different from the Bank of England, which started a year earlier. The Bank of England was made to help the English government pay for wars. But the Bank of Scotland was created by the Scottish government to help Scottish businesses. It was not allowed to lend money to the government without Parliament's permission.

The law that created the bank gave it a special right to be the only public bank in Scotland for 21 years. It was allowed to raise a lot of money, about £100,000 in today's money. This helped the bank give loans to stabilize Scottish businesses.

In its early years, the bank helped Scotland during tough times. For example, in the 1700s, bad harvests caused food shortages. The Bank of Scotland gave loans without interest to help buy food.

The bank was the first in Europe to print banknotes. Before this, coins were the only way to pay, but they were often hard to find. The bank came up with the idea of paper money, each with a set value. Notes for £5, £10, £20, £50, and £100 were first issued in March 1696. A £1 note was added later. The Bank of Scotland still prints its own banknotes today.

The 1700s and 1800s

The Bank of Scotland faced a rival, the Royal Bank of Scotland, which started in 1727. This led to a big competition between the two banks. They tried to make each other fail. This "Bank Wars" ended around 1751. After that, other Scottish banks started, and the Bank of Scotland began opening branches across Scotland.

After the Acts of Union 1707 in 1707, the bank helped change old Scottish coins into Sterling money. It was one of the first banks in Europe to print its own banknotes. It still prints its own sterling banknotes today. The bank also helped make the whole Scottish banking system safe and stable. This was very important after some other banks failed in the 1770s.

Henry Dundas, 1st Viscount Melville was the Governor of the Bank of Scotland from 1790 to 1811. He was also a powerful government official. The bank moved to its special building on The Mound in 1805. In 1857, another bank, the Western Bank, failed. The Bank of Scotland and other Scottish banks stepped in to make sure all of the Western Bank's notes were paid. The Bank of Scotland opened its first branch in London in 1865.

The 1900s

In the 1950s, the Bank of Scotland joined with other banks. In 1955, it merged with the Union Bank of Scotland. The bank also started offering loans to regular people by buying North West Securities. In 1971, the bank agreed to merge with the British Linen Bank. This deal meant Barclays Bank owned 35% of the Bank of Scotland for many years.

In 1959, the Bank of Scotland was the first bank in the UK to use a computer to manage customer accounts. On January 25, 1985, the bank launched HOBS (Home and Office Banking Services). This was an early way for customers to check their bank accounts from home using a TV and phone line. This was a big step towards modern online banking.

Growing Internationally

When North Sea oil was discovered in Scotland in the 1970s, the Bank of Scotland started working with energy companies. It then used this knowledge to expand around the world. It opened offices in places like Houston, Texas, Moscow, and Singapore. In 1987, it bought Countrywide Bank in New Zealand. In 1995, it expanded into Australia by buying Bankwest.

A planned partnership in 1999 with a US figure was cancelled. This happened after public criticism over his controversial statements.

Forming HBOS

In the late 1990s, many banks and building societies in the UK started joining together. For example, Lloyds Bank and TSB Bank merged in 1995 to create Lloyds TSB. In 1999, the Bank of Scotland tried to take over National Westminster Bank. This was a bold move because NatWest was much bigger. However, The Royal Bank of Scotland made a better offer and won the takeover battle.

In 2000, the Bank of Scotland was the first UK bank to offer mobile banking using WAP phones. This simple system allowed customers to check their account information. It helped pave the way for the mobile banking we use today. In 2001, the Bank of Scotland and the Halifax agreed to merge. They formed a new group called HBOS (which stood for "Halifax Bank of Scotland").

In 2006, a special law was passed called the HBOS Group Reorganisation Act 2006. This law helped simplify the bank's structure. The Bank of Scotland became a public limited company, Bank of Scotland plc. Halifax and Capital Bank became part of Bank of Scotland plc. Even though the Halifax name was kept, it operated under the Bank of Scotland's banking license. In 2008, during the Great Recession, the HBOS Group was taken over by Lloyds Banking Group.

