Business cycle facts for kids

Business cycles are like the ups and downs of a country's economy. They show how the economy grows (expands) and then shrinks (recessions). A recession means the economy is slowing down for a few months. This can be seen in things like how much money people earn, how many jobs there are, and how much stuff is being made and sold.

These changes in the economy affect everyone, from families to big companies. Experts usually measure business cycles by looking at things like the total value of goods and services a country produces, called GDP.

Business cycles usually involve many parts of the economy going up or down at the same time. These ups and downs don't last for a fixed time; they can be different lengths and strengths. Typically, a full cycle can last anywhere from about 2 to 10 years. Sometimes, big, unexpected events, like a sudden change in the price of oil or a major event like the 2008 financial crisis or the COVID-19 pandemic, can cause these economic shifts.

Contents

Understanding Economic Ups and Downs

Economists and statisticians have studied business cycles for many years. They use special methods to understand how these cycles work and what causes them. These methods help them learn from past economic data.

How Economists Study Cycles

The idea of economic ups and downs, or "crises," was first talked about in 1819 by a French economist named Jean Charles Léonard de Sismondi. Before him, most economists thought the economy was always balanced or that problems were caused by outside events like wars. Sismondi saw that economic problems could happen even in peacetime, like during the Panic of 1825, which was a big international economic crisis.

Sismondi and another thinker, Robert Owen, believed that these economic problems came from making too many goods and people not buying enough. This was often because of big differences in how much money people had. They suggested that the government should step in to help, or even that society should be organized differently. Their ideas weren't popular at first, but they later influenced Keynesian economics in the 1930s.

Later, Karl Marx also wrote about these regular economic crises. He thought they would get worse over time and eventually lead to a big change in society. Other thinkers, like Henry George, focused on the role of land and land speculation in causing these crises.

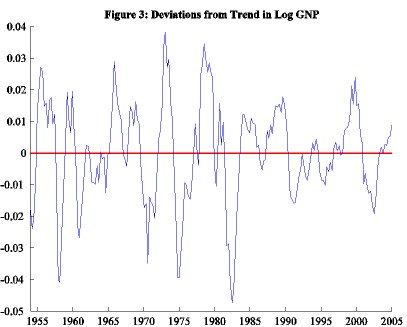

Today, economists also use math and statistics to study business cycles. They look at economic data over time to find patterns and predict future changes.

Different Types of Economic Cycles

In 1860, a French economist named Clément Juglar noticed economic cycles that lasted about 7 to 11 years. He was careful not to say they were always exactly the same length. This length is still often seen in economic data today.

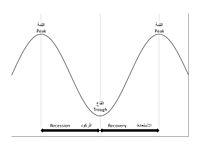

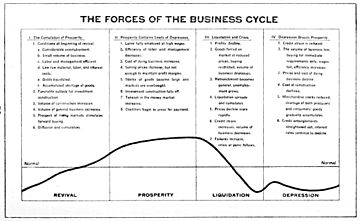

Later, economist Joseph Schumpeter described four stages of a Juglar cycle:

- Expansion: The economy grows, production and prices go up, and it's easy to borrow money.

- Crisis: Stock markets might crash, and many businesses could fail.

- Recession: Prices and production drop, and it becomes harder to borrow money.

- Recovery: The economy starts to get better, and stock markets improve as prices and incomes stabilize.

Schumpeter believed that recovery and good times came from new inventions, people feeling good about the economy, and more people wanting to buy things.

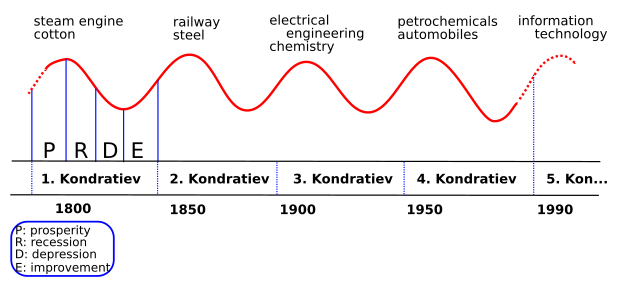

In the 20th century, Schumpeter and others suggested different types of business cycles based on how long they lasted. They named these cycles after the people who discovered them:

| Cycle/wave name | Period (years) |

|---|---|

| Kitchin cycle (inventory, e.g. pork cycle) | 3–5 |

| Juglar cycle (fixed investment) | 7–11 |

| Kuznets swing (infrastructural investment) | 15–25 |

| Kondratiev wave (technological basis) | 45–60 |

- The Kitchin cycle (3 to 5 years): This cycle is often linked to businesses managing their inventory (the goods they have in stock).

- The Juglar cycle (7 to 11 years): This is often called "the" business cycle and is related to how much businesses invest in new equipment and buildings.

