Funding facts for kids

Funding is when you give resources (like money) to help pay for something. This could be a project, a program, or even a new idea. Most of the time, funding means money. But it can also be help, time, or effort from a group or company. When a company uses its own money, it's called funding. When it gets money from outside sources, it's called financing.

Money for funding can come from many places. These include loans, venture capital (money for new businesses), donations, grants, savings, subsidies, and taxes. Some funding, like donations, subsidies, and grants, doesn't need to be paid back. This is called "soft funding" or "crowdfunding". When people invest money online to get a share of a company, it's called equity crowdfunding.

Funds can be used for short-term needs or long-term goals.

Contents

Understanding Funding in Economics

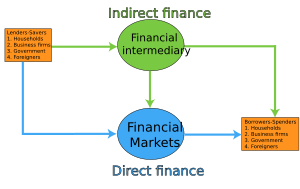

In the world of economics, money is put into the market by lenders. Borrowers then take this money as loans. There are two main ways money can go from a lender to a borrower.

- Indirect Finance: A lender can give money to a financial intermediary (like a bank). The bank then lends this money to others at a higher interest rate.

- Direct Finance: A lender can also lend money directly to a borrower through financial markets.

Why is Funding Important?

Funding for Research Projects

Research funding is money used for research projects. This is often seen in technology or social science fields. Money is usually given for a specific project, department, or research group. This depends on the size and goals of the research.

Research funding can be for commercial or non-commercial projects. Companies often fund their own research and development. Non-commercial research funding comes from charities, research groups, or government agencies. Groups needing this money usually compete for it. Only the best projects get chosen. Funding is key to making sure important projects can continue.

Funding to Start a Business

Entrepreneurs are people with new business ideas. They need to gather all the necessary things, including money, to start their business. Funding is a big part of this process. Some businesses need a lot of money to start. Without this initial money, entrepreneurs cannot turn their ideas into real businesses.

Funding for Investments

Fund management companies collect money from many investors. They use this money to buy securities (like stocks or bonds). Professional investment managers handle these funds. They try to get higher returns and lower risks by spreading out the investments. These funds can be small, with a few million dollars, or very large, with billions. The main goal of these funding activities is to make a profit for individuals or organizations.

How to Get Funding

Government Grants

Governments or their government agencies can give money (grants) to projects that help the public. This is done through a selection process. Students, researchers, and even organizations can apply. Applications are reviewed by experts. A special committee then discusses the best applications. The projects that are chosen receive funding.

Studies show that public grants can help businesses grow. They can create more jobs, increase sales, and encourage new ideas. This has been seen with large research grants and smaller grants for tourism or small businesses.

Crowdfunding Explained

Crowdfunding is when many people give small amounts of money to a project. There are two main types:

- Reward-based crowdfunding: Small businesses can sell a product or service before it's made. Project creators set a money goal and a deadline. People interested can promise money. If the project reaches its goal, the creators must deliver their products or services.

- Equity-based crowdfunding: People buy a small share of a company in exchange for money.

Raising Money from Investors

To get money, you need funds from investors. You must show investors that your projects have high potential for returns. If your projects look promising, investors will be more likely to put their money in. After some time, usually a year, profits from the investment are shared with investors. This keeps investors happy and willing to invest more. If returns are low, investors might not want to invest again.

Venture Capital (VC) is a type of private investment. VC firms fund small new companies that could grow a lot over time. In return for their money, investors get a part of the company's ownership.

Self-Organized Funding Allocation

Self-organized funding allocation (SOFA) is a way to give out money for scientific research. In this system, every researcher gets the same amount of money. They then secretly give a part of their money to other researchers' projects. Supporters of SOFA believe it would distribute money similarly to the current grant system. But it would have less paperwork and costs. A test of SOFA started in the Netherlands in 2016.

Getting Loans

A company or a person can get a loan to access money. Often, borrowers must use a secured loan. This means they promise assets (like property) as collateral. If the borrower cannot pay back the loan, the lender gets the collateral. Both physical things and intangible assets (like patents) can be used as collateral for loans.

When Funding Stops

Withdrawal of funding, or defunding, happens when money previously given to an organization stops. This often refers to government funding.

Defunding can happen because of disagreements or if an organization fails to meet its goals. For example, President Trump decided to stop funding the World Health Organization (WHO). This was due to claims of mismanagement during the Coronavirus pandemic.

See also

In Spanish: Financiación para niños

In Spanish: Financiación para niños

- Foundation (non-profit)

- Investment

- Investment fund

- Crowdfunding

- Peer-to-peer lending

- Research funding

- Seed money

- Micro finance

- Mutual fund

- Trust Fund

- Equity fund

- Intangible asset finance

| May Edward Chinn |

| Rebecca Cole |

| Alexa Canady |

| Dorothy Lavinia Brown |