Panic of 1866 facts for kids

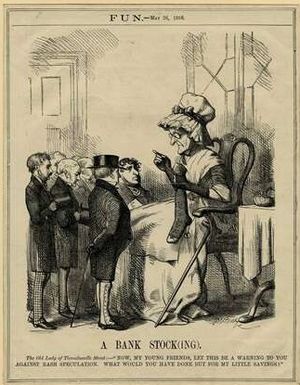

The Panic of 1866 was a big financial crisis that affected many countries. It started when a major bank in London called Overend, Gurney and Company went out of business. At the same time, Italy stopped using the silver standard for its money, which also caused financial problems.

In Britain, this economic crisis led to a lot of public anger and calls for political change. This happened in the months before the 1867 Reform Act was passed. The crisis caused a sharp rise in unemployment, meaning many people lost their jobs. It also led to lower wages across the country.

Just like the "knife and fork" protests of Chartism in the 1830s and 1840s, the financial difficulties faced by the British working class made them want more say in government. Groups like the Reform League quickly gained many new members. This group led several protests against the government, such as the Hyde Park riot of 1866. The pressure from the banking crisis and the economic slowdown that followed helped lead to 1.1 million more people being allowed to vote because of Disraeli's reform bill.

The Panic of 1866 severely damaged the shipbuilding industry in London. A large company called the Millwall Iron Works collapsed. Less than 17% of the new banks formed since 1844 survived this difficult time. However, a law called the Companies Act 1862 had created a period of fast financial growth. This growth set the stage for the larger banks that became important in Britain later in the 19th century.

The growth of credit, which is like borrowing money, was very important for international trade. Historians P. J. Cain and A. G. Hopkins say that "gentlemanly capitalism" was key to the growth of the British Empire and its economy after 1850. This was a type of white-collar work in areas like finance, insurance, shipping, and managing the Empire. Historian David Kynaston noted changes in how money was lent in the 1860s, especially to pay for supplies during the American Civil War. Richard Roberts described the 1860s, 1870s, and 1880s as a time when the lending market became more international.

A study from 2022 found that countries affected by bank failures in London immediately exported much less. They did not recover their lost growth compared to places not affected. Their share of markets in different countries also stayed much lower for forty years.

The Bank of England's Role

The Panic of 1866 was a key event that showed how the Bank of England's role was changing. In May 1866, a writer named Walter Bagehot wrote in The Economist magazine. He noted that the Bank of England's refusal to lend money using government bonds (called Consols) as security was worrying. The next week, he wrote that this refusal caused even more panic. He also said that bankers did not see the Bank of England as a government agency.

However, when the Bank of England issued a letter suspending the Bank Charter Act 1844, it showed that the Government supported it. This "confirmed the popular belief that the Government is behind the Bank, and will help it when needed."

On May 12, 1866, Bagehot wrote that during the panic, people only trusted the Bank of England. This showed a conflict for the Bank. It needed to keep enough money available for the country's economy. But it also needed to keep enough reserves to exchange foreign money. In a panic, the Bank hesitated because of the rules of the Bank Charter Act 1844. Also, suspending these rules confused foreign investors. They thought the Bank had stopped making payments, which led to huge withdrawals of money from other countries.

The Bank of England decided to follow Bagehot's advice. It openly offered to lend money at high interest rates. This policy helped the Bank rebuild its reserves. It also improved how the Bank used its monetary policy to control money flowing in and out of the United Kingdom.

The way the Bank of England handled the 1866 financial crisis helped make the British pound an international currency.

See also

- List of banking crises

| Delilah Pierce |

| Gordon Parks |

| Augusta Savage |

| Charles Ethan Porter |