Fannie Mae facts for kids

Fannie Mae's headquarters in Washington, D.C.

|

|

| Government-sponsored enterprise and public company | |

| Traded as | OTCQB: FNMA |

| Industry | Financial services |

| Founded | 1938 |

| Headquarters | Washington, D.C., U.S. |

|

Key people

|

|

| Products | Mortgage-backed securities |

| Revenue | |

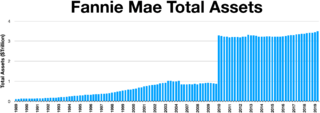

| Total assets | |

| Total equity | |

|

Number of employees

|

c. 8,100 (December 2023) |

The Federal National Mortgage Association (FNMA), usually called Fannie Mae, is a large company in the United States. It was started by the government but is now also a public company. Fannie Mae helps make it easier for people to get home loans. It does this by buying loans from banks and then selling them to investors. This way, banks get money back quickly and can lend more money to other people who want to buy homes.

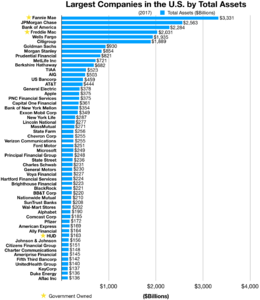

Fannie Mae was created in 1938 during a tough economic time called the Great Depression. Its main goal was to help more people become homeowners. It works closely with another similar organization called Freddie Mac. In 2024, Fannie Mae was one of the largest companies in the world based on its total assets.

History of Fannie Mae

How Fannie Mae Started

Before Fannie Mae, most home loans in the early 1900s were short-term. During the Great Depression, many people lost their jobs and couldn't pay their home loans. This led to many homes being taken back by banks. To fix this problem, the U.S. Congress created Fannie Mae in 1938. It was part of President Franklin Delano Roosevelt's plan called the New Deal.

Fannie Mae's original job was to give local banks money so they could offer more home loans. This helped more people buy homes and made housing more affordable. For about 30 years, Fannie Mae was the only organization doing this. It mainly bought loans that were insured by the Federal Housing Administration (FHA).

In 1968, Fannie Mae changed from being fully government-owned to a private company. At this time, a new government organization called Government National Mortgage Association (Ginnie Mae) was created. Ginnie Mae still guarantees certain types of home loans, and its guarantees are directly backed by the U.S. government.

In 1970, Fannie Mae was allowed to buy other types of loans, not just those insured by the government. Also, Freddie Mac was created to compete with Fannie Mae. This helped make the home loan market even stronger. Fannie Mae also started selling its shares on the stock market that same year.

Changes in the 1990s

In 1992, a new law required Fannie Mae and Freddie Mac to help finance affordable housing. This meant they had to make sure a certain percentage of their loans went to families with low or moderate incomes. This goal increased over the years.

In 1999, Fannie Mae was encouraged to expand its loans to more people, including those in inner-city areas. Some people worried that this might make Fannie Mae take on more risk. They thought it could lead to problems if the economy slowed down.

The 2000s and the Housing Crisis

In the early 2000s, rules were put in place to prevent very risky loans from counting towards affordable housing goals. However, these rules were later removed. Fannie Mae tried to keep its lending standards high, but other private companies started offering very risky loans. These loans often had low initial payments that would jump up later, making them hard for people to afford.

Experts warned that Fannie Mae's risks were growing. In 2005, some U.S. Senators tried to pass laws to better regulate Fannie Mae and Freddie Mac. They were concerned about the companies' financial health. However, these laws did not pass.

The Mortgage Crisis (2007-2008)

Around 2003-2004, the housing market started to change. Many risky loans, called "subprime mortgages," became common. These loans were often given to people with poor credit. Investment banks started selling these risky loans to investors, and they didn't always keep much of the risk themselves.

This led to a decline in lending standards. Fannie Mae and Freddie Mac, trying to keep up with the market, also started to lower their standards. This meant more people, often with poor credit, got loans they couldn't afford.

