Sale of UK gold reserves, 1999–2002 facts for kids

Between 1999 and 2002, the UK government decided to sell a lot of its gold. This happened when the price of gold was very low, the lowest it had been in 20 years. This time is sometimes called the Brown Bottom or Brown's Bottom.

This name comes from Gordon Brown. He was the Chancellor of the Exchequer, which means he was the main person in charge of the UK's money. He decided to sell about half of the UK's gold. At that time, the UK's gold was worth around US$6.5 billion. This was about half of the UK's total foreign currency savings. Some people later said this decision cost British taxpayers a lot of money, like £2 billion or even £7 billion.

Why the UK Sold Its Gold

The UK government announced its plan to sell gold on May 7, 1999. They wanted to use the money from the gold sale to buy other types of money, like euros. At that time, gold was worth about US$282.40 for each ounce.

The main reason given for selling the gold was to make the UK's money savings safer. Gold prices can change a lot, so it was seen as too "unstable." By selling gold and buying other currencies, the government hoped to make its total savings more steady.

However, some people thought the real reason for buying euros was to show support for the new euro currency. The government's own studies suggested that selling gold could make the UK's money savings 20% more stable.

What Happened During the Gold Sale

When the UK announced it would sell a lot of gold, the price of gold went down. By the time the first sale happened on July 6, 1999, the price had dropped by 10%. Many gold traders expected the price to fall even more.

Gold reached a very low point of US$252.80 on July 20. The UK ended up selling about 395 tonnes (12,700,000 ozt) of gold. This happened over 17 separate sales between July 1999 and March 2002. The average price they got was about US$275 per ounce. In total, they raised about US$3.5 billion.

To manage these large gold sales, several important banks, including the European Central Bank and the Bank of England, signed an agreement. This was called the Washington Agreement on Gold in September 1999. This agreement limited how much gold central banks could sell each year.

After this agreement, the price of gold went up quickly. It rose from about US$260 per ounce to around US$330 per ounce in just two weeks. The price then dropped again in 2000 and early 2001. The agreement about gold sales was renewed in 2004 and again in 2009.

See also

- Gold as an investment

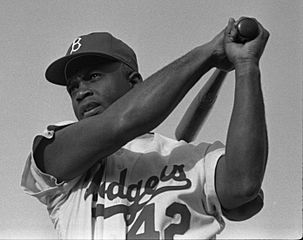

| Jackie Robinson |

| Jack Johnson |

| Althea Gibson |

| Arthur Ashe |

| Muhammad Ali |