Sponsorships and Community Work

The Bank of Scotland sponsored the Scottish Premier League from 1998 until 2007. After that, they decided to invest in local sports instead. They also sponsored Scottish Athletics for many years. Since November 2010, the Bank of Scotland Foundation has given over £32 million to about 2,500 charities in Scotland. This has helped around 1.2 million people by supporting local services.

Banknotes of Scotland

History of Banknotes

Even though the Bank of Scotland is not a central bank today, it can still print pound sterling banknotes. Two other Scottish commercial banks also have this right. These notes have the same value as notes printed by the Bank of England, which is the central bank of the United Kingdom.

The Bank of Scotland was the first European bank to successfully issue paper money that could be exchanged for cash. This was very helpful because Scottish coins were not in good condition in the late 1600s. After the Acts of Union 1707 in 1707, the bank helped change old Scottish coins into Sterling money. The Bank of Scotland still prints its own banknotes, making it the longest continuous issuer of banknotes in the world.

In 2022, the Bank of Scotland showed its new £100 polymer note design. This design was the first to honor an important Scottish person, Dr. Flora Murray. She was a suffragette and a medical pioneer.

In 1826, the UK Parliament tried to stop Scottish banks from printing banknotes worth less than five pounds. People in Scotland were very upset. Sir Walter Scott wrote letters against this idea, and the government had to change its mind. This allowed Scottish banks to keep printing £1 notes.

1995 "Tercentenary" Series

The Bank of Scotland's previous banknotes were issued in 1995. They were called the Tercentenary Series because they marked the bank's 300th anniversary. Each note had Sir Walter Scott on the front. On the back, they showed different Scottish industries:

- £5 note: Oil and energy

- £10 note: Distilling and brewing

- £20 note: Education and research

- £50 note: Arts and culture

- £100 note: Leisure and tourism

These notes are no longer used.

2007 "Bridges" Series

The Bank of Scotland started issuing a new series of banknotes in late 2007. These notes all feature famous Scottish bridges. It took several years for the older notes to be replaced. Like before, the front of these notes shows an image of Sir Walter Scott. This image is based on a painting by Henry Raeburn.

New safety features were added to these notes. This includes a metallic security thread inside each note. It shows the note's value and the bridge image. The £20, £50, and £100 notes also have a new hologram and foil patch. This shows the Bank of Scotland logo and the note's value.

The bridges featured are:

- £5 note: The Brig o' Doon

- £10 note: The Glenfinnan Viaduct

- £20 note: The Forth Bridge

- £50 note: The Falkirk Wheel

- £100 note: The Kessock Bridge

On March 1, 2018, the Bank of Scotland stopped using its paper £5 and £10 notes. They were fully replaced with new plastic (polymer) notes.

2016 Polymer Series

The Bank of Scotland began issuing new plastic (polymer) banknotes in 2016, starting with the £5 note. The theme of Scottish bridges is still used, but the designs are updated. The picture of Sir Walter Scott is the same as on the 2007 notes, but it is moved to the right side. The bank's main building, "The Mound," is shown in the middle of the note. These new notes are also smaller in size.

- £5 note features Brig o' Doon

- £10 note features Glenfinnan Viaduct

- £20 note features the Forth Bridge. A special £20 note also features the Queensferry Crossing.

- £50 note features Falkirk Wheel and The Kelpies

- £100 note features Flora Murray

Other Brands of the Bank

The Bank of Scotland group includes other well-known brands:

- Halifax

- Intelligent Finance

- Birmingham Midshires

- Bank of Scotland Corporate

- Capital Bank

- Bank of Scotland Investment Services

- Bank of Scotland Private Banking

See also

In Spanish: Bank of Scotland para niños

In Spanish: Bank of Scotland para niños

| Janet Taylor Pickett |

| Synthia Saint James |

| Howardena Pindell |

| Faith Ringgold |