- The Kuznets swing (15 to 25 years): Also called the "building cycle," this is about big investments in things like infrastructure.

- The Kondratiev wave (45 to 60 years): This is a very long cycle linked to major new technologies and inventions.

Some experts today don't focus as much on these fixed cycle lengths. Modern economics often sees these cycles as more random than perfectly regular. However, some still believe that long-term patterns exist. For example, some point to historical debt forgiveness events, like the biblical Jubilee or debt relief given to European nations in the 1930s, as ways to reset economic systems.

When Cycles Happen

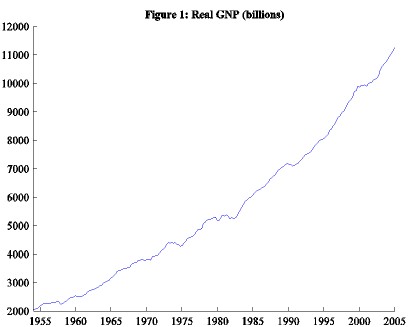

Throughout history, there have been times of great economic growth and times of struggle. For example, from 1870 to 1890, there was a lot of growth in production and new technologies, even during periods like the Long Depression. Similarly, before the Great Depression in the 1930s, there were big increases in productivity. Both the Long Depression and the Great Depression involved too many goods being produced and not enough people buying them.

Over the last two centuries, new technologies have had a huge impact on the economy. For example, the amount of goods and services an average hour of work could buy grew a lot from 1900 to 1990. This shows how much technology helps the economy grow.

Europe and America saw many economic crises between 1815 and 1939. This period included the Post-Napoleonic depression and ended with the Great Depression (1929–1939), which led into World War II. The Panic of 1825 was the first major crisis not linked to a war.

After World War II, business cycles in many developed countries became less extreme. This was especially true during the "Golden Age of Capitalism" (1945–1970s). Governments started using fiscal policy (like changing taxes and spending) and monetary policy (like controlling interest rates) to try and smooth out these ups and downs. This helped prevent the worst economic problems.

However, even with these efforts, there have still been major downturns, like the Late-2000s recession. Some economists thought the problem of depressions had been "solved," but then the 2008 global recession showed that economic challenges can still happen.

Some regions have faced very long economic struggles. For example, many former Eastern Bloc countries experienced a long depression after the Soviet Union ended in 1991. This was due to big changes in their economic systems, not just a normal business cycle.

Spotting Economic Cycles

In 1946, economists Arthur F. Burns and Wesley C. Mitchell gave a widely accepted definition of business cycles. They said that business cycles are ups and downs in a country's overall economic activity. These cycles involve many parts of the economy expanding at the same time, followed by many parts shrinking (recessions), and then recovering. They noted that cycles usually last from more than one year to about ten or twelve years.

Burns also explained that business cycles are not just small changes. They are widespread throughout the economy, affecting industries, businesses, and money matters. To understand business cycles, you need to understand how a capitalist economy, where businesses try to make a profit, works.

In the United States, the National Bureau of Economic Research (NBER) is the group that officially decides when recessions begin and end. An "expansion" is the time when the economy is growing, and a "recession" is when it's shrinking. The NBER defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months." This decline is usually seen in things like GDP, income, jobs, and industrial production.

Prices and Shipping Rates

There's often a close link between when the economy turns downwards, the prices of goods, and the cost of shipping things. For example, in big economic downturns like 1873, 1889, 1900, and 1912, these things often happened together. After World War II, many recessions were linked to a sudden increase in oil prices. Changes in the prices of basic goods are seen as a major reason for business cycles in the U.S.

Economic Clues: Indicators

Economists use different Economic indicators to measure the business cycle. These include:

- Consumer confidence index: This shows how confident people feel about the economy.

- Retail trade index: This measures how much people are buying in stores, which is a big part of the economy.

- Unemployment: The number of people without jobs can show when the economy is slowing down.

- Industry/service production index: This measures how much factories and service businesses are producing.

Some experts say that financial indicators, like stock market prices, can predict future economic changes, but they aren't always stable. The consumer confidence index is considered a "coincident indicator" because it reflects what's happening now. The retail trade index is also a good measure of the current economy because it makes up a large part of the GDP.

Economists also categorize indicators into three types:

- Lagging indicators: These change after the economy has already shifted (e.g., unemployment rates).

- Coincident indicators: These change at the same time as the economy (e.g., industrial production).

- Leading indicators: These change before the economy shifts, helping to predict future peaks and troughs (e.g., new building permits).

For many years, the U.S. Department of Commerce published a "leading index" to help forecast economic changes.

See also

In Spanish: Ciclo económico para niños

In Spanish: Ciclo económico para niños