Current account (balance of payments) facts for kids

In economics, a country's current account is like a report card that shows how much money a country earns and spends with other countries. It tracks the value of everything a country sells to other countries (exports) and everything it buys from them (imports). This includes not just physical goods, but also services like tourism or shipping, and even money sent or received as gifts or aid.

The current account is a key part of a country's balance of payments, which is a record of all money transactions between a country and the rest of the world. If a country has a current account surplus, it means it's earning more money from abroad than it's spending. This is like saving money. If it has a current account deficit, it means it's spending more than it's earning, which is like borrowing money from other countries.

Contents

What is the Current Account?

The current account helps us understand how strong a country's economy is. It's made up of three main parts:

- Balance of Trade: This is the difference between what a country exports (sells) and imports (buys) in goods and services.

- Net Income from Abroad: This includes money earned from investments in other countries, like profits from a factory built overseas, or money sent home by people working in other countries (called remittances).

- Net Current Transfers: This covers money given or received without anything in return, like foreign aid or donations.

If a country has a positive current account balance (a surplus), it means it's lending money to the rest of the world. If it has a negative balance (a deficit), it means it's borrowing from the rest of the world. A surplus increases a country's foreign assets, while a deficit decreases them.

When a country sells more goods and services than it buys, it usually leads to a current account surplus. This is because exports bring money into the country. If a country buys more than it sells, it often leads to a current account deficit.

The income part of the current account tracks money coming in from investments abroad (like interest or dividends) and money going out to foreign investors. For example, if a company from your country owns a factory in another country, the profits sent back home count as income received.

How is it Calculated?

The current account is usually calculated by adding up its four main parts:

- Goods: These are physical items like cars, clothes, or food. When a country sells goods to another country, it's an "export" (money coming in, a credit). When it buys goods from another country, it's an "import" (money going out, a debit).

- Services: These are things you can't touch, like tourism, shipping, or banking. If a tourist from another country visits your country and spends money, that's an export of services (a credit).

- Factor Income: This is money earned from investments or work abroad. For example, if a company in your country owns shares in a foreign company and receives dividends, that's a credit. If a foreign company earns profits from its business in your country and sends them home, that's a debit.

- Current Transfers: These are one-way payments, like gifts, foreign aid, or money sent by migrants to their families back home. If your country receives aid, it's a credit. If it sends aid, it's a debit.

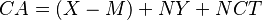

You can think of the current account using this simple formula:  Where:

Where:

- CA is the Current Account balance.

- X is the value of goods and services a country Exports.

- M is the value of goods and services a country Imports.

- NY is the Net Income from abroad (money earned from investments minus money paid to foreign investors).

- NCT is the Net Current Transfers (money received as aid or gifts minus money given as aid or gifts).

Basically, it's the money from exports and income, minus the money spent on imports and transfers.

How to Reduce a Current Account Deficit

Many things can affect a country's current account balance, like its trade rules, how strong its currency is, and how competitive its businesses are.

When an economy is growing fast, people tend to buy more imported goods. If exports don't grow as fast, the current account deficit can get bigger. During a recession, people buy less, so imports might drop, and the deficit could shrink.

The value of a country's currency also plays a big role.

- If a currency is overvalued (too strong), imports become cheaper, and exports become more expensive for other countries to buy. This can make the deficit worse.

- If a currency is undervalued (too weak), exports become cheaper and more attractive, while imports become more expensive. This can help reduce a deficit or increase a surplus.

Countries with big, ongoing current account deficits can sometimes worry investors. This can make their currency weaker. To fix this, countries might have to raise interest rates or limit how much money leaves the country.

To reduce a deficit, a country usually tries to:

- Increase exports: This means selling more goods and services to other countries. Governments might offer help to businesses that export.

- Decrease imports: This means buying fewer goods and services from other countries. Governments might put taxes on imports or limit how much can be imported.

- Encourage domestic savings: If people and the government save more, there's less need to borrow from other countries.

Sometimes, a current account deficit isn't a bad thing. If the deficit is caused by private businesses and people making smart investments, it might not be a problem. This is sometimes called the "consenting adults" view, meaning that if individual transactions are good, the overall deficit might also be fine.

Current Account and the Balance of Payments

The balance of payments (BOP) is a complete record of all money transactions between a country and the rest of the world. It has three main parts:

- The Current Account: As we've discussed, this tracks goods, services, income, and transfers.

- The Capital Account: This records transfers of assets, like a foreign company buying land or a building in your country.

- The Financial Account: This tracks international investments, like buying shares in foreign companies or lending money to other countries.

The current account and the financial/capital accounts are closely linked. If a country has a current account deficit (spending more than it earns), it usually means it's borrowing money from other countries, which shows up as a surplus in the financial account. If it has a current account surplus (earning more than it spends), it's lending money to other countries, which shows up as a deficit in the financial account. They are like two sides of the same coin.

Some economists believe that the current account drives the financial account. Others suggest that the desire of foreign investors to buy assets in a country (financial account) can also influence the current account. However, the main idea is that the current account is the primary factor.

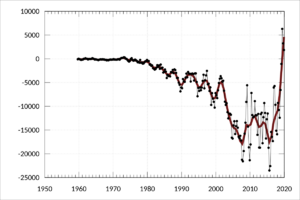

Current Account Deficits in the U.S.

Since 1989, the United States has often had a large current account deficit. In 2006, it was nearly 7% of the country's total economic output (GDP). In 2011, it was the largest deficit in the world.

However, sometimes the value of U.S. investments overseas grows faster than foreign investments in the U.S. This can make the deficit seem less severe. Even with deficits, the U.S. still has a large amount of foreign assets.

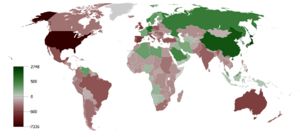

International Comparisons

Organizations like the Organisation for Economic Co-operation and Development (OECD) and the Central Intelligence Agency (CIA) in its The World Factbook collect and publish data on current account balances for different countries. This allows us to compare how countries are doing.

For example, in 2014, some countries with large current account surpluses (earning more than they spent) included:

- Germany: $286.4 billion

- China: $219.7 billion

- Netherlands: $90.16 billion

And some countries with large current account deficits (spending more than they earned) included:

- United Kingdom: -$173.9 billion

- Brazil: -$103.6 billion

- United States: -$389.5 billion

These numbers show how much money is flowing in and out of different countries.

The International Monetary Fund (IMF) also studies current accounts. They explain that a deficit can sometimes mean a country's economy is growing and investing a lot. But if a country imports much more than it exports, it might mean its businesses aren't as competitive.

Interestingly, the IMF notes that often, richer countries like the United States have current account deficits, while developing countries often have surpluses. Very poor countries usually have large deficits that are covered by foreign aid.

See also

In Spanish: Cuenta corriente para niños

In Spanish: Cuenta corriente para niños

- List of countries by current account balance

- List of countries by current account balance as a percentage of GDP

- Global saving glut

- Federal Reserve Economic Data

- National debt of the United States