Slave Compensation Act 1837 facts for kids

| Act of Parliament | |

|

|

| Long title | An Act to carry into further Execution the Provisions of an Act for completing the full Payment of Compensation to Owners of Slaves upon the Abolition of Slavery. |

|---|---|

| Citation | 1 & 2 Vict. c. 3 |

| Dates | |

| Repealed | 7 August 1874 |

| Other legislation | |

| Repealed by | Statute Law Revision Act 1874 (No. 2) |

|

Status: Repealed

|

|

The Slave Compensation Act 1837 was a special law passed in the United Kingdom. It became official on December 23, 1837.

This law worked with an earlier one, the Slavery Abolition Act 1833. Together, they allowed the British government to pay a huge amount of money to people who owned enslaved people in British colonies. This money was meant to make up for their "loss" when slavery was ended.

The government paid about £20 million, which was a massive sum at the time. This money went to over 40,000 slave owners. Some of these payments were made as special government loans that paid interest. These payments actually continued until 2015!

Contents

A Law About Slavery Compensation

Why Was This Law Made?

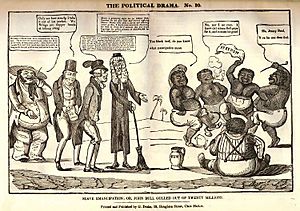

For many years, people in the UK fought to end slavery. This movement was called abolitionism. Finally, the Slavery Abolition Act 1833 was passed, which made slavery illegal across the British Empire.

However, many plantation owners in places like the Caribbean were very unhappy. They had made a lot of money from enslaved labor. To get them to agree to the new law, the government decided to pay them compensation.

The 1837 Act made sure these payments happened. It gave a government group, the Commissioners for the Reduction of the National Debt, the power to pay the money. They could either pay it directly or give out special government bonds.

Who Got the Money?

Slave owners received around £20 million in total. This was paid out in over 40,000 separate payments. The money went to owners of enslaved people in the Caribbean, Mauritius, and the Cape of Good Hope.

This amount was about 40% of the British government's entire yearly budget back then. Today, it would be like paying out around £16.5 billion! About half of this money went to wealthy owners who lived in the UK. The other half went to owners who lived in Africa and the West Indies.

One of the biggest payments went to Sir John Gladstone, 1st Baronet. He was the father of future Prime Minister William Gladstone. Sir John received £106,769 (worth about £83 million today). This was for the 2,508 enslaved people he owned across nine plantations.

The Money's Long Journey

Many of the payments were made using special government bonds. These bonds were like loans that the government would pay back over time, with interest. Because of how these bonds were set up, the final payments to the descendants of those who bought them weren't finished until 2015.

This long repayment period was due to the type of financial agreement used. It wasn't because the amount of money borrowed was too large. A famous banker named Nathan Rothschild and his brother-in-law Moses Montefiore helped the government raise £15 million for these payments.

What Happened Next?

The original 1833 Act had already planned for payments to slave owners in some colonies. The 1837 Act expanded this to cover owners of any African enslaved person in any British colony.

Much of the compensation money was quickly sold off by the slave owners. They often sent this money abroad to invest it. This actually made a financial crisis in Britain in the mid-1830s even worse. It led to hardship and job losses for many working people in the UK.

Sir Hilary Beckles, who leads the CARICOM Reparations Commission, has pointed out something important. He said that the taxes paid by many descendants of enslaved people in the UK were used to pay back this compensation loan. He called this a "great act of political unfairness." Many rich families in the UK still benefit from the wealth created by this compensation.

Learning from the Past

To understand the impact of slavery on British history, a group called the Centre for the Study of the Legacies of British Slave-ownership was created. This group, based at University College London, has a project to list everyone who received compensation.

They believe that between 10% and 20% of wealthy British families at the time had some connection to slavery. This shows how deeply slavery was tied to the economy and society of Britain.

Since 2018, people have asked the British government and the Bank of England for the names of those who received these payments. So far, these requests have not been granted.

See also

| Misty Copeland |

| Raven Wilkinson |

| Debra Austin |

| Aesha Ash |