Debit card facts for kids

A debit card (also known as a bank card or check card) is a plastic card that is used as a payment method to cash when buying things. It is similar to a credit card, but unlike a credit card, it does not borrow money. Instead, the money comes directly from the user's bank account, and if there is no money it does not work. Most debit cards are plastic, but there are cards made of metal and, rarely, wood.

Contents

History

Historically, bank cards have also served the purpose of a cheque guarantee card, a now almost defunct system to guarantee cheques at point of sale.

The first bank cards were automated teller machine (ATM) cards issued by Barclays in London in 1967, and by Chemical Bank in Long Island, New York, in 1969. In 1972, Lloyds Bank issued the first bank card to feature an information-encoding magnetic strip, using a personal identification number (PIN) for security.

The smart card, which was introduced in the 1970s, was adapted for use as a payment card. Smart payment cards were introduced to the banking sector in 1979, and came into wider use in the mid-1980s.

Types of debit card systems

The five major debit card networks are UnionPay, American Express, Discover, Mastercard, and Visa. Other card networks are STAR, JCB, Pulse, etc. There are many types of debit cards, each accepted only within a particular country or region.

Online debit cards require electronic authorization of every transaction, and the debits are reflected in the user's account immediately. The transaction may be additionally secured with the personal identification number (PIN) authentication system; some online cards require such authentication for every transaction, essentially becoming enhanced automatic teller machine (ATM) cards.

Overall, the online debit card is generally viewed as superior to the offline debit card because of its more secure authentication system and live status, which alleviates problems with processing lag on transactions that may only issue online debit cards. Some online debit systems are using the normal authentication processes of Internet banking to provide real-time online debit transactions.

Consumer protection

Consumer protections vary depending on the network used. Visa and MasterCard, for instance, prohibit minimum and maximum purchase sizes, surcharges, and arbitrary security procedures on the part of merchants. Merchants are usually charged higher transaction fees for credit transactions since debit network transactions are less likely to be fraudulent.

According to Singapore's local financial and banking laws and regulations, all Singapore-issued credit and debit cards with Visa or MasterCard swipe magnet strips are disabled by default if used outside of Singapore. The whole idea is to prevent fraudulent activities and protect the card holder. If customers want to use card swipe magnet strips aboard and internationally, they will have to activate and enable international card usage.

Financial access

Debit cards and secured credit cards are popular among college students who have not yet established a credit history. Debit cards may also be used by expatriate workers to send money home to their families holding an affiliated debit card.

Internet purchases

Debit cards may also be used on the Internet, either with or without using a PIN. Internet transactions may be conducted in either online or offline mode. Shops accepting online-only cards are rare in some countries (such as Sweden), while they are common in other countries (such as the Netherlands). For a comparison, PayPal offers the customer to use an online-only Maestro card if the customer enters a Dutch address of residence, but not if the same customer enters a Swedish address of residence.

Internet purchases can be authenticated by the consumer entering their PIN if the merchant has enabled a secure online PIN pad, in which case the transaction is conducted in debit mode. Otherwise, transactions may be conducted in either credit or debit mode (which is sometimes, but not always, indicated on the receipt), and this has nothing to do with whether the transaction was conducted in online or offline mode, since both credit and debit transactions may be conducted in both modes.

Technologies

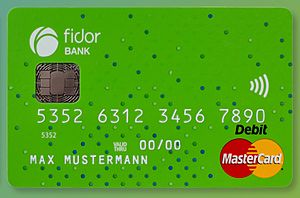

A number of International Organization for Standardization standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583, and ISO/IEC 4909, define the physical properties of payment cards, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats. They also provide the standards for financial cards, including the allocation of card number ranges to different card issuing institutions.

Embossing

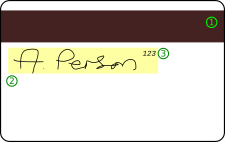

Originally charge account identification was paper-based. In 1959 American Express was the first charge card operator to issue embossed plastic cards which enabled cards to be manually imprinted for processing, making processing faster and reducing transcription errors. Other credit card issuers followed suit. The information typically embossed are the bank card number, card expiry date and cardholder's name. Though the imprinting method has been predominantly superseded by the magnetic stripe and then by the integrated chip, cards continued to be embossed in case a transaction needs to be processed manually until recently. Under manual processing, cardholder verification was by the cardholder signing the payment voucher after which the merchant would check the signature against the cardholder's signature on the back of the card. Cards conform to the ISO/IEC 7810 ID-1 standard, ISO/IEC 7811 on embossing, and the ISO/IEC 7812 card numbering standard.

Magnetic stripe

- Magnetic stripe

- Signature strip

- Card Security Code

Magnetic stripes started to be rolled out on debit cards in the 1970s with the introduction of ATMs. The magnetic stripe stores card data which can be read by physical contact and swiping past a reading head. The magnetic stripe contains all the information appearing on the card face, but allows for faster processing at point-of-sale than the then manual alternative as well as subsequently by the transaction processing company. When the magnetic stripe is being used, the cardholder will have been issued with a PIN, which is used for cardholder identification at the point-of-sale, and a signature is no longer required. The magnetic stripe is in the process of being augmented by the integrated chip.

See also

In Spanish: Tarjeta de débito para niños

In Spanish: Tarjeta de débito para niños

- Card (disambiguation)

- ATM card

- Cantaloupe, Inc.

- Charge card

- Credit card

- Debit card cashback

- Electronic funds transfer

- Electronic Payment Services

- EPAS

- Interac

- Inventory information approval system, a point-of-sale technology used with FSA debit cards

- Payment card

- Payments Council

- Payoneer

- Point-of-sale (POS)