By 2006, many borrowers couldn't pay their mortgages, especially those with adjustable interest rates. This caused a lot of homes to be taken back by banks. As more homes became available, prices dropped. This created huge losses for Fannie Mae and Freddie Mac because they had guaranteed many of these loans.

In July 2008, the U.S. government tried to calm fears about Fannie Mae and Freddie Mac. They said these companies were very important to the housing system. The government even allowed them to borrow money from the Federal Reserve. However, their stock prices still fell sharply.

Government Takeover in 2008

On September 7, 2008, the U.S. government took control of Fannie Mae and Freddie Mac. This was a major step to prevent a complete collapse of the housing market. The government removed the companies' leaders and took a large ownership stake. The goal was to keep the companies stable and ensure that people could still get home loans.

The government's ability to support Fannie Mae and Freddie Mac was very large. This action helped prevent a much bigger financial crisis.

Changes After 2010

In 2010, Fannie Mae's stock was removed from the New York Stock Exchange because its price dropped too low. It now trades on a different market.

Since the government takeover, Fannie Mae has paid back a lot of money to the U.S. Treasury. By 2014, Fannie Mae had paid back more money than it received in government support.

In 2015, a court ruled that some banks had not been honest about the quality of mortgage-backed securities they sold to Fannie Mae and Freddie Mac. This led to these banks paying large penalties, which helped Fannie Mae and Freddie Mac recover some of their losses.

How Fannie Mae Works

Fannie Mae makes money in a few ways. It borrows money at low interest rates and then uses that money to buy home loans or mortgage-backed securities. It also earns fees for guaranteeing that investors will get their payments from the mortgage-backed securities, even if borrowers can't pay their loans.

As a government-sponsored company, Fannie Mae is required to help banks lend money in all economic conditions. This means it buys loans even when the market is tough. Because many people believe the U.S. government would help Fannie Mae if it faced big problems, Fannie Mae can borrow money at very low rates. This helps keep home loans more affordable for everyone.

Buying and Selling Mortgages

Fannie Mae buys home loans from banks and other lenders. It then groups these loans together to create what are called mortgage-backed securities (MBS). These MBS are then sold to investors. Fannie Mae guarantees that investors will receive their payments on time. By buying these loans, Fannie Mae gives banks new money, which they can then use to make more loans to other people. This keeps the housing market active and flexible.

Fannie Mae has rules for the types of loans it will buy. These are called "conforming loans." They even have a special computer system that lenders can use to check if a loan meets Fannie Mae's rules.

Conforming Loan Limits

Fannie Mae and Freddie Mac have a limit on how large a loan they will buy. This is called the "conforming loan limit." If a loan is bigger than this limit, it's called a "jumbo loan." Jumbo loans are usually harder for banks to sell to Fannie Mae, so they often cost borrowers a bit more in interest.

Government Support and Benefits

Even though Fannie Mae is a private company, it gets special benefits because it was created by the government. It has a direct line of credit to the U.S. Treasury. This means that many people believe the government would step in to help Fannie Mae if it ever faced serious financial trouble. This "implied guarantee" allows Fannie Mae to borrow money at very low rates, saving it billions of dollars each year.

Fannie Mae also has different rules for how much money it needs to keep on hand compared to other banks. This allows it to take on more loans. It is also exempt from some state and local taxes. These special treatments help Fannie Mae operate and support the housing market.

Leadership

Chief Executive Officers

- Priscilla Almodovar (December 2022–present)

- Hugh R. Frater (2018–2022)

- Timothy Mayopoulos (2012–2018)

- Michael Williams (2009–2012)

- Herbert M. Allison (2008–2009)

- Daniel Mudd (2005–2008)

- Franklin Raines (1999–2004)

- James A. Johnson (1991–1998)

- David O. Maxwell (1981-1991)

- Allan O. Hunter (1970–1981)

Related Information

- Farmer Mac

- Freddie Mac

- Ginnie Mae

- Sallie Mae

- State of New York Mortgage Agency – A similar agency in New York

- Canada Mortgage and Housing Corporation – A similar agency in Canada

See also

In Spanish: Fannie Mae para niños

In Spanish: Fannie Mae para niños